One step forward, a few meals short

While the passage of Act 139 was a meaningful step toward free school meals, it was just that—a step. The work is not finished.

Taking policy local: how to shape county action on food security

Counties may not always be centered in the food security conversation, but they are some of Hawaiʻi’s most powerful leaders in combating hunger.

A turning point for SNAP: Strengthening local supports for Hawaiʻi households

Hawaiʻi has an opportunity to build a more resilient, community-driven food system—one that protects families regardless of federal uncertainty.

Hawaiʻi’s two-tier tax system: How the rich use a glaring loophole to pay less

While teachers, nurses and service workers pay income tax on every dollar they earn, the wealthy can shield a large portion of their profits thanks to a special tax break on capital gains.

Keiki Ride Free: Building a more connected Hawaiʻi

By removing financial barriers to public transit, Hawaiʻi can empower young people to participate fully in their communities, while easing family costs and supporting climate goals.

Can Hawaiʻi afford to cut the grocery tax?

Any proposal to reduce or remove the GET on food must be paired with a credible plan for replacing the revenue. It’s a challenge, but also an opportunity to build a fairer and more sustainable system.

The chilling effect: How federal cuts and immigration crackdowns threaten food security in Hawaiʻi

The mega budget bill that Congress recently passed narrows who can access critical programs like SNAP and Medicaid, while fueling fear and confusion about who can safely apply for assistance in the wake of increased immigration enforcement.

Incoming federal tax cuts will heavily favor Hawaiʻi’s wealthiest residents

The State of Hawaiʻi has an obligation to shore up its revenue through tax policies that make the wealthiest among us pay their fair share.

Hawaiʻi families deserve better: How federal cuts to nutrition programs will impact our state

With grocery prices still soaring and food insecurity on the rise, this is the worst possible time to shrink our nation's most important anti-hunger program.

Hawaiʻi’s 2025 legislature focused on raising tax revenue to prepare for federal cuts

Assessing a proper tax rate on corporations and the wealthy will be necessary to produce a budget that can fund critical safety net programs and investments in our future.

Wins for food access and low-income families at the 2025 legislative session

While there’s still more work to be done, this year’s wins have laid the groundwork for a future in which food access is treated as a right, not a privilege.

Proposed Trump tax cuts will overwhelmingly benefit the top 1 percent

As millions of Americans file their taxes this April, both the U.S. House and Senate have passed budget resolutions that open the pathway for a massive tax giveaway for the wealthiest people in the country.

As federal support fades, farm to families could fill the gap

Now, more than ever, investing in local food systems through programs like Farm to Families is a necessary strategy to build Hawaiʻi’s economic resilience and reduce food insecurity.

Implement strong eviction record sealing processes to protect Hawaiʻi renters

A single eviction filing—even one that doesn't result in actual eviction—can negatively impact renters for years. It's time for lawmakers to take decisive action to protect vulnerable tenants.

Hawaiʻi should close tax loopholes for multinational corporations

Multinational corporations make huge profits from the business activity they conduct in Hawaiʻi, while dodging the taxes they should be paying to support our state.

Why is SNAP failing Hawaiʻi residents?

It’s time for the state to invest in a more resilient, independent social safety net system that can keep working families going regardless of chaos at the federal level.

Tax credits are more necessary than ever in 2025

Hawaiʻi’s families need urgent help to deal with the high cost of living. This is especially true for parents, who have to balance the cost of child care, rent, and food every month.

Hawaiʻi’s keiki are still waiting for universal free school meals. The time to act is now.

Research shows that consistent access to nutritious meals improves both academic performance and long-term health. Yet, in 2023, 6 percent of Hawaiʻi households with children had one or more children go a whole day without food.

