Hawaiʻi’s costly tax shift: How a billion-dollar cut threatens public services

The choice before us is whether we will allow a billion-dollar annual loss to erode our common foundation, or whether we will act to preserve it—for every family, and for generations to come.

Hawaiʻi’s 2025 legislature focused on raising tax revenue to prepare for federal cuts

Assessing a proper tax rate on corporations and the wealthy will be necessary to produce a budget that can fund critical safety net programs and investments in our future.

How to fix Honolulu’s Empty Homes Tax proposal

A newly released report commissioned by the county council demonstrates the need to align Honolulu’s policy proposal with demonstrated best practices.

Proposed Trump tax cuts will overwhelmingly benefit the top 1 percent

As millions of Americans file their taxes this April, both the U.S. House and Senate have passed budget resolutions that open the pathway for a massive tax giveaway for the wealthiest people in the country.

Hawaiʻi should close tax loopholes for multinational corporations

Multinational corporations make huge profits from the business activity they conduct in Hawaiʻi, while dodging the taxes they should be paying to support our state.

Congress’ budget blueprint leaves Hawaiʻi’s working families behind

In effect, the budget blueprint aims to take food out of the mouths of hungry keiki, so that billionaires can pad their pockets even more on the way to the bank.

Marginal conveyance tax rates would advantage the majority of Hawaiʻi’s local homeowners

Hawaiʻi has some of the highest home prices in the nation, yet our current, flat conveyance tax structure fails to ensure that real estate market activity meaningfully contributes to affordable housing, infrastructure, and community investment.

Tax credits are more necessary than ever in 2025

Hawaiʻi’s families need urgent help to deal with the high cost of living. This is especially true for parents, who have to balance the cost of child care, rent, and food every month.

How Hawaiʻi’s hardworking undocumented immigrants support our economy and communities

A new report from the Institute on Taxation and Economic Policy lifts up the significant tax contributions that undocumented immigrants make to our federal, state and local governments through the taxes they pay each year.

The big budget trouble with HB2404’s over-broad and sweeping tax cuts

Last minute changes to the bill, made without public scrutiny, will increase its cost by nearly eight-fold, while higher-income households will get a far bigger benefit than those struggling to make ends meet.

Hawaiʻi’s capital gains loophole floats the rich as working families struggle to stay above water

In the interest of tax fairness, the State of Hawaiʻi should tax capital gains—income from selling assets such as stocks, bonds, art and real estate—at the same rates as income made from wages, salaries and other compensation for work.

Leverage Hawaiʻi’s conveyance tax to equitably fund affordable housing, land conservation and infrastructure needs

The legislature has the opportunity this session to raise revenue to pay for much needed affordable housing—as well as land conservation and infrastructure—by increasing conveyance tax rates on investment properties.

Congress considers making the federal Child Tax Credit refundable; Hawaiʻi considers Keiki Credit

H.R. 7024 is a reminder that the Child Tax Credit is a widely popular program with proven anti-poverty benefits.

Appleseed agenda 2021: stop cuts, boost working families and the economy

Hawaiʻi Appleseed’s work during the 2021 legislative session focuses on the areas most critical to preserving the strength and stability of Hawaiʻi people, families and communities.

How COVID-19 shaped Appleseed’s work in 2020

The year 2020 was a turbulent one, but it proved the power of Hawaiʻi’s greatest strength—its people.

Continuing research into poverty and housing with Hawaiʻi Community Foundation grant

The grant continues generous support from Hawaiʻi Community Foundation for fact-based research into budget, tax and housing policy issues that affect the wellbeing of Hawaiʻi’s people.

No cause for panic: Hawaiʻi’s economy is OK

A quarter of slow growth is no reason for lawmakers to forgo important economic justice measures like raising the minimum wage.

