Hawaiʻi’s costly tax shift: How a billion-dollar cut threatens public services

The choice before us is whether we will allow a billion-dollar annual loss to erode our common foundation, or whether we will act to preserve it—for every family, and for generations to come.

Incoming federal tax cuts will heavily favor Hawaiʻi’s wealthiest residents

The State of Hawaiʻi has an obligation to shore up its revenue through tax policies that make the wealthiest among us pay their fair share.

Hawaiʻi’s 2025 legislature focused on raising tax revenue to prepare for federal cuts

Assessing a proper tax rate on corporations and the wealthy will be necessary to produce a budget that can fund critical safety net programs and investments in our future.

How a second Trump presidency could impact the pocket books of Hawaiʻi’s working families

Outside of the top 5 percent richest households, families will likely see significant tax increases, while the cost of consumer items would spike under proposed tariffs.

Census poverty data for 2023 highlights the importance of government assistance

Promising trends for families across the nation, but many continue to feel the lasting effects of widespread unemployment during the pandemic, a rising cost of living, and inadequate government assistance.

Hawaiʻi’s elected leaders buy-in to costly “trickle-down” myth

Passing an “historic” tax cut that mostly benefits the wealthiest Hawaiʻi residents is not the path to a healthy economy that works for working people.

Expanding economic opportunity with the Hawaiʻi EITC

Expanding the state Earned Income Tax Credit to make it refundable would put more money back in the pockets of Hawaiʻi's working families, strengthening the local economy.

Put more money in working people’s pockets and reduce housing costs

This legislative session, Hawaiʻi Appleseed is pushing hard to implement a significant minimum wage increase, expand successful tax credits for low-income families, and lay the groundwork for housing policy that will mean no one in Hawaiʻi is left unsheltered because of poverty.

Tax fairness is popular and needed for Hawaiʻi’s future

Most taxpayers agree that a fair and effective tax system is a critical part of building Hawaiʻi’s future.

Our tax system increases inequity

Our tax system plays a big role in the widening gap between those who are wealthy and those who are struggling to get by—a gap that is exponentially greater in Black, brown and indigenous communities.

How to plug Hawaiʻi’s budget gap while preserving critical services like education

There’s no doubt that the recession has punched a hole in Hawaiʻi’s state budget, but there are ways to plug the gap without cutting critical services.

Appleseed announces 2019 policy agenda

After months of research spent examining these critical issues, this agenda prioritizes efforts for maximum benefit to the community at-large.

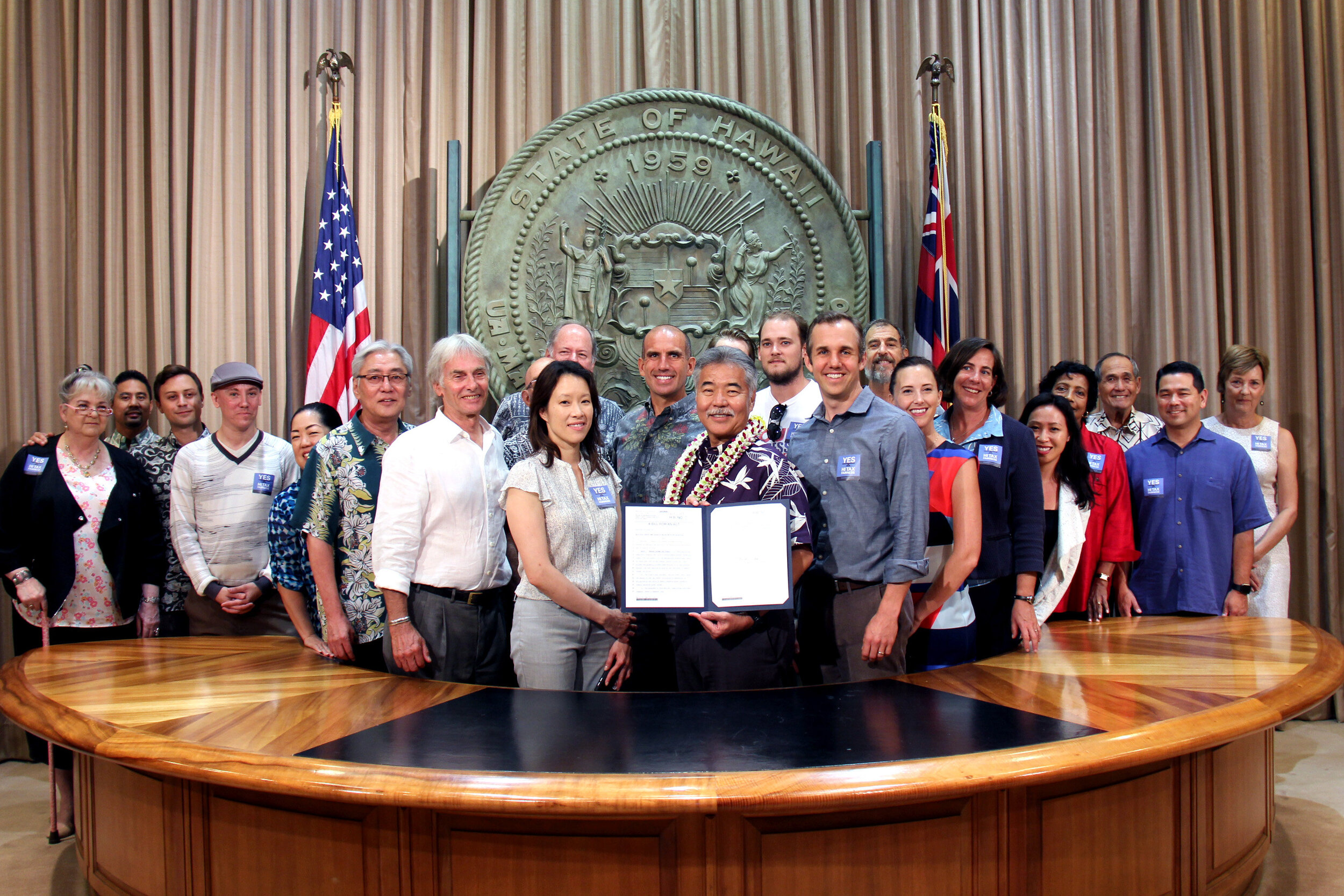

Governor Ige signs HB209, a win for working families and children

With this new law, Hawaiʻi joins 28 other states and Washington D.C. in offering a state-level EITC to help working families keep more of their earnings.

Hawaiʻi bill will create historic new working families tax credit

Rep. Scott Saiki called passage of the bill the “most consequential work in the last few years to reduce poverty and Hawaiʻi’s high cost of living.”

Appleseed releases 2016 State of Poverty report

The report brings together the most recent available data to provide a snapshot of how low-income residents have fared after the economic recovery from the Great Recession.