Two truths in tension: Hawaiʻi’s housing crisis and the urgent need for anti-displacement measures

We should reject the false choice between growth and protection, we can do both. Anti-displacement policies like HB1325 ensure that, as we build for the future, we don’t abandon our present.

Hawaiʻi should close tax loopholes for multinational corporations

Multinational corporations make huge profits from the business activity they conduct in Hawaiʻi, while dodging the taxes they should be paying to support our state.

Expand the state’s e-bike rebate program to improve mobility options

Now is the time for the state to expand the electric bike and moped rebate program to lower household transportation costs, reduce vehicle costs, and increase resident’s physical activity.

Invest in Safe Routes to School to improve pedestrian safety in Hawaiʻi

Federal funding freezes, requirements from the Navahine lawsuit settlement, and worsening traffic and its associated negative impacts—why state lawmakers shouldn't wait to invest in Safe Routes to School.

Marginal conveyance tax rates would advantage the majority of Hawaiʻi’s local homeowners

Hawaiʻi has some of the highest home prices in the nation, yet our current, flat conveyance tax structure fails to ensure that real estate market activity meaningfully contributes to affordable housing, infrastructure, and community investment.

Tax credits are more necessary than ever in 2025

Hawaiʻi’s families need urgent help to deal with the high cost of living. This is especially true for parents, who have to balance the cost of child care, rent, and food every month.

Hawaiʻi’s keiki are still waiting for universal free school meals. The time to act is now.

Research shows that consistent access to nutritious meals improves both academic performance and long-term health. Yet, in 2023, 6 percent of Hawaiʻi households with children had one or more children go a whole day without food.

What’s in store for 2025: Hawaiʻi Appleseed transportation equity projects on the horizon

In 2025, we’ll take a greater look at more equitable approaches to traffic enforcement, the impacts of parking mandates on affordable housing, and addressing the unique mobility challenges that women and their families face.

