Hawaiʻi is even less affordable after the pandemic

How have jobs, wages and costs changed from before the COVID pandemic compared to after? These charts show changes from 2019 to 2022 that have affected livability for Hawaiʻi residents.

Congress considers making the federal Child Tax Credit refundable; Hawaiʻi considers Keiki Credit

H.R. 7024 is a reminder that the Child Tax Credit is a widely popular program with proven anti-poverty benefits.

Keiki poverty more than doubled last year without the expanded Child Tax Credit

Hawaiʻi lawmakers have an obvious solution at their disposal, if they are willing to act on it.

Lawmakers still need to equitably raise revenue to meet Hawaiʻi’s needs

On tax policy, state legislators made progress in 2023 with tax relief, but left smart, revenue-raising policy initiatives on the table for next session.

A Hawaiʻi Child Tax Credit would keep thousands of keiki out of poverty

After the expiration of the expanded federal Child Tax Credit, poverty rates spiked—it’s time for Hawaiʻi lawmakers to step up and fill the gap.

Hawaiʻi inequality is on the rise—wealth taxes can help fix the problem

Hawaiʻi is one of the most unequal states in the nation for wealth distribution, but tax policy changes can help capture more wealth at the top to invest back into communities.

Opportunities for Hawaiʻi to maximize its budget investments

Maintaining government spending on public programs, Hawaiʻi’s workforce, and contractors for the state keeps money circulating throughout the economy as people pay for housing, food and other services.

How Hawaiʻi is funding its $24 billion FY23 budget

The legislature not only decides where money is spent, but also makes many of the decisions about who pays how much to support the budget.

2022 legislative session: A big win for working families; but more must be done

Legislators adopted two priority economic justice policies to deliver a significant household income boost to hundreds of thousands of Hawaiʻi workers.

Put more money in working people’s pockets and reduce housing costs

This legislative session, Hawaiʻi Appleseed is pushing hard to implement a significant minimum wage increase, expand successful tax credits for low-income families, and lay the groundwork for housing policy that will mean no one in Hawaiʻi is left unsheltered because of poverty.

A pandemic recession update in charts

Unprecedented job loss, a rise in housing costs, and inflation in food, fuel and consumer goods has made the pandemic recession especially devastating to Hawaiʻi’s working families.

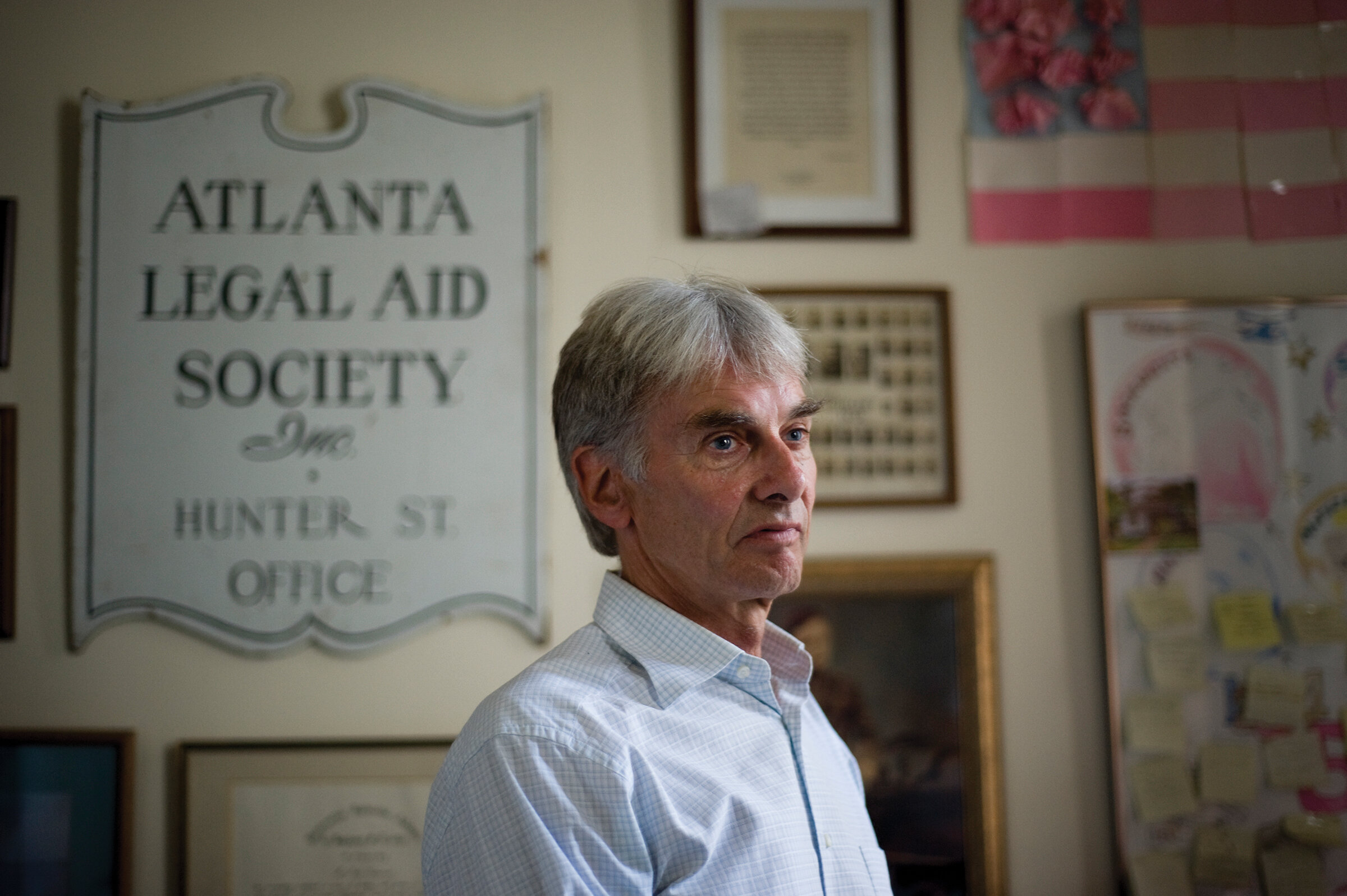

50 years in the fight for equal justice

Victor Geminiani, founding director of Hawaiʻi Appleseed and career advocate for low-income and underserved communities, will retire on August 31, 2019.

Official poverty data obscures the reality faced by many Hawaiʻi residents

If you hear Hawaiʻi has one of the lowest official poverty rates in the nation, remember that doesn’t take into account our highest-in-the-nation cost of living.

Coming soon: The Hawaiʻi Budget and Policy Center

Hawaiʻi Appleseed is creating a new think tank focused on research and analysis of state budget and tax policy—the Hawaiʻi Budget & Policy Center (HBPC).

Hawaiʻi bill will create historic new working families tax credit

Rep. Scott Saiki called passage of the bill the “most consequential work in the last few years to reduce poverty and Hawaiʻi’s high cost of living.”

Appleseed releases 2016 State of Poverty report

The report brings together the most recent available data to provide a snapshot of how low-income residents have fared after the economic recovery from the Great Recession.