Expanding economic opportunity with the Hawaiʻi EITC

For a more detailed look at the Earned Income Tax Credit and the benefits of refundability, read the Hawaiʻi Budget & Policy Center brief, Refunding Hawaiʻi.

Hawaiʻi’s working families continue to struggle with the nation’s highest gap between median earnings and the cost of living, and this difficult reality has only been made harsher by the COVID-19 pandemic. In fact, more than a third of Hawaiʻi households had at least some difficulty paying for their monthly expenses in December of 2021.

One way for state government to relieve some of this financial burden on hardworking families, and at the same time boost the economy, is through the targeted use of tax credits.

The Earned Income Tax Credit (EITC), a special program for low- and middle-wage workers, allows working families to hold on to more of their income. Since it was implemented at the federal level in 1975, the EITC has been an effective tool for improving the economic security of all workers, especially those with children. By giving working families more leeway to pay for their expenses, the EITC helps them to achieve the prosperity they deserve. In recognition of its success as a highly effective anti-poverty measure, Hawaiʻi and 29 other states (in addition to Puerto Rico and the District of Columbia) have created separate EITC programs for their own residents.

In 2020, 90,000 Hawaiʻi households received almost $203 million in benefits from the state EITC. These credits have been particularly beneficial for Native Hawaiians, Pacific Islanders and Filipinos. However, Hawaiʻi’s state-level EITC will expire next year unless lawmakers vote to make the credit permanent during the 2022 legislative session.

Furthermore, the state EITC was established in 2017 as a non-refundable tax credit, which reduces its effectiveness by limiting access for the lowest-wage workers. In addition to making the state EITC permanent, policymakers also have an opportunity to expand the program’s reach by making it refundable instead.

Figure 1. Average State EITC Claim by Household Income Level (2020)

Figure 1. Hawaiʻi residents with incomes under $15,000 are unable to claim the full value of the state EITC because they are paid low wages, effectively penalizing the families that would benefit the most from this tax credit.

Source: Choy, Isaac, Seth Colby and Dongliang Wu, “Earned Income Tax Credit Report: Tax Year 2020,” Hawaiʻi State Department of Taxation, November 2021

Despite working long and difficult hours in demanding and stressful jobs, these workers earn so little on chronically low wages that they do not have a large enough tax liability to make full use of the amount of the credit. Non-refundable tax credits can, at most, reduce a tax liability down to $0, but they cannot distribute any leftover amount of the credit in the form of a refund check. This is illustrated by Figure 1, which shows that households earning under $15,000 a year receive lower state EITC amounts than households in higher income brackets.

On the other hand, a refundable EITC would allow workers who are paid very low wages to receive a tax refund, accessing the full value of the credit. If Hawaiʻi’s state EITC were made refundable in 2022, the benefit amounts for all recipients would increase, but the lowest 20 percent of earners would see the greatest boost to their current benefits, as shown in Table 1.

Table 1. Impact of Refundability on EITC Benefits by Income Quintile (2022)

Table 1. Expanding the state EITC to make it refundable not only puts more money into the pockets of families at all four income quintiles where families are eligible, it also better distributes that money to the families that need it the most. increasing the share of the total credit that goes to families in the lowest 20 percent of earners. The cost of a refundable credit versus the non-refundable credit is $41 million versus $21 million.

Source: Analysis conducted by the Institute for Taxation and Economic Policy (ITEP), December 2021.

Since they are more likely to be paid low wages (because of systemic barriers to economic opportunity rooted in colonialism), Native Hawaiians and Pacific Islanders have higher uptake rates for Hawaiʻi’s state EITC than the remainder of the population, as shown in Figure 2. Owing to the non-refundability of the state EITC, they are also more likely to be underserved by the current program.

Figure 2. Share of Hawaiʻi Households Receiving EITC by Racial Group (Projected 2022)

Figure 2. Pacific Islanders and Native Hawaiians have the highest uptake rates of the EITC in Hawai‘i, signaling the program’s impact as a policy that supports racial equity.

