How Hawaiʻi is funding its $24 billion FY23 budget

The legislature not only decides where money is spent, but also makes many of the decisions about who pays how much to support the budget. Since the majority of funds come from a system of taxes and fees authorized by the legislature, these decisions reflect our values as much as our decisions about spending.

Additional funds include federal grants and other revenues that are tied to specific spending.

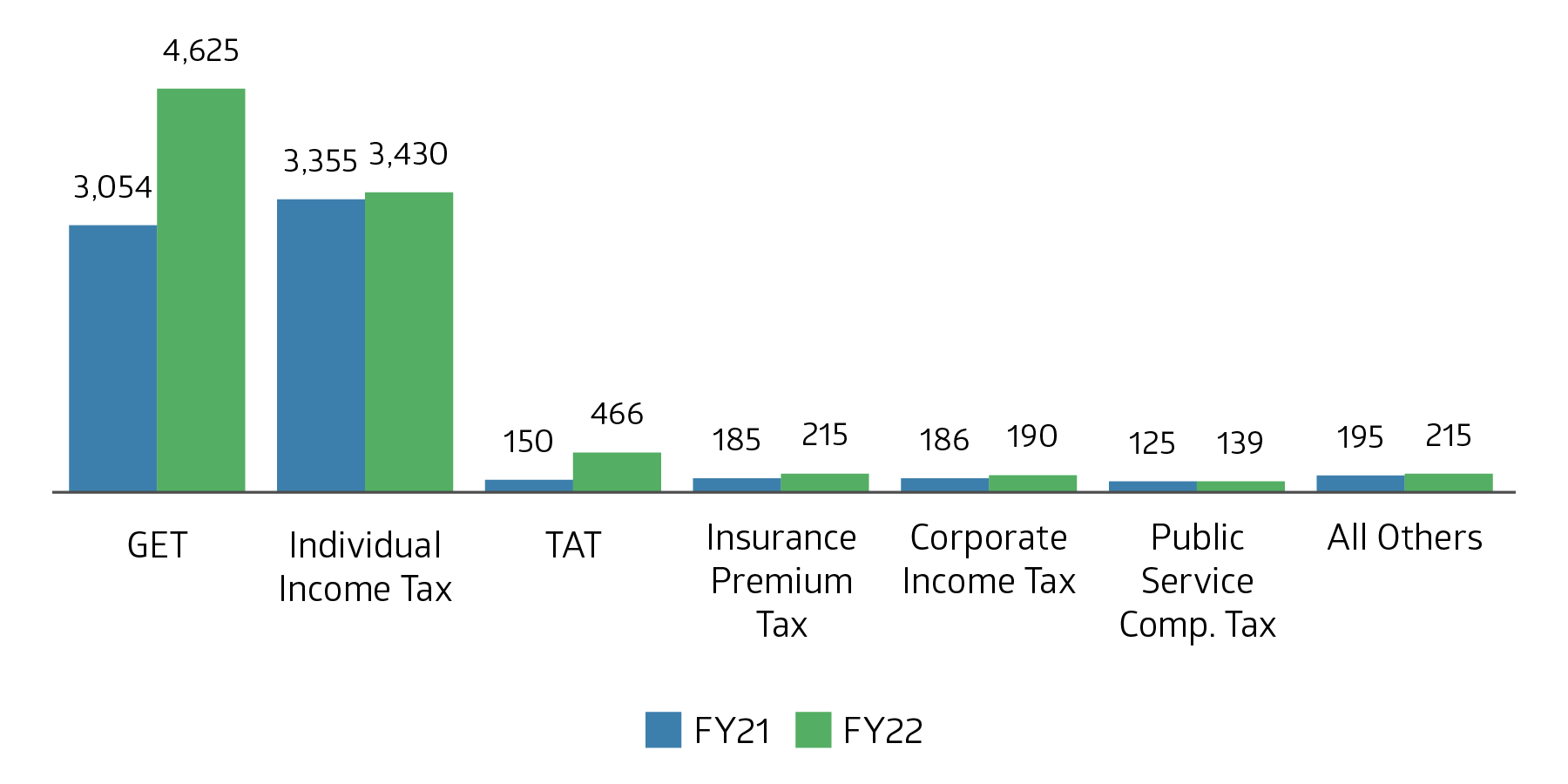

Figure 1. Hawaiʻi Tax Revenues, FY21 vs FY22 ($ Millions)

Figure 1 compares actual Fiscal Year (FY) 21 tax revenues to expected FY22 revenues. The greatest increases are for the taxes most dependent on visitor spending, namely the GET and the TAT.

The general fund, which supports half of Hawaiʻi’s operating budget, is largely made up of tax revenue. After a steep decline during the pandemic, actual and projected general fund revenues have increased significantly.

Figure 2. Actual and Projected State Revenue Over Time ($ Billions)

Figure 2 shows Hawaiʻi’s revenue collections and financial expectations for fiscal years 2021–2027, taken from the Council on Revenues’ projections from May 23, 2022. The beginning of the period was characterized by low general fund revenues, while other funds—largely from federal pandemic relief—made up the shortfall. In out-years, general fund revenues are expected to match or exceed other revenues.

Hawaiʻi’s Economic Recovery

How did we get from the austere revenues of 2021 to the ample resources available to support the 2023 budget? The remarkable turnaround is due mostly to federal COVID-19 relief. A half dozen acts, from the Coronavirus Preparedness and Response Supplemental Appropriation Act signed on March 6, 2020, to the American Rescue Plan Act, signed on March 22, 2021, added nearly $20 billion to Hawaiʻi’s economy.

Some of the money, such as the unemployment insurance bump and the relief for gig workers and contractors, increased taxable household incomes and spending, which in turn helped state revenue collections in 2021.

In addition, more than $2 billion in federal relief funds directly supported state programs in the FY22 and FY23 budgets, and some of the federal dollars for education, food and other needs have longer timelines for spending.

Tax Credits

In 2019, Hawaiʻi granted more than $300 million in tax credits, a sum equal to 10 percent of all individual and corporate income taxes collected that year.

Tax credits are among the tools the state uses to invest in people, businesses and the environment. Instead of appropriating state funds for these investments through the budget process, tax credits meet the state’s objectives by reducing the tax liability of qualified individuals and businesses in order to:

Promote social welfare;

Encourage certain industries or economic activities; or

Avoid double taxation or pyramiding of Hawai‘i taxes.

The most significant “social welfare” tax credit legislation in a number of years was passed in 2022 (HB2510) when lawmakers made the state’s Earned Income Tax Credit refundable and permanent. This tax credit is an effective anti-poverty tool that helps low-income working families with flexible cash to pay for household essentials.

The state’s largest business incentive tax credit, the Motion Picture, Digital Media, and Film Production credit, was changed in 2022 per HB1982. The new version increases the per-production credit amount from $15 million to $17 million, but retains the overall annual cap of $50 million. It also imposes a surcharge on the credit to be deposited to a special fund that supports staff at the Department of Business Economic Development and Tourism and at the Department of Taxation to monitor and certify applications for the credit.

For more information about tax credits, download the “Tax Credits as Tools to Advance Prosperity” report below.