Hawaiʻi’s costly tax shift: How a billion-dollar cut threatens public services

The choice before us is whether we will allow a billion-dollar annual loss to erode our common foundation, or whether we will act to preserve it—for every family, and for generations to come.

A turning point for SNAP: Strengthening local supports for Hawaiʻi households

Hawaiʻi has an opportunity to build a more resilient, community-driven food system—one that protects families regardless of federal uncertainty.

Hawaiʻi’s two-tier tax system: How the rich use a glaring loophole to pay less

While teachers, nurses and service workers pay income tax on every dollar they earn, the wealthy can shield a large portion of their profits thanks to a special tax break on capital gains.

Transformative change meets budget realities—a central lawmaking tension plays out in two new reports

Policy in Perspective 2025 and the Hawaiʻi Budget Primer FY2025–26 provide a compelling—and sometimes sobering—look at how Hawaiʻi invests, and often under-invests, in its communities.

Proposed Trump tax cuts will overwhelmingly benefit the top 1 percent

As millions of Americans file their taxes this April, both the U.S. House and Senate have passed budget resolutions that open the pathway for a massive tax giveaway for the wealthiest people in the country.

The big budget trouble with HB2404’s over-broad and sweeping tax cuts

Last minute changes to the bill, made without public scrutiny, will increase its cost by nearly eight-fold, while higher-income households will get a far bigger benefit than those struggling to make ends meet.

How the state plans to spend its $24 billion FY23 budget

The budget determines how our collective resources will be distributed to pay for programs and investments that support public needs. The funding decisions made in the budget demonstrate where our collective values lie.

The House’s budget proposal for the coming year

Buoyed by increasing tax collections and continued federal relief funds, the state House sent the Senate an amended budget that proposes to increase the executive budget by $1.3 billion.

Hawaiʻi budget challenges: tax revenues, fixed costs, state salaries

The pandemic’s effects on the economy will make passing a balanced budget more challenging than ever.

Data sovereignty and disaggregation research to be featured at State Capitol

Data disaggregation and data ensure that state spending is adequate and appropriately allocated, and that revenues are assessed and collected fairly.

How to plug Hawaiʻi’s budget gap while preserving critical services like education

There’s no doubt that the recession has punched a hole in Hawaiʻi’s state budget, but there are ways to plug the gap without cutting critical services.

Unemployed workers in Hawaiʻi can’t wait for Congress

Hawaiʻi has more than 200,000 unemployed workers and contractors. The state must move now to offer immediate support for these workers and their families.