Source: ITEP analysis, December 2021

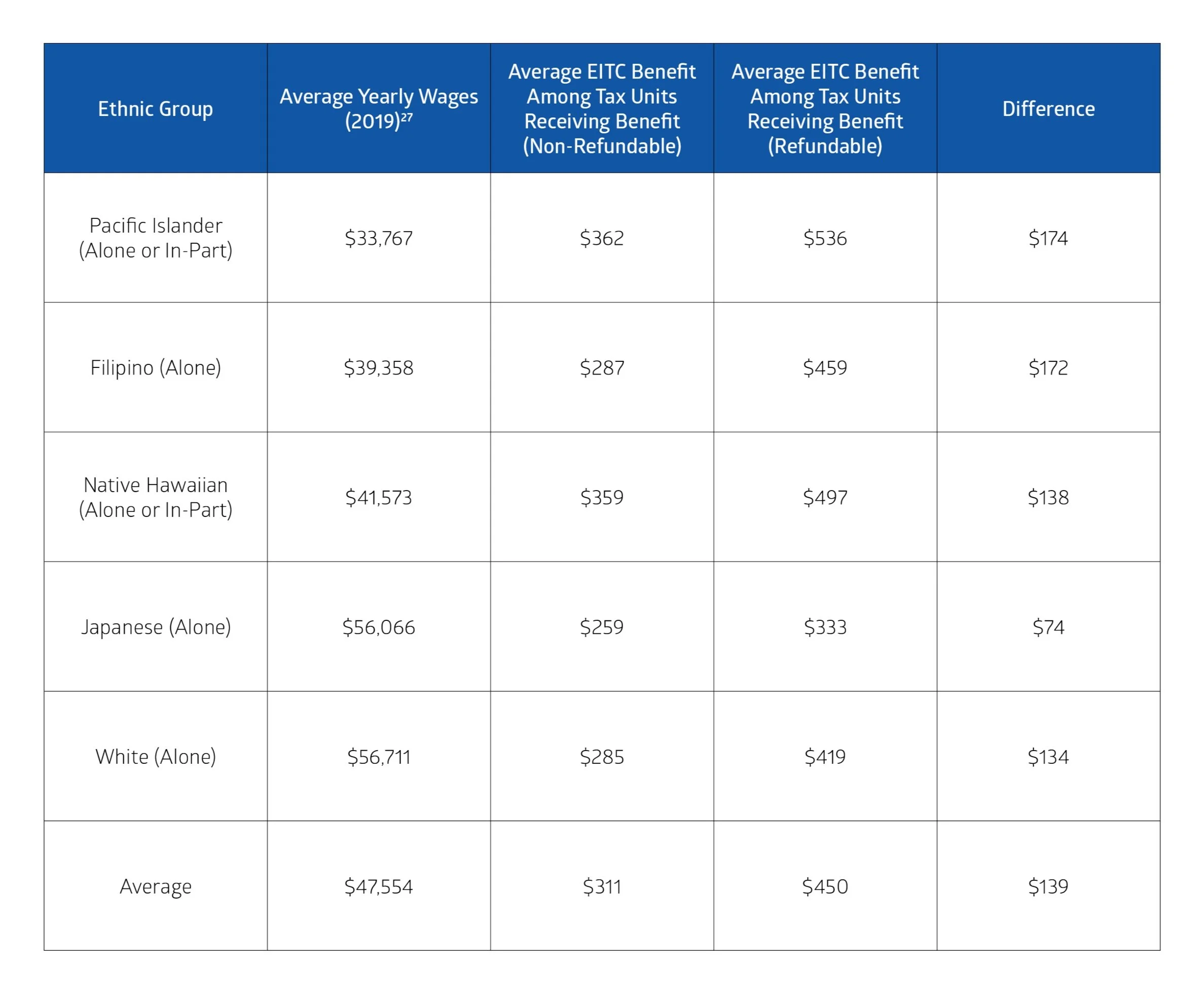

Pacific Islanders, Filipinos, and Native Hawaiians would benefit the most from a refundable state EITC. Overall, the average tax benefit for EITC recipients would increase by $139, as shown in Table 2.

Table 2. Average Yearly Wages and EITC Benefit by Racial Group (Projected 2022)

Table 2. Native Hawaiians, Pacific Islanders and Filipinos would benefit the most from a refundable state EITC.

Source: ITEP analysis, December 2021

In 2022, a refundable state EITC would cost Hawaiʻi $41 million, which is $20 million more than the cost of the currently non-refundable state EITC. However, the state legislature added three high-income tax brackets in Act 107 (the bill that established the state program in 2017) with no expiration date. Alone, the revenue collected from these high income earners would provide enough funding to pay for a refundable state EITC.

Raising Hawaiʻi’s taxes on long-term capital gains—profits from the sale of assets held almost exclusively by the top 5 percent of earners in our state—would also be an equitable way to ensure that our state EITC remains permanently refundable. Hawaiʻi is one of only nine states in which capital gains are taxed at a lower rate than standard income.

If Hawaiʻi were to raise its tax on long-term capital gains from 7.25 percent to 11 percent, it would collect $57 million in additional revenue during 2022. This, too, would provide more than enough funding to support the state EITC program in the long term.

Hawaiʻi’s state EITC has lifted up thousands of working families, especially during times of economic strife. To ensure that the state EITC supports this population in the best way possible, state legislators should make the program permanent and refundable in 2022.