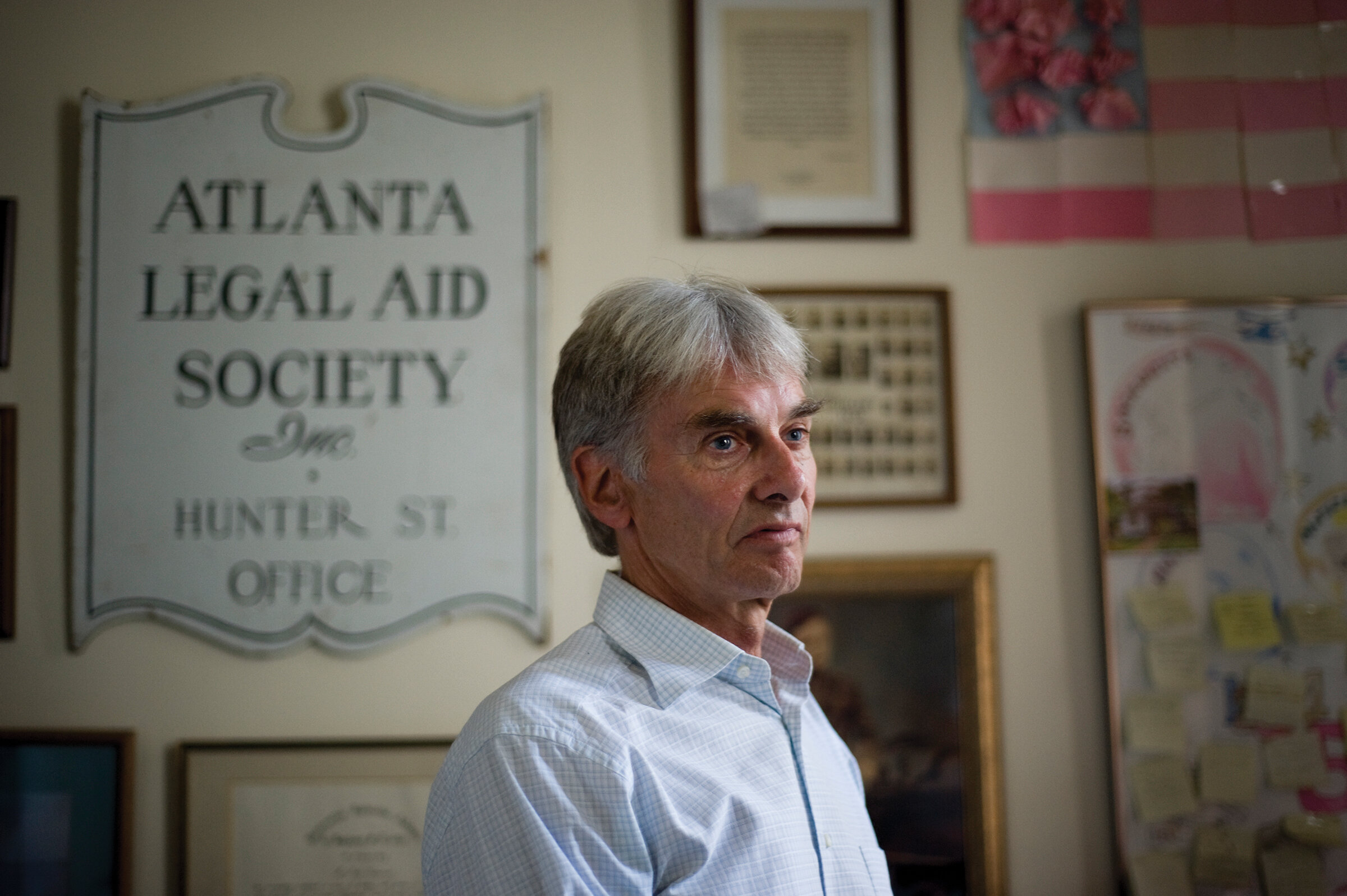

50 years in the fight for equal justice

Victor Geminiani, founding director of Hawaiʻi Appleseed and career advocate for low-income and underserved communities, will retire on August 31, 2019.

A tax on vacant units could provide housing crisis relief, if done right

Besides funding sources, taxes can be an excellent way of shifting behaviors; but getting rates and exemptions right is key to success.