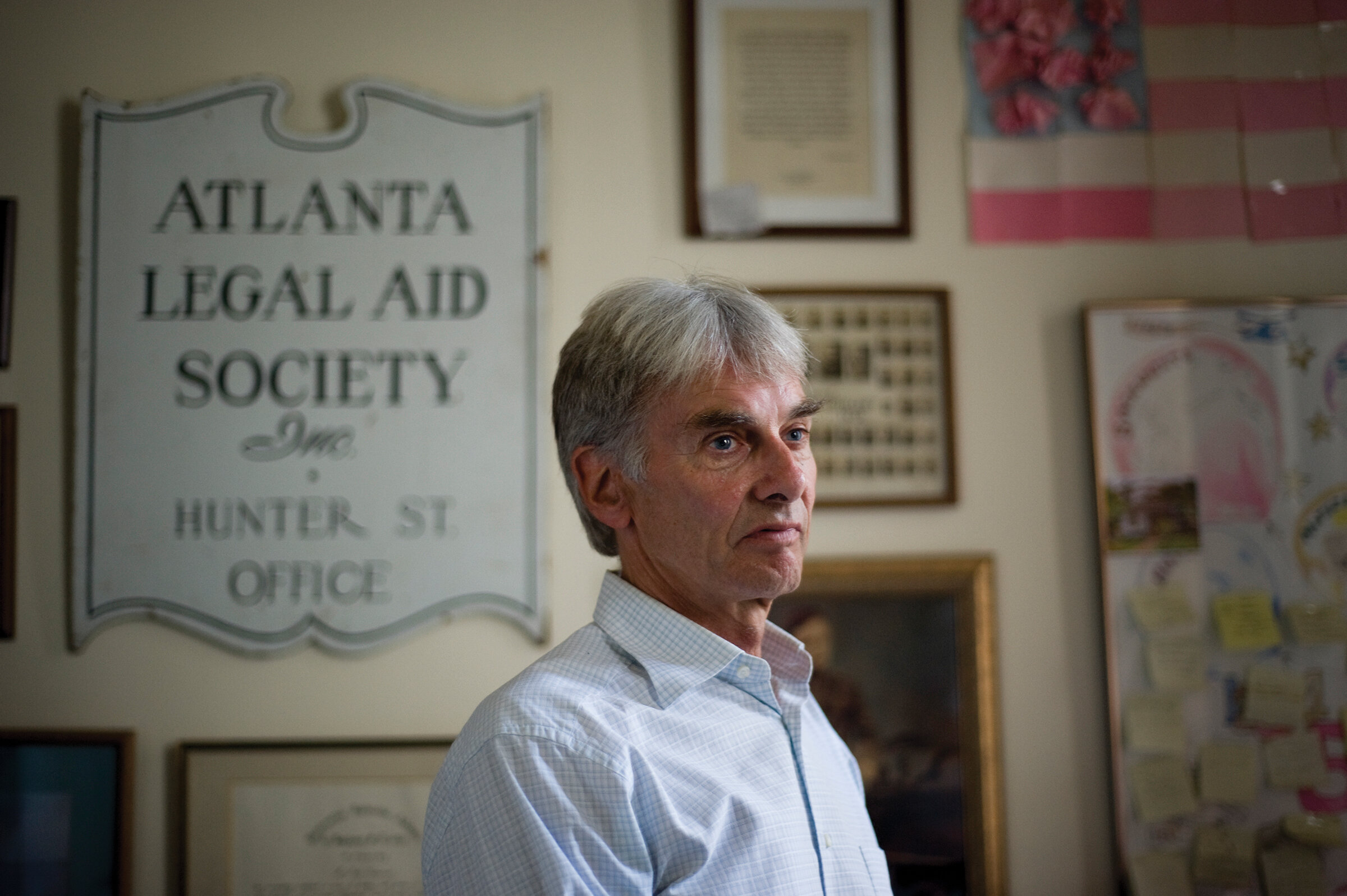

50 years in the fight for equal justice

Victor Geminiani, founding director of Hawaiʻi Appleseed and career advocate for low-income and underserved communities, will retire on August 31, 2019.

Redefining poverty would throw millions off critical social support programs

A Trump Administration rule change would force millions of Americans off critical programs that help women, children and families meet their basic needs.

Public charge rule change would hurt Hawaiʻi’s economy

Not only would the proposed rule change adversely impact the standard of living of Hawaiʻi’s immigrant families, it would also harm Hawaiʻi’s overall economy.

After school supper is a big missed opportunity in Hawaiʻi

Only 182 Hawaiʻi children benefited from after school suppers on an average weekday in 2017, according to a new report from the Food Research and Action Center.

School breakfast: building a solid foundation for learning

When you checkout at Safeway in September, you’ll have the option to donate to this important fundraiser to expand participation in school breakfast programs.

Coming soon: The Hawaiʻi Budget and Policy Center

Hawaiʻi Appleseed is creating a new think tank focused on research and analysis of state budget and tax policy—the Hawaiʻi Budget & Policy Center (HBPC).

A win for Hawaiʻi’s foster families

The state human services department has agreed to increase the amount that should be paid to cover the expense of caring for children in foster care.

Appleseed releases 2016 State of Poverty report

The report brings together the most recent available data to provide a snapshot of how low-income residents have fared after the economic recovery from the Great Recession.