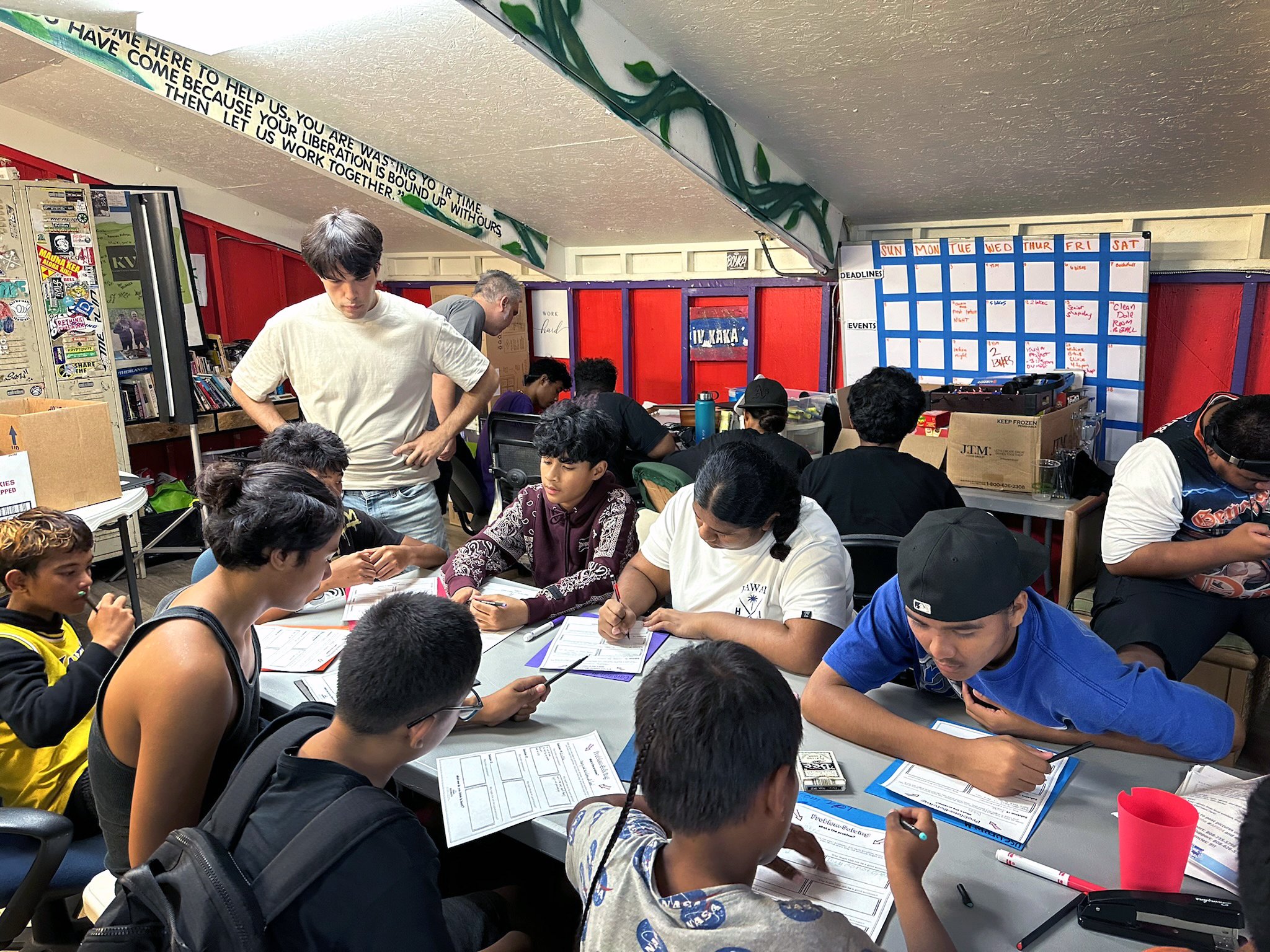

Empowering Kalihi’s youth leaders through community organizing and policy advocacy training

While people in power sometimes hand wave the voice of youth in policy conversations, our partnership with KVIBE is a reminder that young people can and should be integral components of the decision-making process.

How a second Trump presidency could impact the pocket books of Hawaiʻi’s working families

Outside of the top 5 percent richest households, families will likely see significant tax increases, while the cost of consumer items would spike under proposed tariffs.

How Hawaiʻi’s hardworking undocumented immigrants support our economy and communities

A new report from the Institute on Taxation and Economic Policy lifts up the significant tax contributions that undocumented immigrants make to our federal, state and local governments through the taxes they pay each year.

A mix of progress and missed opportunities: affordable housing efforts at the 2024 legislature

As Hawaiʻi continues to grapple with the complex dynamics of housing affordability and availability, it is clear that a more balanced approach that incorporates both supply- and demand-side measures, is essential.

Jaywalking remains illegal in Hawaiʻi; Freedom to Walk elevates transportation equity discussion

By maintaining the focus on data-driven strategies to address systemic roadway safety issues, we can push for investments in infrastructure that slows vehicle speeds, increases the visibility of pedestrians, and physically separates vehicles and pedestrians.

Hawaiʻi’s elected leaders buy-in to costly “trickle-down” myth

Passing an “historic” tax cut that mostly benefits the wealthiest Hawaiʻi residents is not the path to a healthy economy that works for working people.

Hawaiʻi is even less affordable after the pandemic

How have jobs, wages and costs changed from before the COVID pandemic compared to after? These charts show changes from 2019 to 2022 that have affected livability for Hawaiʻi residents.

Hawaiʻi’s serious mental health care needs take a top spot in Governor Green’s 2025 supplemental budget

In addition to funding Lahaina's recovery, the governor proposes increases to much-needed funding for the state's unmet mental health care needs.

Decriminalize jaywalking in the 2024 legislative session

Jaywalking laws have failed to reduce pedestrian deaths. It is time to shift resources away from penalizing pedestrians, and redirect resources towards providing infrastructure so that people can safely walk, bike and roll.

Legislative agenda 2023: tax reforms to boost incomes and fund investments in our future

Top of the list of immediate challenges for Hawaiʻi is to find a way to prevent our people from being overwhelmed by the high and rising cost of living in the islands.

How the state plans to spend its $24 billion FY23 budget

The budget determines how our collective resources will be distributed to pay for programs and investments that support public needs. The funding decisions made in the budget demonstrate where our collective values lie.

Community-driven progress on Hawaiʻi’s affordable housing crisis

The only to address Hawai‘i’s long-standing housing crisis is through a comprehensive, community- and data-driven approach designed not to just build more housing, but to build the housing that Hawaiʻi residents need and can afford.