One step forward, a few meals short

While the passage of Act 139 was a meaningful step toward free school meals, it was just that—a step. The work is not finished.

Hawaiʻi’s costly tax shift: How a billion-dollar cut threatens public services

The choice before us is whether we will allow a billion-dollar annual loss to erode our common foundation, or whether we will act to preserve it—for every family, and for generations to come.

Hawaiʻi’s two-tier tax system: How the rich use a glaring loophole to pay less

While teachers, nurses and service workers pay income tax on every dollar they earn, the wealthy can shield a large portion of their profits thanks to a special tax break on capital gains.

Our Census Bureau is understaffed and underfunded—the quality of its data is suffering

Already facing resource shortages, new federal budget cuts call into question the very future of the Census Bureau itself.

Kūpuna at risk: How federal changes to SNAP impact older adults in Hawaiʻi

Even within these new constraints, Hawaiʻi can innovate by combining or re-imagining existing programs to expand access and strengthen support for our seniors.

Transformative change meets budget realities—a central lawmaking tension plays out in two new reports

Policy in Perspective 2025 and the Hawaiʻi Budget Primer FY2025–26 provide a compelling—and sometimes sobering—look at how Hawaiʻi invests, and often under-invests, in its communities.

Hawaiʻi already has the tools to create a locals-only housing market; we just need to use them

Whether buying a first home, renting, or selling within the community, local people should have the advantage. Housing should function as a home—not as a global commodity.

Powered by the people: How Hawaiʻi Appleseed’s community-first focus can create change—with your help

When we put people first, it means our policy proposals come from the community—which is essential to turning those proposals into law.

We need to talk about inclusionary zoning

Inclusionary Zoning is a band-aid solution to a crisis that demands major surgery. It’s time to confront why this policy hasn’t worked—and what we should do instead.

Hawaiʻi families deserve better: How federal cuts to nutrition programs will impact our state

With grocery prices still soaring and food insecurity on the rise, this is the worst possible time to shrink our nation's most important anti-hunger program.

Hawaiʻi’s 2025 legislature focused on raising tax revenue to prepare for federal cuts

Assessing a proper tax rate on corporations and the wealthy will be necessary to produce a budget that can fund critical safety net programs and investments in our future.

Transformative housing bills went nowhere this legislative session, but small wins keep hope alive

With federal cuts looming and home prices still climbing, the stakes have never been higher. One thing is clear: Hawaiʻi’s families can’t afford another session of half-measures.

Reimagining our streets for health, fun and community

HB1260 would support the creation of a Summer Street Pilot Program, designed to temporarily transform car-congested roadways into vibrant spaces for outdoor fun and social interaction.

As federal support fades, farm to families could fill the gap

Now, more than ever, investing in local food systems through programs like Farm to Families is a necessary strategy to build Hawaiʻi’s economic resilience and reduce food insecurity.

Reducing the burden of pedestrian fines and fees with Freedom to Walk legislation

At a societal level, we seek to shift public resources away from penalizing pedestrians and toward addressing the root causes of traffic violence.

Expand the state’s e-bike rebate program to improve mobility options

Now is the time for the state to expand the electric bike and moped rebate program to lower household transportation costs, reduce vehicle costs, and increase resident’s physical activity.

Congress’ budget blueprint leaves Hawaiʻi’s working families behind

In effect, the budget blueprint aims to take food out of the mouths of hungry keiki, so that billionaires can pad their pockets even more on the way to the bank.

Hawaiʻi’s keiki are still waiting for universal free school meals. The time to act is now.

Research shows that consistent access to nutritious meals improves both academic performance and long-term health. Yet, in 2023, 6 percent of Hawaiʻi households with children had one or more children go a whole day without food.

What’s in store for 2025: Hawaiʻi Appleseed transportation equity projects on the horizon

In 2025, we’ll take a greater look at more equitable approaches to traffic enforcement, the impacts of parking mandates on affordable housing, and addressing the unique mobility challenges that women and their families face.

