Incoming federal tax cuts will heavily favor Hawaiʻi’s wealthiest residents

The State of Hawaiʻi has an obligation to shore up its revenue through tax policies that make the wealthiest among us pay their fair share.

Hawaiʻi’s 2025 legislature focused on raising tax revenue to prepare for federal cuts

Assessing a proper tax rate on corporations and the wealthy will be necessary to produce a budget that can fund critical safety net programs and investments in our future.

Congress’ budget blueprint leaves Hawaiʻi’s working families behind

In effect, the budget blueprint aims to take food out of the mouths of hungry keiki, so that billionaires can pad their pockets even more on the way to the bank.

Tax credits are more necessary than ever in 2025

Hawaiʻi’s families need urgent help to deal with the high cost of living. This is especially true for parents, who have to balance the cost of child care, rent, and food every month.

How Hawaiʻi’s hardworking undocumented immigrants support our economy and communities

A new report from the Institute on Taxation and Economic Policy lifts up the significant tax contributions that undocumented immigrants make to our federal, state and local governments through the taxes they pay each year.

The big budget trouble with HB2404’s over-broad and sweeping tax cuts

Last minute changes to the bill, made without public scrutiny, will increase its cost by nearly eight-fold, while higher-income households will get a far bigger benefit than those struggling to make ends meet.

Congress considers making the federal Child Tax Credit refundable; Hawaiʻi considers Keiki Credit

H.R. 7024 is a reminder that the Child Tax Credit is a widely popular program with proven anti-poverty benefits.

Lawmakers still need to equitably raise revenue to meet Hawaiʻi’s needs

On tax policy, state legislators made progress in 2023 with tax relief, but left smart, revenue-raising policy initiatives on the table for next session.

Legislative agenda 2023: tax reforms to boost incomes and fund investments in our future

Top of the list of immediate challenges for Hawaiʻi is to find a way to prevent our people from being overwhelmed by the high and rising cost of living in the islands.

What made the 2022 Hawaiʻi legislative session a win for working families?

After multiple years with little progress on policy to help working families survive Hawaiʻi’s highest-in-the-nation cost of living, several factors came together to deliver a banner year in 2022.

A Hawaiʻi Child Tax Credit would keep thousands of keiki out of poverty

After the expiration of the expanded federal Child Tax Credit, poverty rates spiked—it’s time for Hawaiʻi lawmakers to step up and fill the gap.

Opportunities for Hawaiʻi to maximize its budget investments

Maintaining government spending on public programs, Hawaiʻi’s workforce, and contractors for the state keeps money circulating throughout the economy as people pay for housing, food and other services.

How Hawaiʻi is funding its $24 billion FY23 budget

The legislature not only decides where money is spent, but also makes many of the decisions about who pays how much to support the budget.

2022 legislative session: A big win for working families; but more must be done

Legislators adopted two priority economic justice policies to deliver a significant household income boost to hundreds of thousands of Hawaiʻi workers.

Now is the right time to expand Hawaiʻi’s Earned Income Tax Credit

In 2021, 12 states and D.C. recognized the devastating effects of the pandemic recession and improved their EITCs to support their working families. Hawaiʻi should join them.

Expanding economic opportunity with the Hawaiʻi EITC

Expanding the state Earned Income Tax Credit to make it refundable would put more money back in the pockets of Hawaiʻi's working families, strengthening the local economy.

Put more money in working people’s pockets and reduce housing costs

This legislative session, Hawaiʻi Appleseed is pushing hard to implement a significant minimum wage increase, expand successful tax credits for low-income families, and lay the groundwork for housing policy that will mean no one in Hawaiʻi is left unsheltered because of poverty.

Appleseed agenda 2021: stop cuts, boost working families and the economy

Hawaiʻi Appleseed’s work during the 2021 legislative session focuses on the areas most critical to preserving the strength and stability of Hawaiʻi people, families and communities.

