How the state plans to spend its $24 billion FY23 budget

The state’s budget may not be what we typically think of as state policy, but it is—and it’s the most important policy decision lawmakers enact. That’s because the budget is the agreement about how our collective resources will be distributed to pay for programs and investments that support public needs. The funding decisions made in the budget demonstrate where our collective values lie.

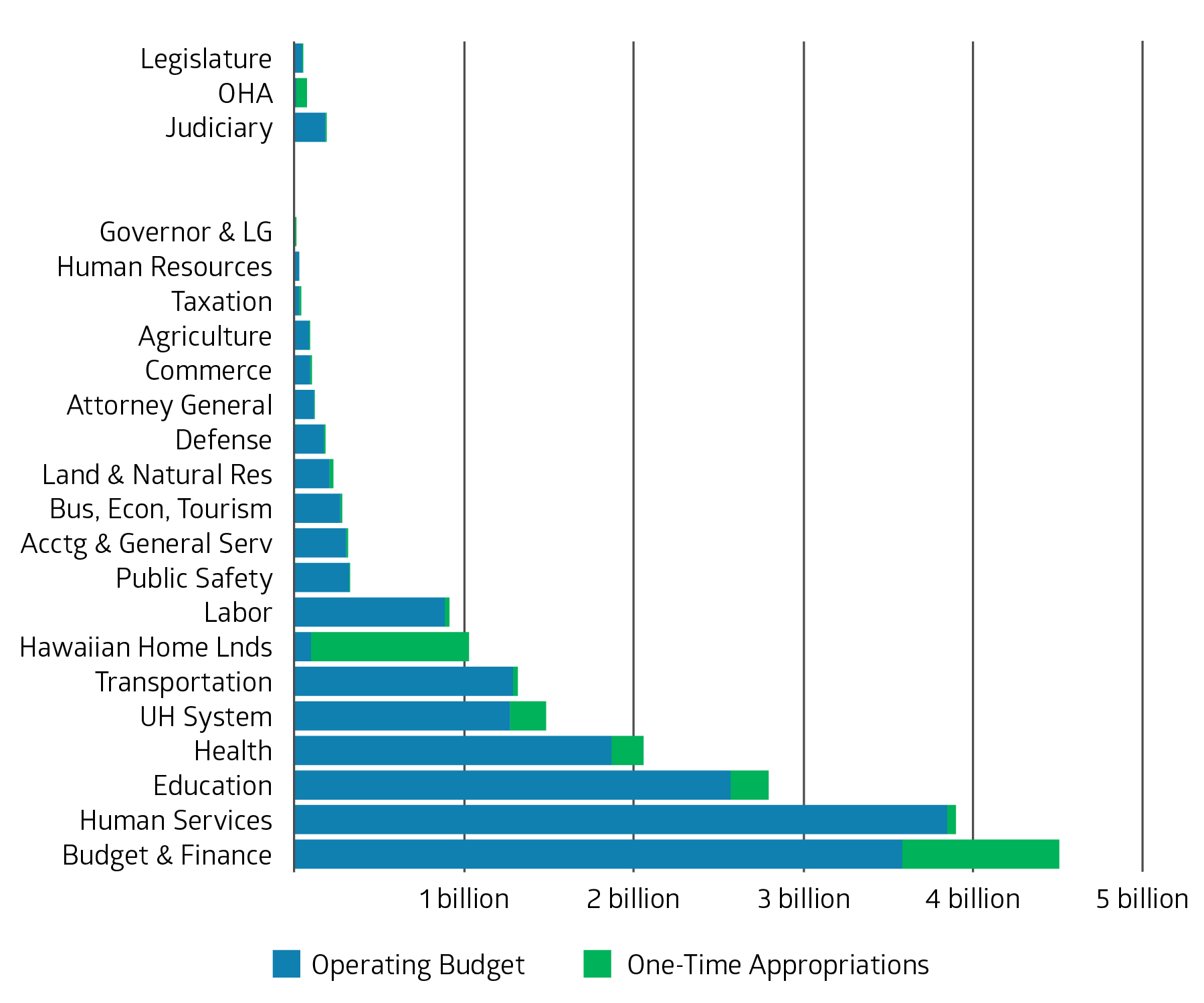

Spending in All Categories Authorized for FY23

In Fiscal Year (FY) 23 (July 1, 2022–June 30, 2023), the state plans to spend $24.3 billion total to fund the operational and capital needs of the executive branch and its departments, the legislature, the judiciary and the Office of Hawaiian Affairs (OHA).

