Hawaiʻi’s costly tax shift: How a billion-dollar cut threatens public services

The choice before us is whether we will allow a billion-dollar annual loss to erode our common foundation, or whether we will act to preserve it—for every family, and for generations to come.

Transformative change meets budget realities—a central lawmaking tension plays out in two new reports

Policy in Perspective 2025 and the Hawaiʻi Budget Primer FY2025–26 provide a compelling—and sometimes sobering—look at how Hawaiʻi invests, and often under-invests, in its communities.

Incoming federal tax cuts will heavily favor Hawaiʻi’s wealthiest residents

The State of Hawaiʻi has an obligation to shore up its revenue through tax policies that make the wealthiest among us pay their fair share.

Hawaiʻi’s 2025 legislature focused on raising tax revenue to prepare for federal cuts

Assessing a proper tax rate on corporations and the wealthy will be necessary to produce a budget that can fund critical safety net programs and investments in our future.

How to fix Honolulu’s Empty Homes Tax proposal

A newly released report commissioned by the county council demonstrates the need to align Honolulu’s policy proposal with demonstrated best practices.

Invest in Safe Routes to School to improve pedestrian safety in Hawaiʻi

Federal funding freezes, requirements from the Navahine lawsuit settlement, and worsening traffic and its associated negative impacts—why state lawmakers shouldn't wait to invest in Safe Routes to School.

Census poverty data for 2023 highlights the importance of government assistance

Promising trends for families across the nation, but many continue to feel the lasting effects of widespread unemployment during the pandemic, a rising cost of living, and inadequate government assistance.

What Finland can teach us about ending homelessness in Hawaiʻi

Hawaiʻi can end homelessness. It starts with a mindset shift: housing is a human right, and the cost to provide housing to each and every person in Hawaiʻi is well worth the necessary investment in public resources.

A Hawaiʻi Child Tax Credit would keep thousands of keiki out of poverty

After the expiration of the expanded federal Child Tax Credit, poverty rates spiked—it’s time for Hawaiʻi lawmakers to step up and fill the gap.

2022 legislative session: A big win for working families; but more must be done

Legislators adopted two priority economic justice policies to deliver a significant household income boost to hundreds of thousands of Hawaiʻi workers.

Now is the right time to expand Hawaiʻi’s Earned Income Tax Credit

In 2021, 12 states and D.C. recognized the devastating effects of the pandemic recession and improved their EITCs to support their working families. Hawaiʻi should join them.

Expanding economic opportunity with the Hawaiʻi EITC

Expanding the state Earned Income Tax Credit to make it refundable would put more money back in the pockets of Hawaiʻi's working families, strengthening the local economy.

Put more money in working people’s pockets and reduce housing costs

This legislative session, Hawaiʻi Appleseed is pushing hard to implement a significant minimum wage increase, expand successful tax credits for low-income families, and lay the groundwork for housing policy that will mean no one in Hawaiʻi is left unsheltered because of poverty.

A pandemic recession update in charts

Unprecedented job loss, a rise in housing costs, and inflation in food, fuel and consumer goods has made the pandemic recession especially devastating to Hawaiʻi’s working families.

Solving Hawaiʻi’s housing crisis means building smart, not just more

An analysis of Maui’s housing stock demonstrates that, although Hawaiʻi is building more housing, we’re not building it at the prices that meet demand from local residents.

Tax fairness is popular and needed for Hawaiʻi’s future

Most taxpayers agree that a fair and effective tax system is a critical part of building Hawaiʻi’s future.

Making Hawaiʻi's housing market work for local residents

Investors are buying up more of Hawaiʻi’s homes than ever before because our current system encourages them to do so—that’s bad for our economy in the long run.

We need a visitor recreation fee to benefit Hawaiʻi

The COVID-19 pandemic has highlighted our dependency on tourism, and the need to create a more sustainable and less exploitative version of the industry.

State research confirms economic benefit of minimum wage hikes

The Department of Business, Economic Development and Tourism’s latest report demonstrates that a living wage is not only possible, it is economically desirable.

