Trump’s tax cuts gave Hawaiʻi’s rich a windfall; recapturing it would help our economy

Between 2001 and 2018, federal tax cuts have reduced revenue by $5.1 trillion dollars. At the same time, nearly two-thirds of the benefits from these cuts flowed to the richest 20 percent of taxpayers.

Then the Tax Cuts and Jobs Act (TCJA, or the Trump tax law) was approved in December of 2017, and the flow became a torrent. According to the Institute on Taxation and Economic Policy (ITEP), by the end of 2025, “the tally of tax cuts will grow to $10.6 trillion. Nearly $2 trillion of this amount will have gone to the richest 1 percent.”

The TCJA generally reduced taxes for all Americans, but the differences are stark between low- and high-income households: tax cuts as a percentage of income were seven times greater for the nation's wealthiest taxpayers than they were for the poorest.

ITEP recently updated their estimates on the effects of the Trump tax law on 2020 federal taxes. Their findings for Hawaiʻi and the nation are shown in Table 1.

In Hawaiʻi, the estimated value of 2020 federal tax reductions is $1.2 billion, with 42 percent of those savings going to the wealthiest 5 percent (their average incomes are between $359,400 and $1,321,300). That means the TCJA reduced federal taxes for Hawaiʻi’s top 5 percent in 2020 by $488 million.

A significantly greater share of tax savings from the TCJA goes to the wealthiest 20 percent of households as shown in Figure 1.

Wealthier taxpayers also got much bigger tax cuts as a percentage of their income. The tax break for Hawaiʻi’s top 1 percent was nearly four times greater than that of the poorest 20 percent. Hawaiʻi’s highest-income households got larger tax breaks as a percentage of their income than did low-income households as shown in Figure 2.

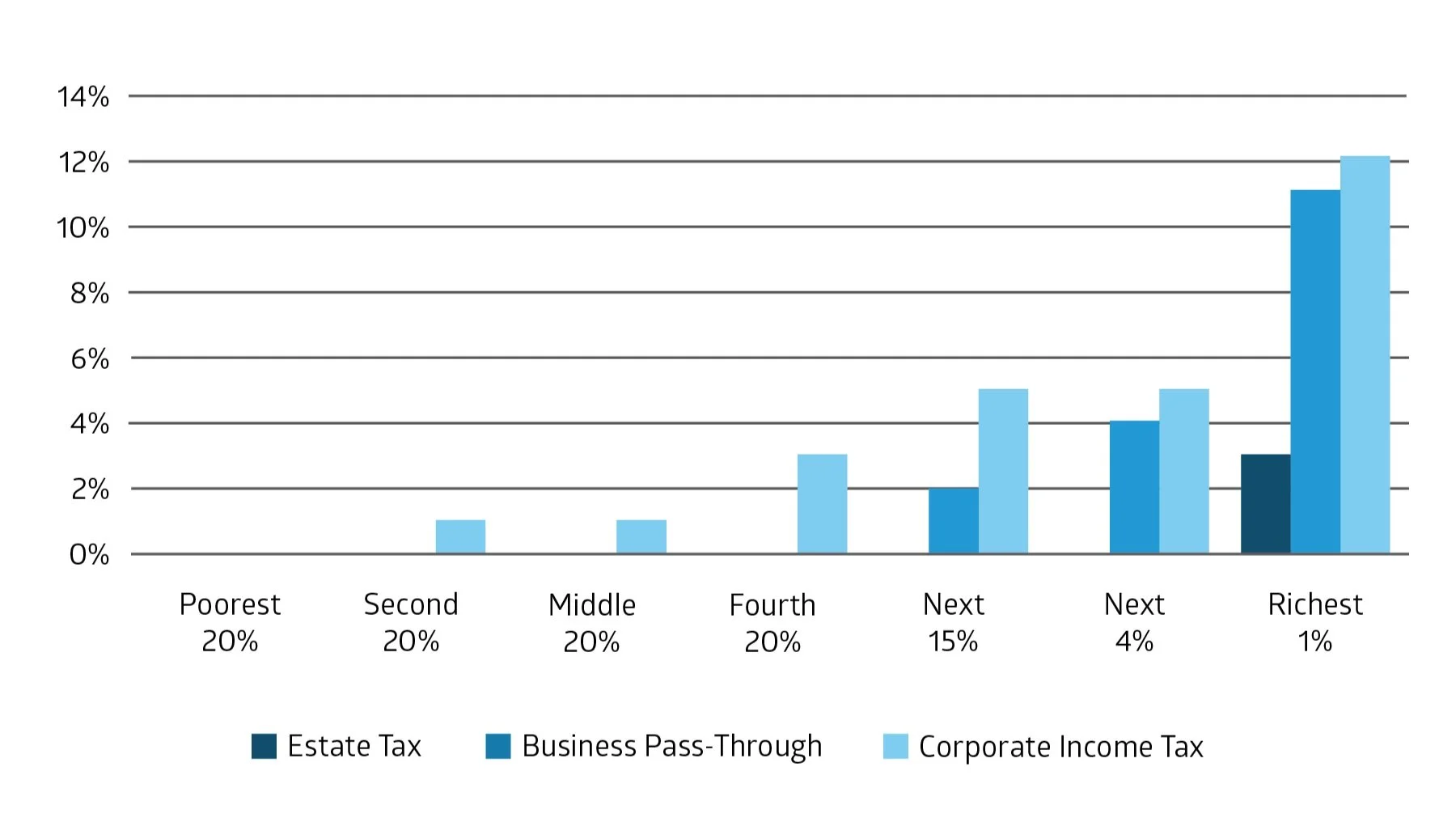

The dramatically greater benefits in tax cuts for the rich is due, in part, to aspects of the TCJA other than just income tax reductions. Notably, the federal act reduced taxes on estates by raising the threshold of taxability to $11 million for an individual or to $22 million for a couple.

Business owners got a 20 percent reduction in the tax rate on their pass-through income. Corporate taxes that were previously graduated with a top rate of 35 percent were changed to a flat rate of 21 percent for all. It’s quite clear that these tax cuts helped wealthy taxpayers much more than other tax filers as shown in Figure 3.

What does this mean for Hawaiʻi right now? Thousands of residents are still out of work and struggling to cover basic needs. Our economy needs a steady stream of state spending to support recovery. Now is the time to reflect on growing economic inequity in Hawaiʻi, where the richest—on average—increased their wealth through stock market gains and rising housing values, while lower-income residents were the most likely to lose their jobs.

One positive step that the legislature can take is to support progressive changes to our tax system that ask the households that have been the beneficiaries of the TCJA to share some of those gains now with Hawaiʻi.

Table 1. Average Federal Tax Cuts by Income Group and Overall, 2020

Table 1. On average, taxpayers in every income class saw a reduction in tax liability, but those most able to pay—the richest 1 percent—benefited far more than others.