In addition, the legislature authorized a tax rebate for all state resident taxpayers, which will cost the state an estimated $335 million in tax revenue. This is not an “appropriation” but can be described as a “tax expenditure.”

Operating Budgets

The state’s FY23 operating budget for all branches and OHA totals $17.3 billion, of which $17.1 billion supports the executive branch. This is the budget for the governor’s and lieutenant governor’s offices and 18 state departments including the University of Hawaiʻi System.

Distribution of Operating Budgets & Other Appropriations, FY23

There is significant variation among branches and executive departments for both operating budgets and one-time appropriations ($20 billion total).

According to Article V, Section 6 of the State Constitution, the executive branch is allowed up to 20 departments, so creating a new department is a very rare occurrence. However, in 2022 the legislature passed HB2171, which established a new Department of Law Enforcement:

…to consolidate and administer the criminal law enforcement and investigations functions of the department of transportation, certain investigations functions of the department of the attorney general, functions of the office of homeland security, and current law enforcement and investigations functions of the department of public safety.

The legislation also establishes a law enforcement training center. A one-time appropriation of $900,000 was authorized to support the development of the new department.

HB2171 also changes the current name of a different state department, the “Department of Public Safety,” to “Department of Corrections and Rehabilitation” to reflect its newly narrowed focus.

