The great Skyline adventure: Hawaiʻi Appleseed tests the walkability of areas around rail stops

Success will require partnership across state and county lines, but the goal is shared: turning the areas around rail lines and high capacity bus routes into places where people can live, work and meet daily needs without the necessity of getting back into a car.

Taking policy local: how to shape county action on food security

Counties may not always be centered in the food security conversation, but they are some of Hawaiʻi’s most powerful leaders in combating hunger.

Hawaiʻi’s costly tax shift: How a billion-dollar cut threatens public services

The choice before us is whether we will allow a billion-dollar annual loss to erode our common foundation, or whether we will act to preserve it—for every family, and for generations to come.

A turning point for SNAP: Strengthening local supports for Hawaiʻi households

Hawaiʻi has an opportunity to build a more resilient, community-driven food system—one that protects families regardless of federal uncertainty.

Keiki Ride Free: Building a more connected Hawaiʻi

By removing financial barriers to public transit, Hawaiʻi can empower young people to participate fully in their communities, while easing family costs and supporting climate goals.

Can Hawaiʻi afford to cut the grocery tax?

Any proposal to reduce or remove the GET on food must be paired with a credible plan for replacing the revenue. It’s a challenge, but also an opportunity to build a fairer and more sustainable system.

The chilling effect: How federal cuts and immigration crackdowns threaten food security in Hawaiʻi

The mega budget bill that Congress recently passed narrows who can access critical programs like SNAP and Medicaid, while fueling fear and confusion about who can safely apply for assistance in the wake of increased immigration enforcement.

Incoming federal tax cuts will heavily favor Hawaiʻi’s wealthiest residents

The State of Hawaiʻi has an obligation to shore up its revenue through tax policies that make the wealthiest among us pay their fair share.

Hawaiʻi’s 2025 legislature focused on raising tax revenue to prepare for federal cuts

Assessing a proper tax rate on corporations and the wealthy will be necessary to produce a budget that can fund critical safety net programs and investments in our future.

Reimagining our streets for health, fun and community

HB1260 would support the creation of a Summer Street Pilot Program, designed to temporarily transform car-congested roadways into vibrant spaces for outdoor fun and social interaction.

As federal support fades, farm to families could fill the gap

Now, more than ever, investing in local food systems through programs like Farm to Families is a necessary strategy to build Hawaiʻi’s economic resilience and reduce food insecurity.

Implement strong eviction record sealing processes to protect Hawaiʻi renters

A single eviction filing—even one that doesn't result in actual eviction—can negatively impact renters for years. It's time for lawmakers to take decisive action to protect vulnerable tenants.

Hawaiʻi should close tax loopholes for multinational corporations

Multinational corporations make huge profits from the business activity they conduct in Hawaiʻi, while dodging the taxes they should be paying to support our state.

Expand the state’s e-bike rebate program to improve mobility options

Now is the time for the state to expand the electric bike and moped rebate program to lower household transportation costs, reduce vehicle costs, and increase resident’s physical activity.