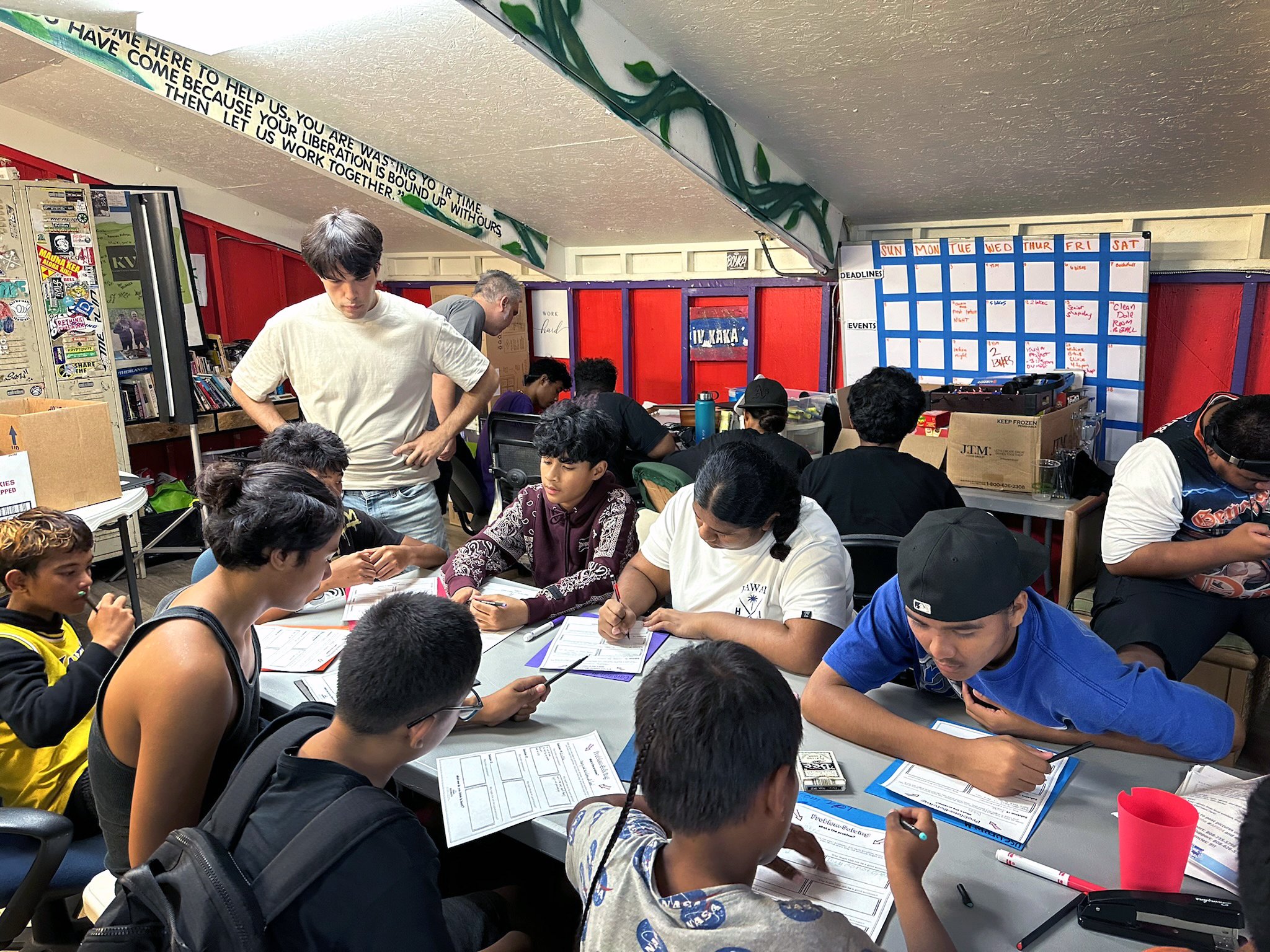

Empowering Kalihi’s youth leaders through community organizing and policy advocacy training

While people in power sometimes hand wave the voice of youth in policy conversations, our partnership with KVIBE is a reminder that young people can and should be integral components of the decision-making process.