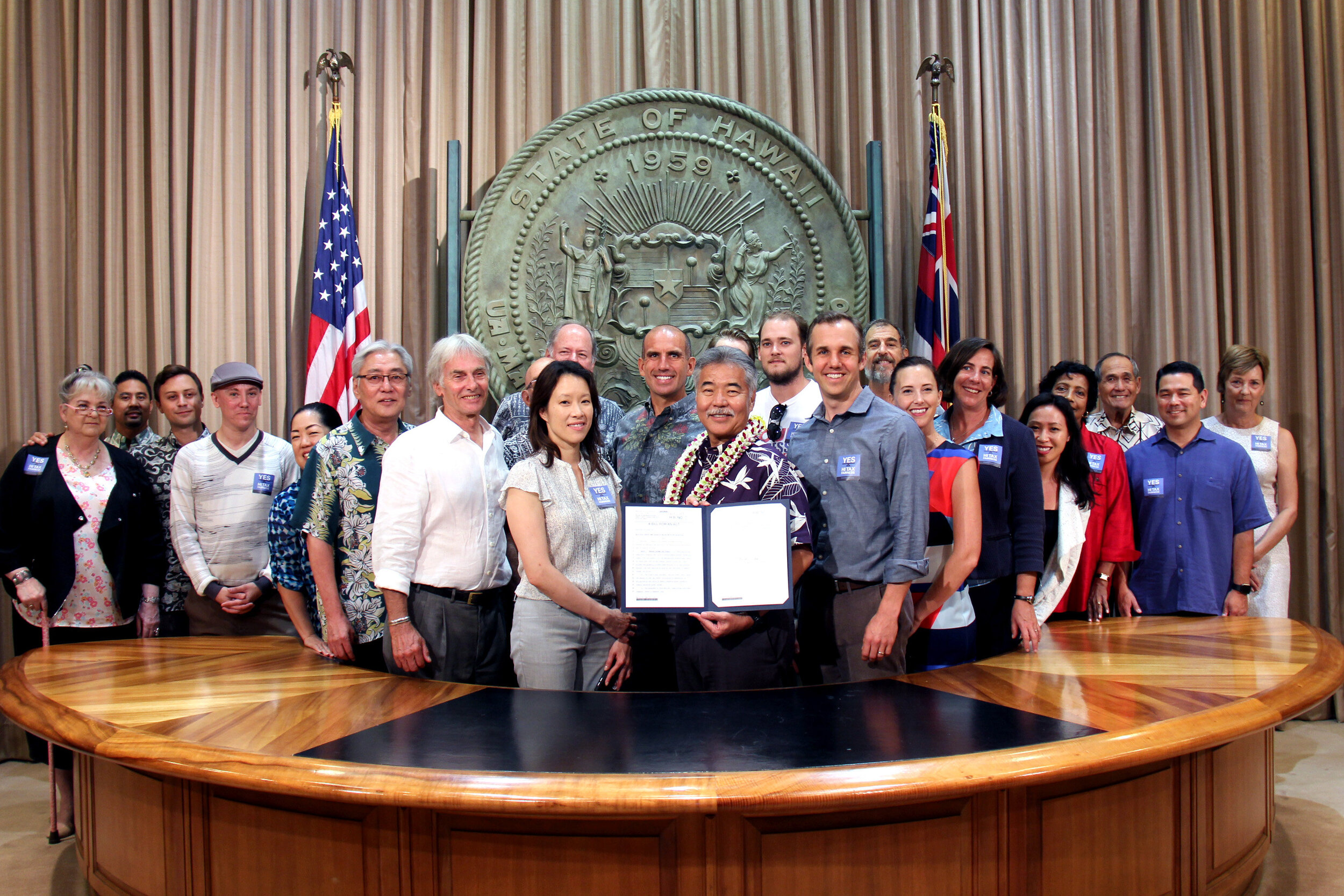

Governor Ige signs HB209, a win for working families and children

With this new law, Hawaiʻi joins 28 other states and Washington D.C. in offering a state-level EITC to help working families keep more of their earnings.

Hawaiʻi bill will create historic new working families tax credit

Rep. Scott Saiki called passage of the bill the “most consequential work in the last few years to reduce poverty and Hawaiʻi’s high cost of living.”