High levels of consumer debt add to Hawaiʻi household financial struggles

Even before the COVID-19 pandemic hit Hawaiʻi’s consumer economy especially hard, many residents were already struggling to get by in an out-of-balance economy.

Figure 1. Hawaiʻi Household Financial Health, 2019

Figure 1. The “Hawaiʻi Financial Health Pulse 2019 Survey,” released in early 2020, reported that only 31 percent of households in the state were financially healthy. That means that more than two in three families regularly spent more than they earned, failed to pay all their bills on time, had inadequate liquid and long-term savings, had accumulated more debt than they could manage, and/or were not adequately insured.

Since Hawaiʻi’s average wages failed to keep up with the high cost of living even before COVID-19-related income losses, no one should be surprised by the financial insecurity of the majority of Hawaiʻi residents. But high levels of consumer debt add another worrying element to Hawaiʻi’s fragile financial health.

Note: For both Hawaiʻi and the U.S., the “total population” is based on the number of people with at least one credit line. The per person average is total debt divided by the number of people with at least one credit line.

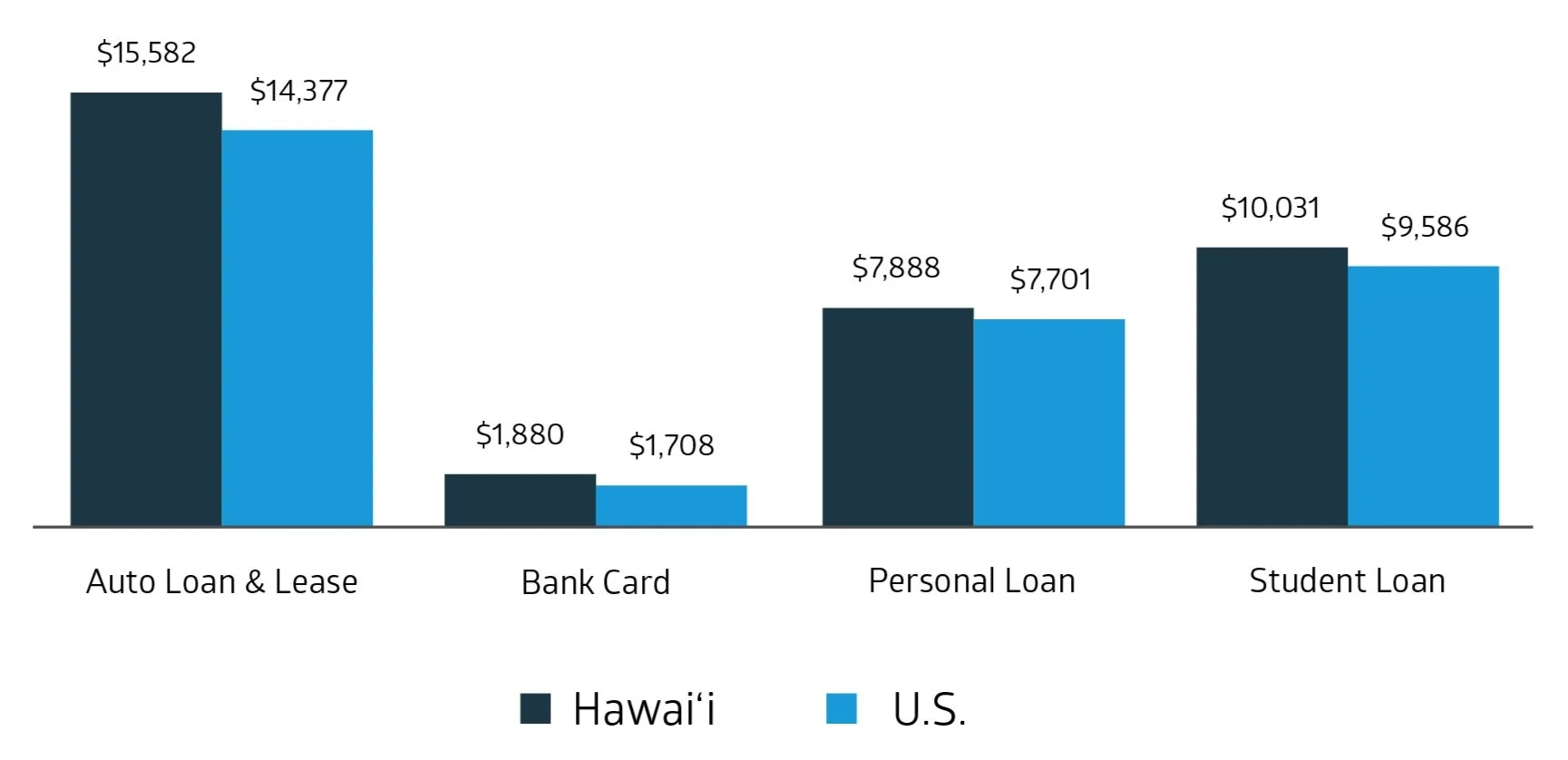

Figure 2. Monthly Loan Payments, Assuming Halfway Through Loan Period, Hawaiʻi vs U.S.

Figure 2. As reported in “Hawaiʻi Consumer Debt Report: 2019 Update,” Hawaiʻi residents carried a total of $68,656, per person in consumer debt in 2019, compared with the U.S. average of only $47,034. Hawaiʻi consumers paid an average of $1,402 per month on these credit obligations, 27 percent more than the U.S. average of $1,108 per month.

Figure 3. Average Consumer Debt on Loans Not Related to Housing, Hawaiʻi vs U.S.

Figure 4. Average Consumer Debt on Mortgage, HELOC and HE Loans, Hawaiʻi vs U.S.

Figure 3–4. While Hawaiʻi has a slightly higher debt load in every credit category, there’s a big difference in loans related to home ownership. As the “Consumer Debt Report” notes, in September 2019 the median home value in Hawaiʻi was $616,600, whereas the U.S. median was only $229,600. Consequently, mortgages, Home Equity Lines of Credit (HELOC), and Home Equity Loans (HE Loans) together average $425,507 in Hawaiʻi, compared to $254,774 for the U.S.

Figure 5. Consumer Loan Delinquency Rates, Hawaiʻi vs U.S.

Figure 5. One more really remarkable thing about Hawaiʻi credit record: in almost all cases (student loans being the exception), we’ve been more likely to make good on our payments.

Hawaiʻi’s high debt load is usually invisible, but that may change soon as households become unable to carry this burden in the COVID-19 economy. Now is the time to ensure that our policies and public resources are ready to help keep families from losing their homes and being driven into bankruptcy.