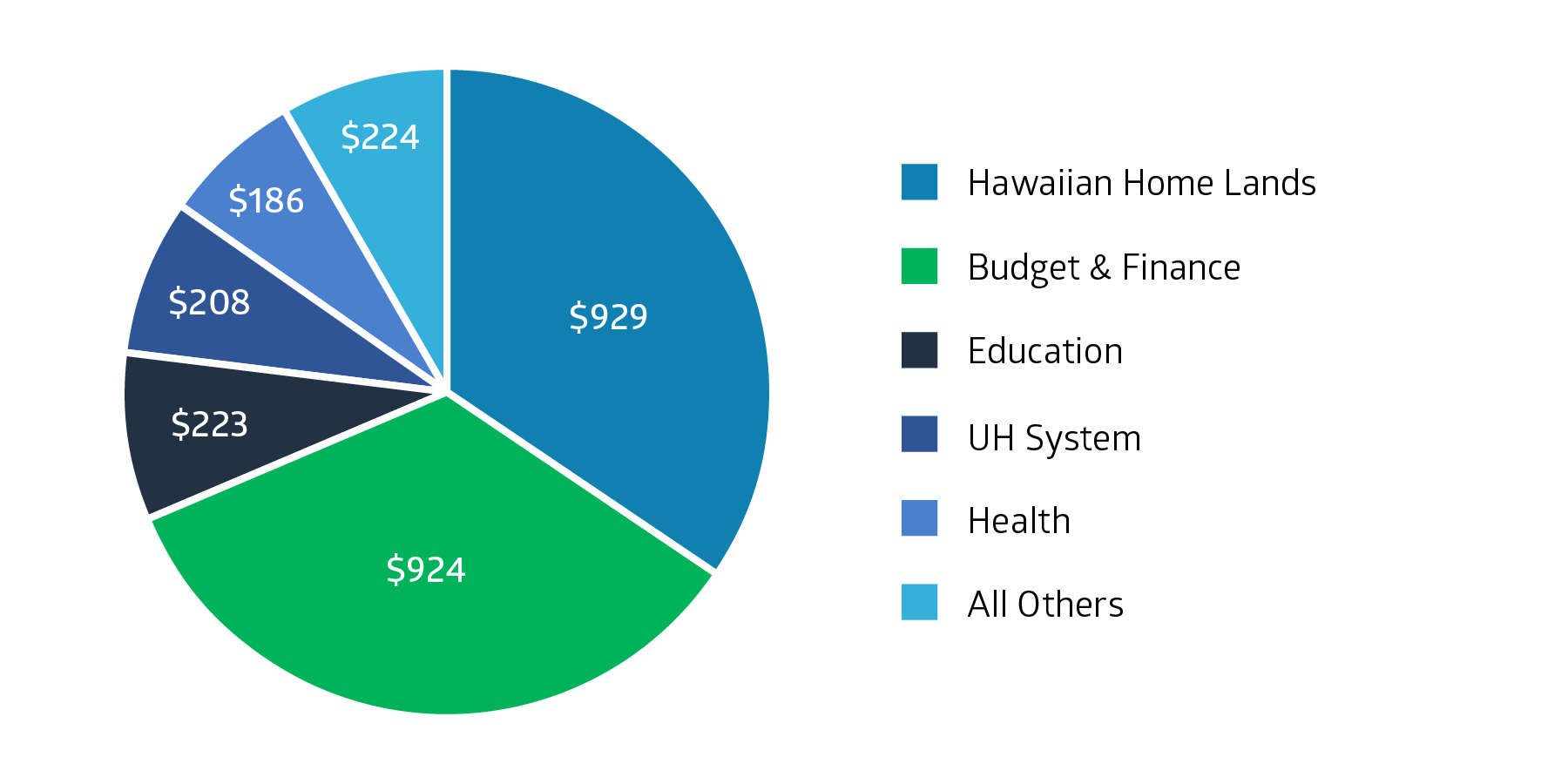

One-Time Appropriations

The legislature authorized $2.7 billion in one-time appropriations for FY23. General funds supported 85 percent of these appropriations with the balance divided equally between special funds and federal pandemic relief funds.

Distribution of One-Time Appropriations by Department, FY23 ($ Millions)

The Department of Hawaiian Home Lands received the largest amount of additional appropriations, largely intended to reduce the waiting list by building homes for eligible families. The Department of Budget & Finance also came in for significant other appropriations, which included funding collective bargaining for public workers as well as $500 million to deposit to the Emergency Budget Reserve Fund (Hawaiʻi’s “Rainy Day” fund) and $300 million to prepay pension obligations.