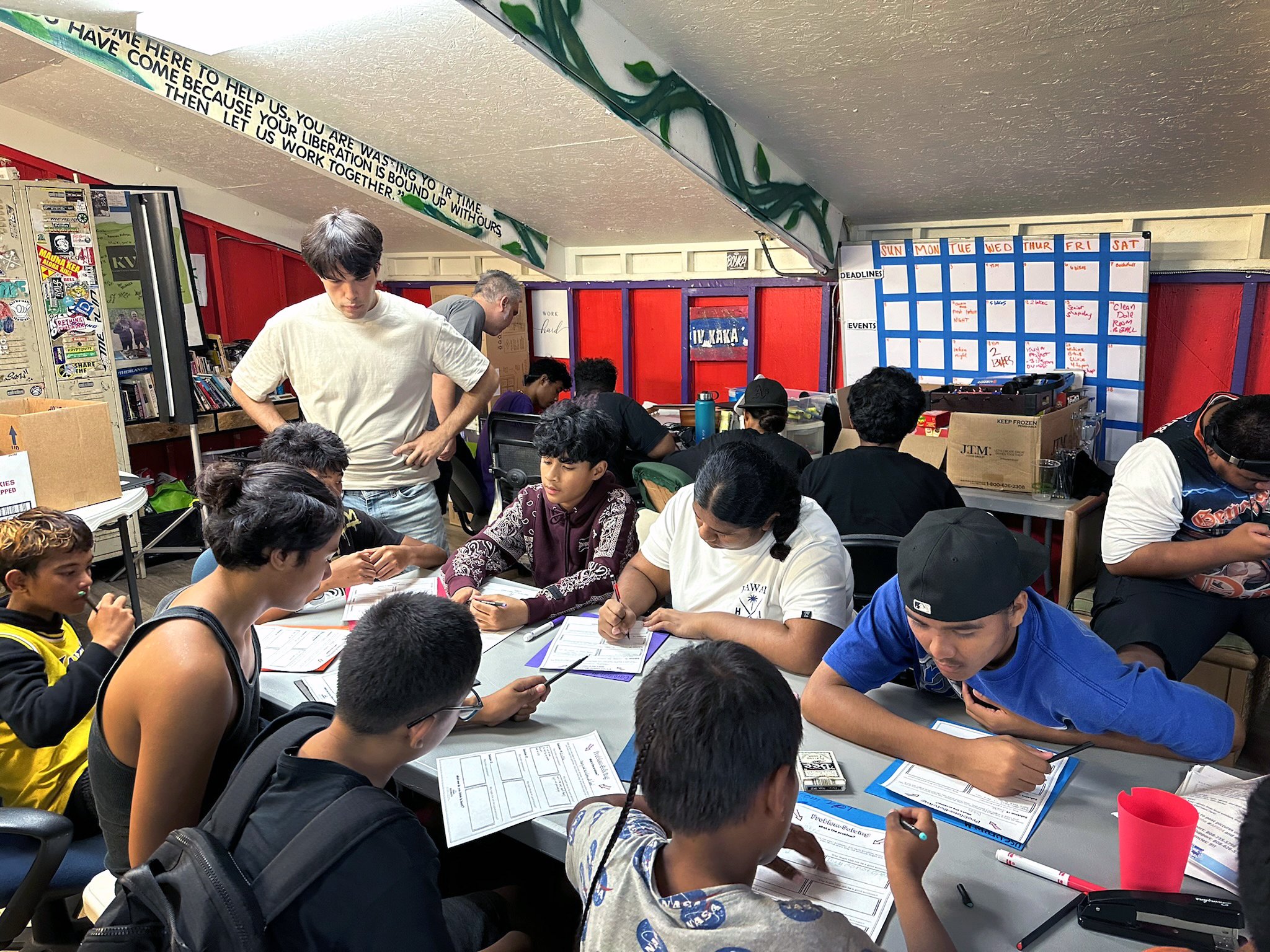

Empowering Kalihi’s youth leaders through community organizing and policy advocacy training

While people in power sometimes hand wave the voice of youth in policy conversations, our partnership with KVIBE is a reminder that young people can and should be integral components of the decision-making process.

How a second Trump presidency could impact the pocket books of Hawaiʻi’s working families

Outside of the top 5 percent richest households, families will likely see significant tax increases, while the cost of consumer items would spike under proposed tariffs.