A better kind of unemployment insurance

Most economists predict that Hawaiʻi’s economic recovery will take at least a few years. During this time, hours may be cut and jobs shared, resulting in more workers being partially unemployed. In these circumstances, the state’s current unemployment insurance (UI) program—also called “Partial Unemployment”—doesn’t help much, if at all, to compensate workers for lost hours. Nor does it help businesses stay connected to the valued employees who will help them expand when the economy picks back up again.

A much better program to address cut-backs in hours is the Short-Time Compensation (STC) or “Workshare” Program. It allows employees to stay in their jobs at reduced hours, pays more than the state’s current UI does, and ensures that they keep their benefits. Employers like it too because they maintain their relationships with their staff and don’t lose the experienced workers they’ll need in the future. And STC can be used in both public and private sectors when money is tight and hours are cut.

STC is an unemployment insurance program that aligns with the state’s UI requirements, but it isn’t the same as Hawaiʻi’s Partial Unemployment program. STC differs from the state’s current program in two significant ways that make it better for most part-time workers and for employers.

The first difference is that, under STC, most workers get paid more if their hours are cut so it does a better job of helping families make ends meet. That’s because under STC compensation is paid for wages lost. It is calculated by applying the percentage of wages lost to the amount available for UI. Partial Unemployment, on the other hand, compares what was actually earned to the amount the state allows for weekly unemployment.