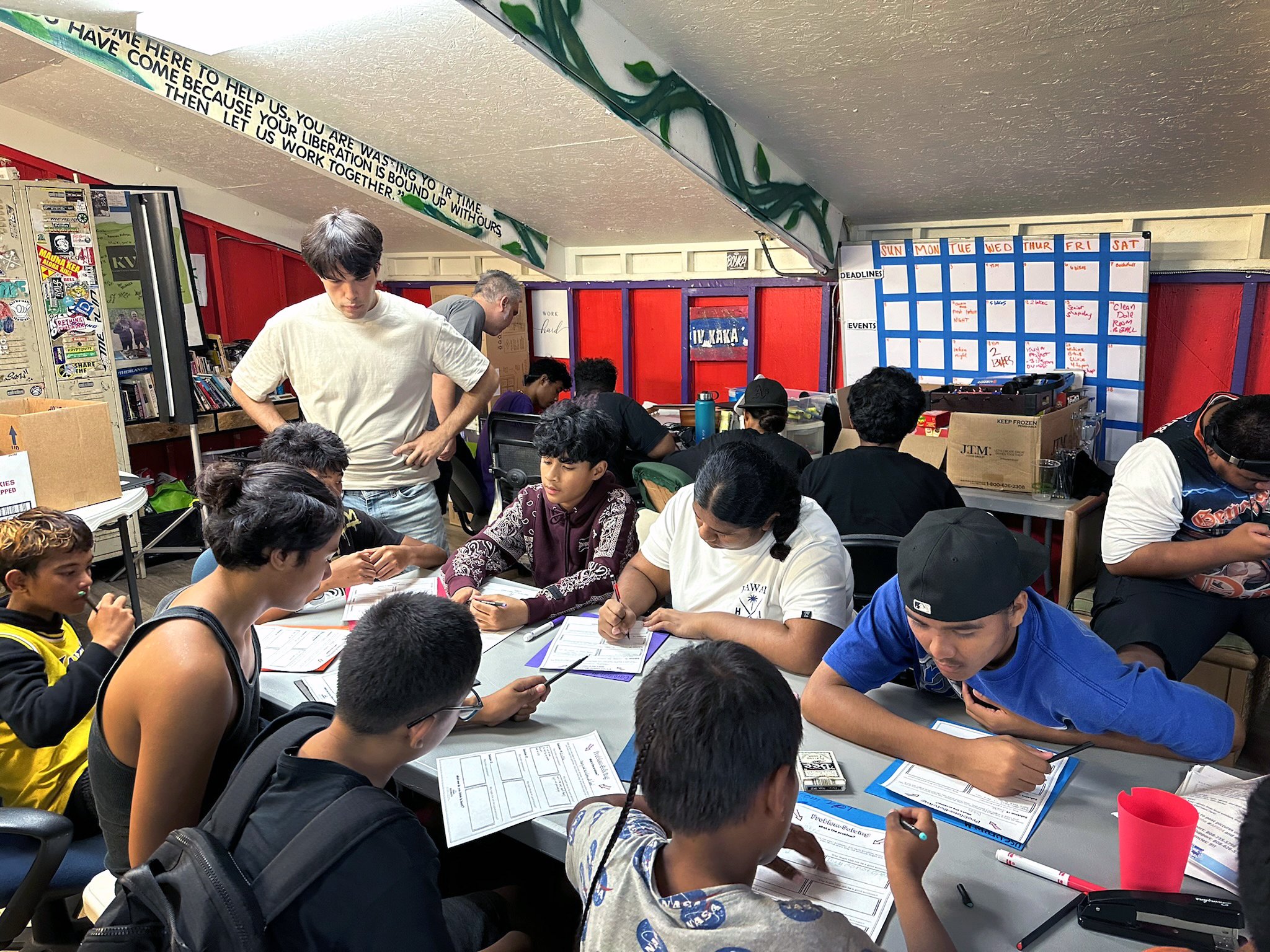

Empowering Kalihi’s youth leaders through community organizing and policy advocacy training

While people in power sometimes hand wave the voice of youth in policy conversations, our partnership with KVIBE is a reminder that young people can and should be integral components of the decision-making process.

How a second Trump presidency could impact the pocket books of Hawaiʻi’s working families

Outside of the top 5 percent richest households, families will likely see significant tax increases, while the cost of consumer items would spike under proposed tariffs.

Census poverty data for 2023 highlights the importance of government assistance

Promising trends for families across the nation, but many continue to feel the lasting effects of widespread unemployment during the pandemic, a rising cost of living, and inadequate government assistance.

How Hawaiʻi’s hardworking undocumented immigrants support our economy and communities

A new report from the Institute on Taxation and Economic Policy lifts up the significant tax contributions that undocumented immigrants make to our federal, state and local governments through the taxes they pay each year.

Hawaiʻi’s elected leaders buy-in to costly “trickle-down” myth

Passing an “historic” tax cut that mostly benefits the wealthiest Hawaiʻi residents is not the path to a healthy economy that works for working people.

Hawaiʻi’s capital gains loophole floats the rich as working families struggle to stay above water

In the interest of tax fairness, the State of Hawaiʻi should tax capital gains—income from selling assets such as stocks, bonds, art and real estate—at the same rates as income made from wages, salaries and other compensation for work.