Highlights of the Hawaiʻi 2023 Supplemental Budget

Among the legislature’s most important jobs is approving spending for the ongoing operations of the state’s four branches of government, making additional appropriations, and authorizing capital improvement projects.

After two years of public resources constrained by the COVID-19 pandemic, the projected finances for the coming fiscal year are surprisingly buoyant. This allowed legislators to make unprecedented investments in some areas long in need of funding, such as resources for Native Hawaiians, housing, health and preschool education.

Here’s a basic overview for the budget year that starts this coming July.

Operating Budgets

Each of Hawaiʻi’s four branches of government has an operating budget that covers staff costs and expenditures for on-going programs. Operating budgets make up most of the state’s annual spending.

Table 1. Overall spending on operating budgets for the four branches of state government is planned to increase by $1.7 billion, or 7 percent. Most of the increase is reflected in the executive branch budget, which accounts for 99 percent of all state spending.

Table 1 compares the approved budgets for operations for each branch of government for the current year, ending this coming June (Fiscal Year 22) and for the year that starts in July (FY23).

The budget bills for the executive branch are HB1600 and HB1147.

The supplemental budget bill for the judicial branch is HB1536.

The supplemental budget bill for the legislative branch is HB2500.

The Office of Hawaiian Affairs budget remains the same as appropriated in 2021 (HB204).

Other Appropriations

Table 2. All branches of government benefited from additional appropriations but most will be expended by the Executive Branch.

Besides approving funds for on-going operations, the legislature authorizes additional spending for one-time needs through hundreds of other appropriations bills.

This year, the big jump in general funds fueled by growing tax revenues allowed legislators to make these extra appropriations the most interesting part of the new budget, and included comparatively high levels of funding for programs that benefit Native Hawaiian and for education.

Approved spending for additional appropriations amounted to $2.7 billion this year (compared to $895 million last year) with 85 percent coming from general funds.

The largest appropriations are:

$600 million for the Department of Hawaiian Home Lands to greatly expand long-delayed housing for native Hawaiians (HB2511).

$500 million put into the Emergency Budget Reserve Fund (a.k.a., the Rainy Day Fund) and $300 million to prepay public worker pension contributions (SB514). (This bill also authorizes tax rebates for residents that will cost an estimated $334.6 million. This amount is not included in spending summaries here because it is a revenue reduction rather than an expenditure.)

$328 million to award court-ordered damages to native Hawaiians waitlisted for Hawaiian Home Lands benefits (SB3041).

$200 million to develop facilities to expand public preschool (HB2000).

$200 million to build-out statewide broadband capacity from American Rescue Plan Act funds plus $360,000 in general funds (SB2076).

$64 million to transfer income from the public land trust to the Office of Hawaiian Affairs, in fulfillment of State trust responsibilities (SB2021).

Other promising investments in Hawaiʻi’s people include:

Housing gains from a Housing Voucher Incentive Program ($1.45 million in HB1752), continued funding for ʻOhana Zones to assist people experiencing homelessness ($15 million in HB2512), and money to rehab public housing units ($5 million in SB2588).

Agriculture and food support included an Ag Loan Revolving Fund ($1.5 million in HB2062) and a Food Hub Pilot Program ($1.5 million SB2218).

A sustainable economy gets a boost with grant funds to support entrepreneurship, business training, and historic preservation for Native Hawaiian communities ($1.5 million in SB3357), a career development program in public schools ($2.6 million in SB2826) and a Green Jobs Youth Corps ($5 million in SB2768).

The state will set up a new retirement program to benefit people whose private sector employers don’t offer retirement investment programs ($27.3 million in SB3289).

School facilities will be improved with a lead abatement program ($1.9 million in SB3098) and funding for air conditioning ($10 million in SB2862).

Health and healthcare will be supported with funds for medical residencies ($6.7 million in SB2657) and a healthcare professional loan repayment program ($500 thousand in SB2597), tele-health expansion for rural communities ($200 thousand in SB2624), Trauma Informed Care ($895 thousand in SB2482), and a Child Wellness Incentive Pilot ($4.5 million in SB2857)

Means of Financing

Every expenditure is paid from a specific kind of fund. The major funds are:

General funds made up largely by tax revenues.

Special funds that come from a source tied to the expense, for instance University of Hawaiʻi tuition goes into a special fund that supports UH expenditures.

Ongoing and competitive federal funds that support programs such as Medicaid.

Pandemic relief funds from the federal government.

Other funds from a variety of sources that make up a small part of the budget.

There is an unusually large shift in the means of financing the budget from FY22 to FY23. Anemic general funds accounted for only 45 percent of budget support in FY22 while federal pandemic relief paid for 10 percent of expenditures. In FY23, most of the relief funding will be gone but general funds will support 57 percent of the whole.

Figure 1. Means of Financing the Budget ($ Billions)

Figure 1. The shift in general funds and federal relief funds is clear in this figure. Other sources of funds changed little.

