Marginal conveyance tax rates would advantage the majority of Hawaiʻi’s local homeowners

Hawaiʻi has some of the highest home prices in the nation, yet our tax policies fail to ensure that real estate market activity meaningfully contributes to affordable housing, infrastructure, and community investment. To help address this problem, Hawaiʻi Appleseed is advocating for a modernized conveyance tax structure through House Bill 1410.

For the past 3 years, Hawai‘i Appleseed has pushed to strengthen the conveyance tax so it can be effectively used as a tool for public benefit—funding investments in our aging infrastructure, depositing revenue in the Rental Housing Revolving Fund (RHRF) for price-restricted rentals, and, this year, establishing a dedicated source for supportive housing initiatives.

While past efforts have focused on tax rate adjustments and increasing allocations to these critical funds, this year’s efforts center on adopting a marginal rate system for the state’s conveyance tax. This reform will create a tax structure that is more equitable, while generating essential revenue for public investment.

Modernizing An Outdated, Regressive Tax Structure

Hawaiʻi’s conveyance tax rates have not been updated since 2009, despite soaring real estate prices. The current system applies a flat tax rate to the entire sale price of a property once its value crosses a certain threshold. This leads to what is often called the “cliff effect,” where a small increase in property value can push a property into a higher bracket, resulting in a significantly higher conveyance tax burden when the property is sold.

This outdated structure is a burden on resident home buyers and with large jumps in tax liability. For example, the difference in conveyance tax owed between a home sold for $999,999 versus $1,000,001 is more than two thousand dollars, even though the sales price is only a $2 difference.

Worse still, this system fails to generate adequate revenue from the highest-value sales that contribute most to housing speculation and market inflation.

The proposed marginal rate structure in HB1410 mirrors Hawaiʻi income tax brackets, ensuring that higher rates apply only to the portion of a property’s value exceeding each threshold. By shifting to a marginal system, we ensure that the tax structure reflects the actual value of high-end property transactions while protecting middle-class homeowners.

Take the example of a $1.1 million home sale by a resident. Under the current conveyance tax structure’s flat rate system, the resident would owe $3,300 in conveyance tax on the sale of the home. Should HB1410 pass into law, the conveyance tax burden would drop to $2,600 because most of the value of the home would be taxed at a lower rate. With the average home price in Hawaiʻi hovering around $1 million, the proposal for a marginal conveyance tax structure would reduce the tax liability for the average local homeowner selling their property, while targeting the tax at owners of high-end real estate.