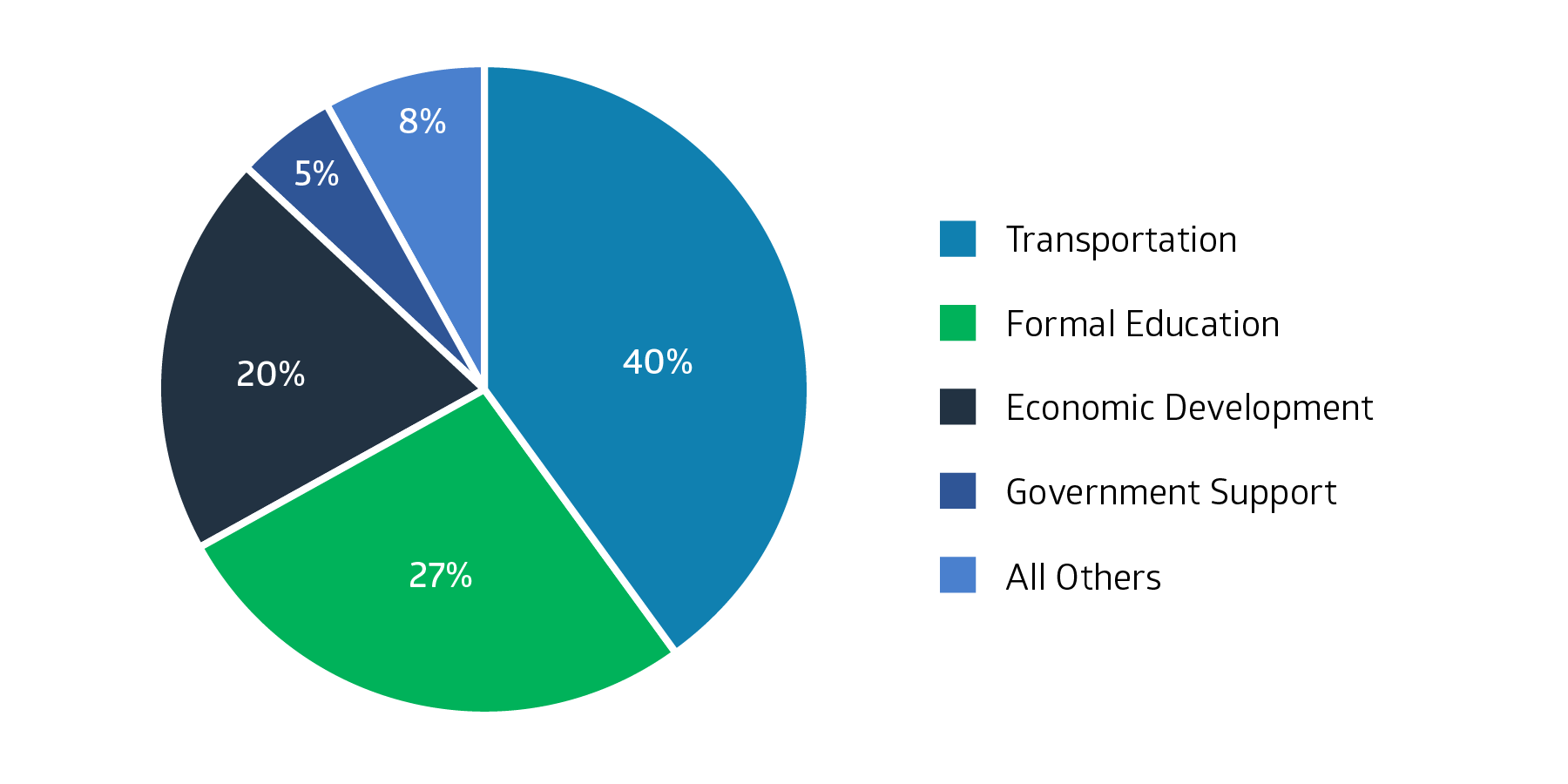

Capital Improvement Projects

Distribution of Capital Improvement Project Funding by Category, FY23

Capital Improvement Projects (CIPs) are completed and paid for over multiple years. The buoyant economic expectations underpinning FY23 budget decisions also resulted in a big increase in CIP spending. The $4.3 billion CIP budget approved for FY23 is more than double FY22’s CIP budget.

Obligated Costs

Before the legislature can make any other spending decisions it has to address the state’s non-negotiable obligations. These costs are:

Interest on borrowing (debt service);

Health benefits for current employees;

Health costs and “other post-employment benefits” (OPEB) for retirees;

Pension and social security contributions for public workers; and the

State share for Medicaid.

Growth in Obligated Costs, 2014–2023 ($ Billions)

These obligations take up half of the state’s general funds and a quarter of the whole operating budget. In aggregate, obligated costs—sometimes called “fixed” costs—grew from $2.8 billion to $4.3 billion over the past 10 years, a 55 percent increase. In contrast, the general fund receipts that support them increased by only 48 percent. The problem that arises when obligated costs grow more quickly than general fund revenues is that less money is available for everything else the state needs or wants to fund.

The increase in obligated costs has been led by required payments for public worker retirement and health/OPEB, which together grew by 98 percent between 2014 and 2023. (For more information about public worker pension, health and OPEB, see our 2019 in-depth report “A Public Investment.”)

State matching payments for Medicaid have increased by only 18 percent during the period, while debt service payments have risen by 52 percent and the cost of employee health benefits rose 65 percent.

Hawaiʻi’s obligated costs have increased by 55 percent since 2014. These obligations are supported almost entirely by general funds. The state covered only a portion of its obligation for retiree health and OPEB in 2022, as shown in the figure, because of pandemic-related budget concerns, but is back on track for FY23.

For more details on Hawaiʻi’s 2022–23 budget, download our primer below.