Figure 2. Method of Funding by Percentage, FY22 vs FY23

Figure 2. General fund support will increase by 47 percent in FY23 compared with FY22, more than eclipsing the decrease in federal pandemic relief funding. Other categories of funding changed only slightly.

GIAs

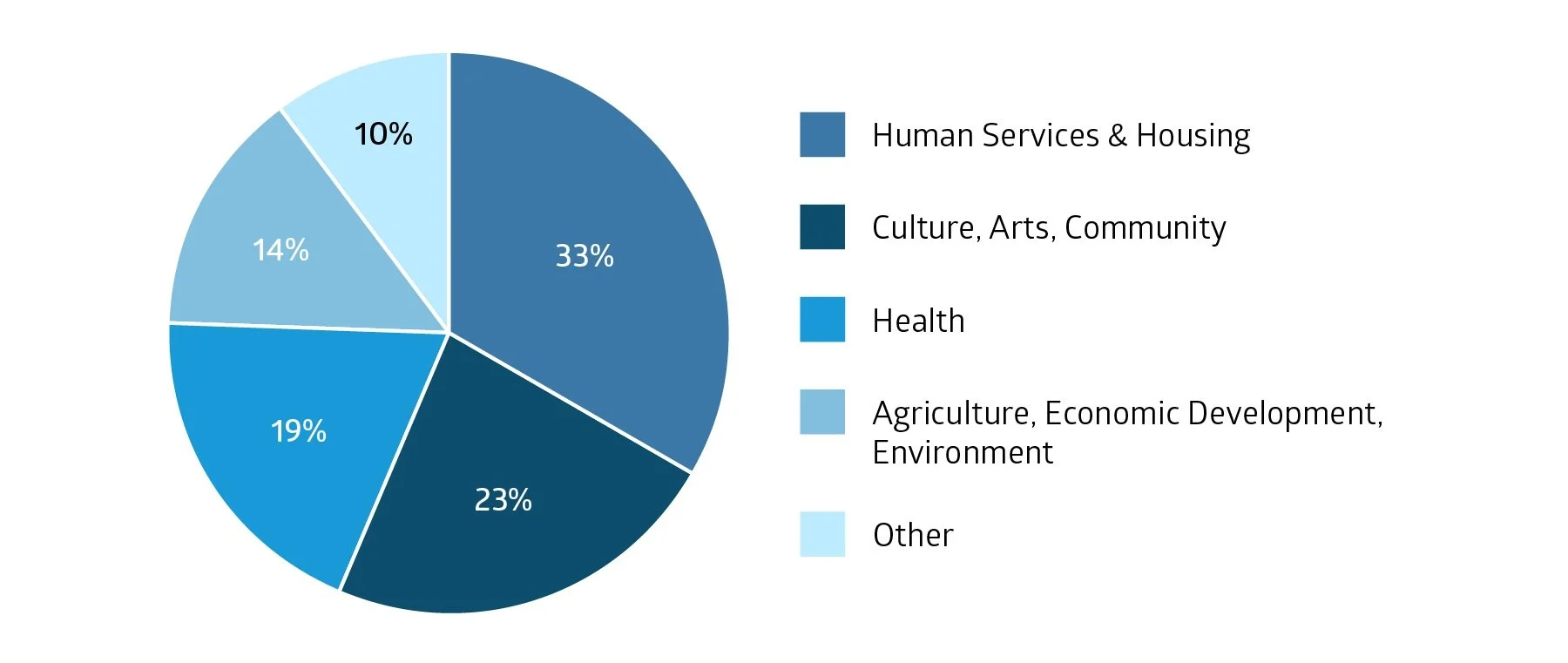

Grants-in-aid (GIAs) were back this year after a hiatus in 2020 or 2021 as legislators made $48.5 million available for Hawaiʻi nonprofits. More than $16 million will support human services and housing organizations. Another $11 million will go to culture and the arts or community centers. Health programs will get $9 million and programs that support agriculture, economic development, or the environment will receive $7 million. Grants amounting to $21.5 million will help pay for program costs while $27 million will support capital improvements.

Figure 3. Breakdown of $48.5 Million in GIAs by Category, 2022

Figure 3. Grants-in-aid to nonprofit organizations will support program and capital needs for a variety of services.

Capital Improvement Projects

The legislature also invested significantly more in capital improvement projects (CIPs), which are typically multi-year building projects financed by borrowed money. This year $3.7 billion in projects were authorized compared with $1.7 billion last year.

The Department of Transportation oversees $1.7 billion in state CIPs. The Department of Business Economic Development and Tourism was given a $838.5 million CIP budget to cover a new stadium ($350 million) and water and infrastructure development on Maui ($320 million), among other projects. The Department of Education CIP budget amounts to $644 million for statewide school development and improvements.

Figure 4. Breakdown of $3.7 Billion in Authorized CIP Funds by Category, FY23 ($ Millions)

Figure 4. CIPs were authorized for 13 of the 18 Executive Branch departments plus the Governor’s Office. The Judiciary Branch also received CIP funding. This figure shows how CIP project funding was distributed across programs.