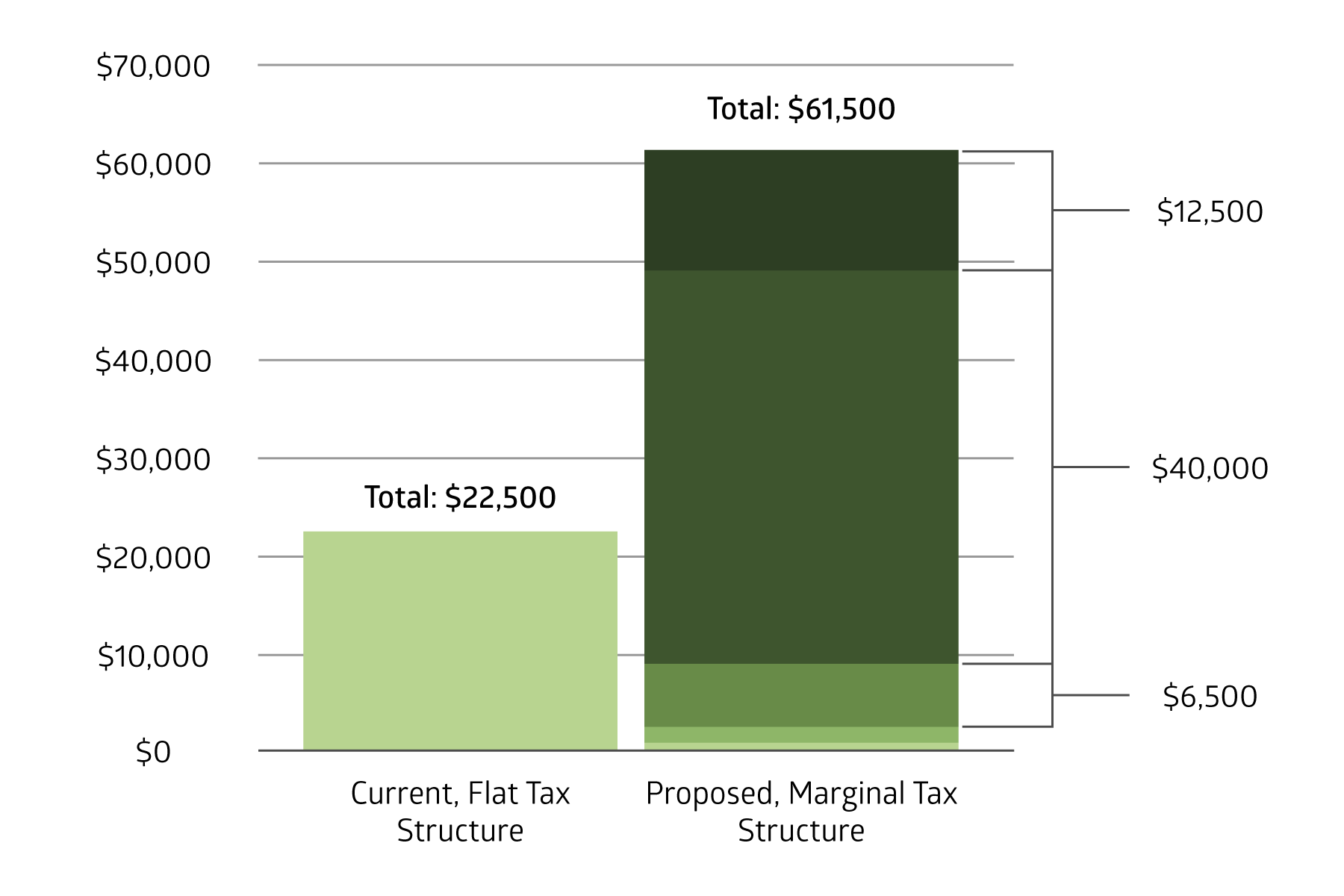

In a different example, under the current system, a $4.5 million property is taxed at 0.85 percent on the entire value, leading to a $22,500 tax bill. Under the marginal system, the first $600,000 would be taxed at 0.10 percent, the portion from $600,000 to $1 million at 0.35 percent, and so on. This creates a smoother, fairer progression and removes the incentive to manipulate prices to avoid large tax jumps, while more accurately assessing the true value of the property and capturing the corresponding fair tax rate.

Figure 1. Amount of conveyance tax owed on sale of a $1.1 million owner-occupied home

Figure 2. Amount of conveyance tax owed on sale of a $4.5 million non owner-occupied home

Appleseed analysis of home sales shows that, in general, higher value properties are more likely to be bought and sold by out-of-state investor owners, and less likely to be bought and sold by local residents. Switching to a marginal rate will put more of the tax burden on these wealthy home buyers and less tax burden on the average local home buyer.

Figure 3. Residential home sales by owner occupancy status, Hawaiʻi (2023)

More Revenue, Smarter Investments

Adopting a marginal rate system is not just about fairness—it’s also about funding critical needs. Under HB1410, the conveyance tax would better target very expensive property sales, giving it the potential to generate up to 33 percent more revenue than it currently does. This would unlock tens of millions of dollars in new revenue that could be invested directly into our most pressing housing and infrastructure needs.

Infrastructure Investments through DURF: The Dwelling Unit Revolving Fund (DURF) supports infrastructure needed for housing development, such as roads, sewers and utilities. Without these investments, housing production stalls due to inadequate infrastructure. HB1410 mandates a 10 percent allocation to DURF from high-value sales, ensuring that new housing developments are backed by the infrastructure they need to succeed.

Supportive Housing Special Fund: HB1410 also allocates 8 percent of conveyance tax revenue to supportive housing, ensuring that we fund long-term solutions for homelessness. Supportive housing is an important part of the full spectrum of housing needs our community has. Hawaiʻi does not currently have a dedicated source of funding for supportive housing, leaving a hole in our safety net through which too many fall. As we continue to see displacement from public housing redevelopment and rising rents across the state, this funding is critical to keeping vulnerable residents housed and to house residents who have experienced homelessness.

Rental Housing Revolving Fund (RHRF): The RHRF was established as gap financing for Low-Income Housing Tax Credit projects. This is a preexisting, dedicated fund which receives either 50 percent or $38 million in conveyance tax revenue, whichever is less, every year in addition to whatever cash infusion the legislature commits.

Hawaiʻi’s housing crisis won’t fix itself. Real estate speculation, rising property values, and a lack of funding for necessary infrastructure upgrades all contribute to our deepening affordability challenges. By modernizing our conveyance tax with a marginal rate system, we ensure that our tax policy works for local people too, and not just for investors and luxury property owners. HB1410 is a smart policy that offers us a big step toward a more equitable and sustainable housing future for Hawaiʻi.