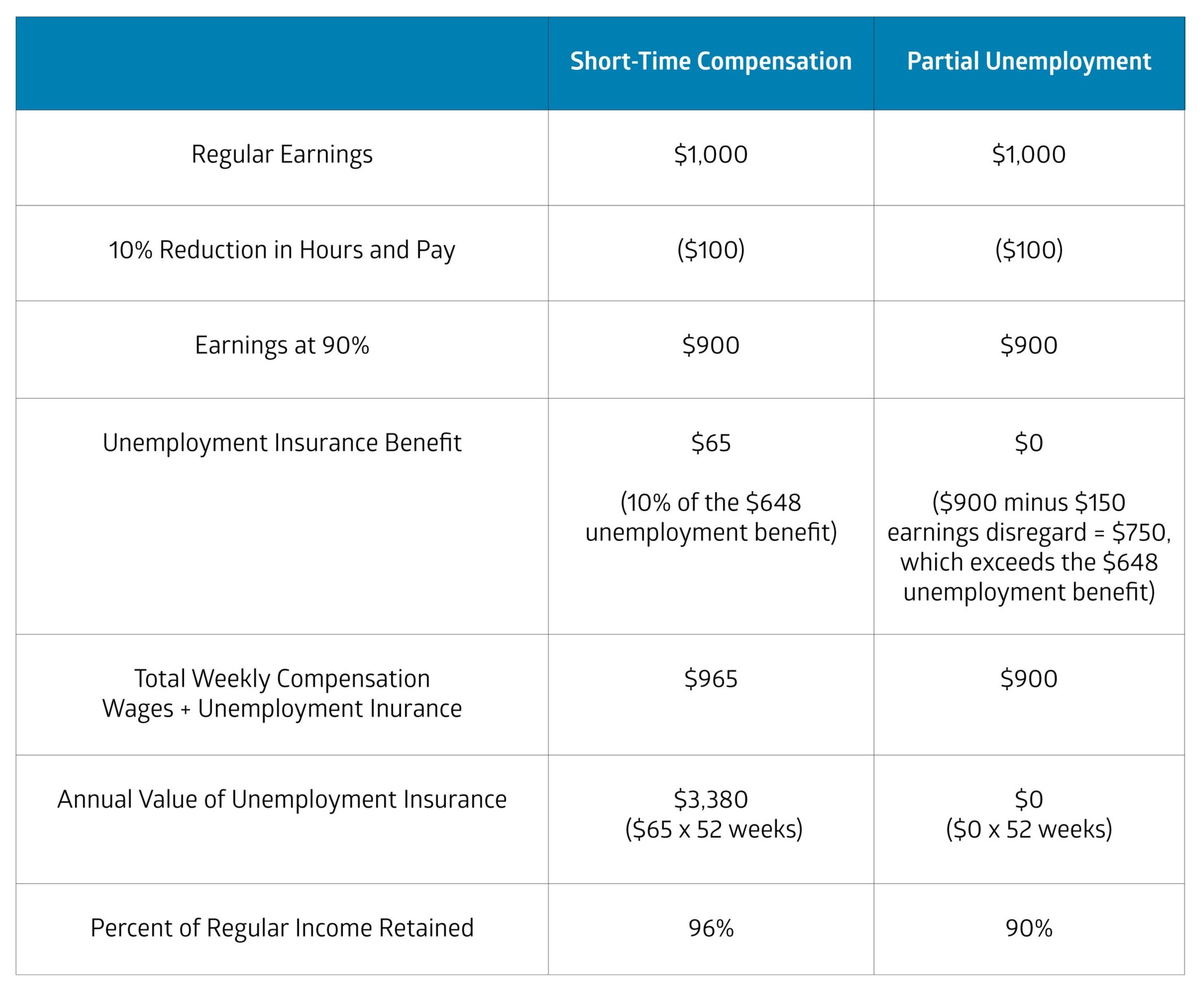

Tabel 1. Short-Time Compensation Model vs Partial Unemployment Model

The example in Table 1 makes the difference clearer, but it is helpful to understand some of the basic conditions of Hawaiʻi’s unemployment insurance. Hawaiʻi’s weekly UI benefit amounts to 65 percent of wages; however, it is capped at $648. The program also allows a $150 per week earnings disregard, which means it doesn’t count the first $150 per week in a claimant’s wages. Workers who earn the state average wage or higher will probably get no UI compensation for the hours that were cut because they are likely to still earn more than the cap, even after considering the earnings disregard.

In this example, a worker earns the state average salary of $1,000 for a 40-hour work week. The maximum unemployment benefit for someone who earns this much is $648.

The worker’s employer has cut employees’ hours and pay by 10 percent. The worker’s earnings are now $900, having been decreased by $100.

This example shows that STC is a better deal for workers who have their hours cut than the current Partial Unemployment program. Since STC adds a partial UI benefit to reduced wages, the worker is paid all but 4 percent of regular wages. STC increases the worker’s resources by nearly $3,400 per year. On the other hand, Partial Unemployment doesn’t help because earnings remain higher than the maximum weekly UI benefit. That leaves the worker to bear the full brunt of the 10 percent cut in hours and earnings.

The second important difference is that the STC program provides UI through the employer. The employer sets up a program with the State Department of Labor and Industrial Relations (DLIR) and DLIR reimburses the employer for compensation paid to workers.

In contrast, DLIR directly manages individual worker applications and compensation in Hawaiʻi’s current Partial Unemployment program, That makes a big difference. STC allows employers to retain their employee relationships and systems for payroll and benefits, while employees can avoid applying for unemployment through the state.

Here are six ways STC is better than Partial Unemployment for Hawaiʻi’s working people and businesses:

Employers are encouraged to reduce hours and share work among a group of employees rather than eliminate positions. As a result, employers keep workers who are experts in their jobs and fewer workers are entirely unemployed.

Most employees receive more compensation through STC. This helps them continue to meet household obligations, while continued spending supports the whole state economy.

Partially employed workers continue to get fringe benefits.

Employers manage the program and add compensation to regular wages. Individual workers don’t have to apply for unemployment.

Employers retain valuable workers. This gives them a competitive advantage when the economy improves and they have an opportunity to grow.

Employer satisfaction with STC has been high, but participation is completely optional for employers. Some businesses may decide that STC is not appropriate for them and that’s OK.

The STC program sounds like a perfect fit for Hawaiʻi, both in the current moment and going forward into the future. In fact, if we’d had this program in place at the beginning of the pandemic, the federal government would have paid 100 percent of the STC costs.

While we may not be able to take advantage of that benefit (it expires at the end of December), we still have an opportunity to get a federal grant to set up the STC program in the Hawaiʻi DLIR. The important thing is the state has to apply for this funding and technical assistance. In addition, when the legislature reconvenes in January, it has to pass legislation to establish the program.

The STC program is a big improvement over the system we now have to help both workers and employers during an economic downturn. Twenty-six states already offer this option and it’s time for Hawaiʻi to join them.