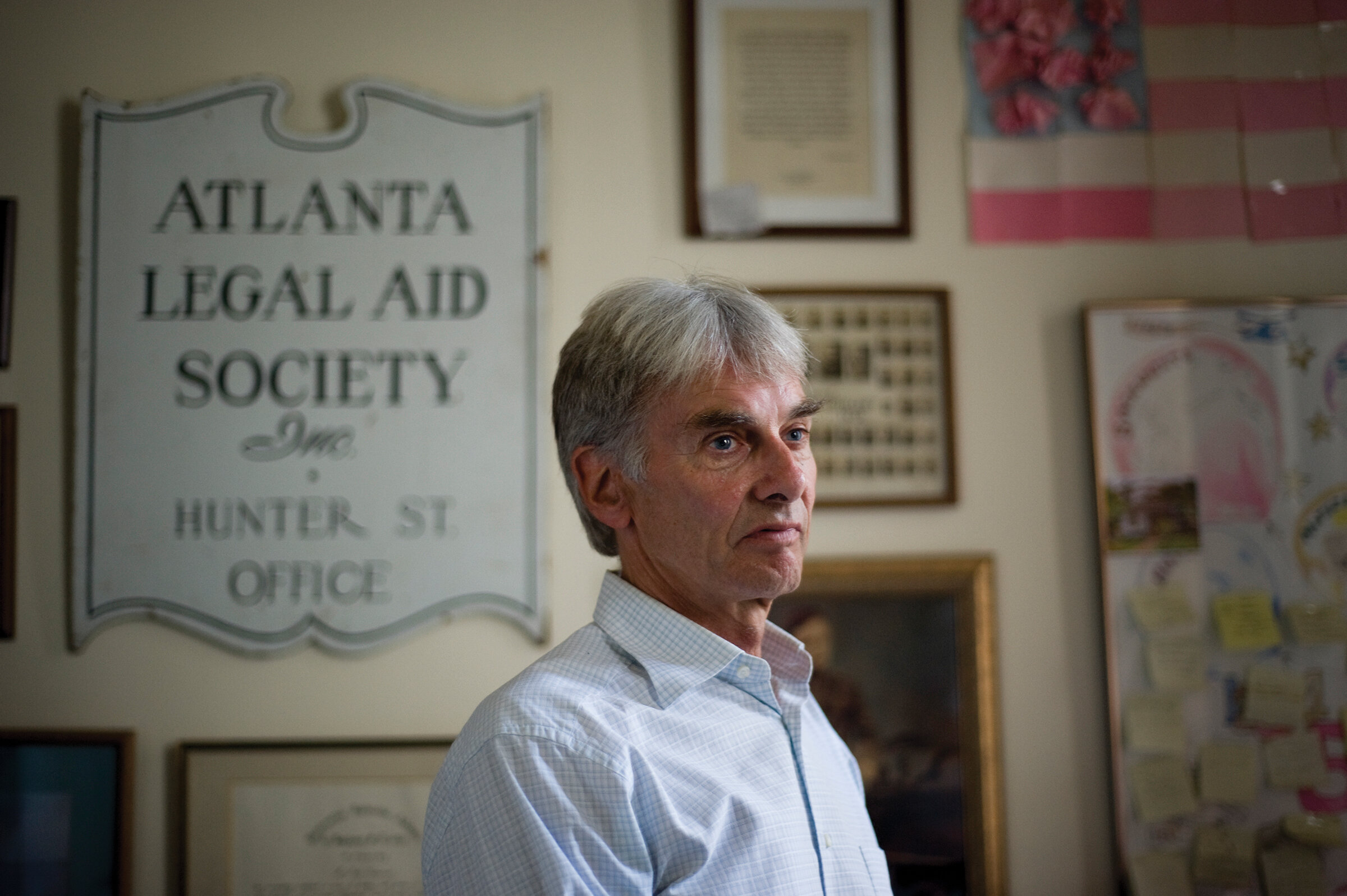

50 years in the fight for equal justice

Victor Geminiani, founding director of Hawaiʻi Appleseed and career advocate for low-income and underserved communities, will retire on August 31, 2019.