How to make housing affordable to local buyers: Lessons from ALOHA Homes

In 2020, the state’s Hawaiʻi Housing Finance and Development Corporation (HHFDC) commissioned Hawaiʻi Appleseed Center and the Hawaiʻi Budget & Policy Center to study the feasibility of the ALOHA Homes proposal. Here are some highlights from the interim report submitted February 11, 2021. (An updated version is forthcoming.)

What ALOHA Homes Proposes To Do

The ALOHA Homes program was introduced by Hawaiʻi State Senator Stanley Chang (District 9, Hawaiʻi Kai, Kuliʻouʻou, Niu, ʻĀina Haina, Waiʻalae-Kāhala, Diamond Head). It proposes to build housing that Hawaiʻi’s families earning median income—teachers, firefighters, ordinary workers—can afford to buy on a leasehold basis. The project would be affordable because it would be high density, 99-year leasehold housing built on state land.

Figure 1. Singapore Housing Development Board, Number of Units Developed and Resale Price Change, 2013–2019

Much of the original ALOHA Homes concept was fashioned after Singapore’s model of housing development. The city-state of Singapore has successfully provided quality affordable housing for its 5 million residents and virtually eliminated homelessness. Singapore is able to expand housing, as needed, through:

Strong government involvement in infrastructure and housing construction;

The use of low-wage immigrant labor; and

Providing significant mortgage subsidies to lower-income residents.

The government in Singapore builds tens of thousands of new homes a year to meet citizen demand, which keeps house prices stable over time, as shown in Figure 1. This approach of building train stations, roads, sewers etc., as needed, along with enough homes every year to meet demand is simply not feasible in Hawaiʻi. This is because it takes a long time to build infrastructure and other major public works with a high-level of citizen engagement in government decisions.

As an example, Hawaiʻi voters first approved funding for the Honolulu rail in 2008, and now nine stations are nearing completion. Singapore, with a centralized and less democratic government has built 91 stations since 2008. Singapore has four times more people than Hawaiʻi, but even with a much larger population size, Singapore has built approximately three times more stations per million people than Hawaiʻi.

Alternative Models: Helsinki and Vienna

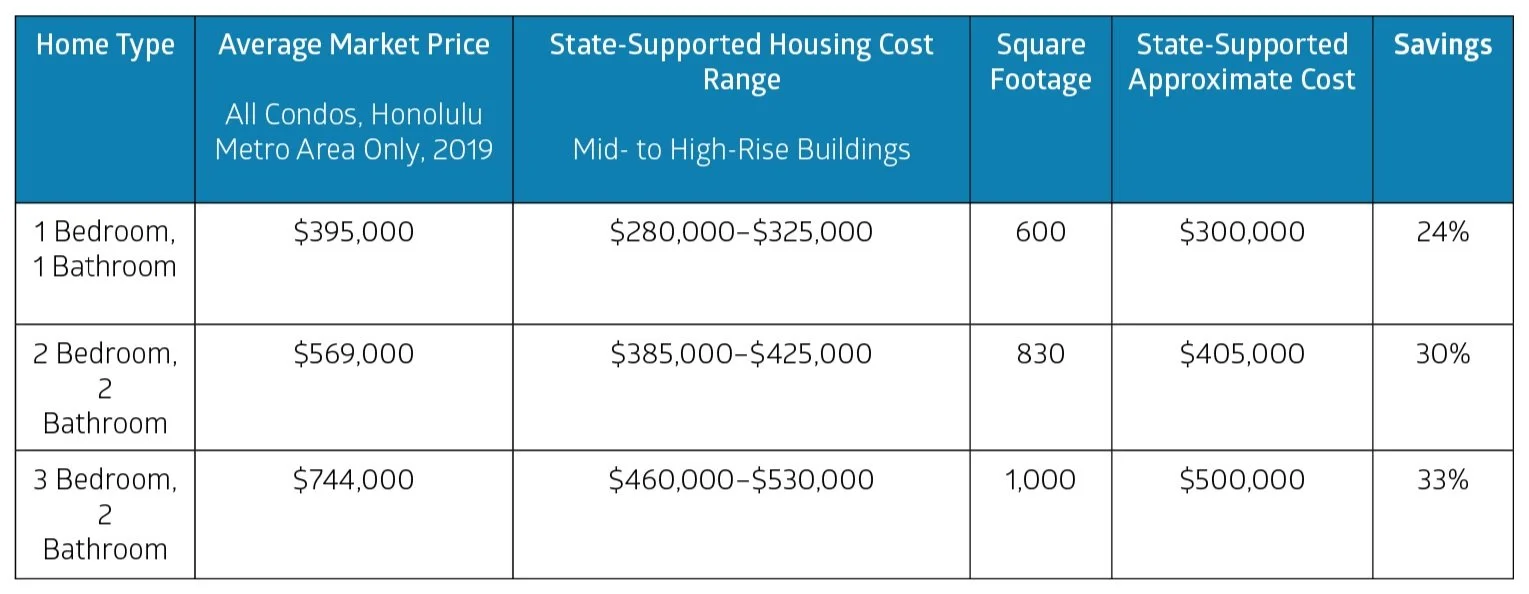

In addition to Singapore, we also looked at cities with successful affordable housing policies that are politically and economically closer to Hawaiʻi. We found that Hawaiʻi can build housing that local working families can afford to buy, even with our much higher construction costs. Our analysis based on local building costs is shown in Table 1.

These prices are significantly lower than market prices for four main reasons:

State land contributions

Reduction in financing costs / investor profit

Infrastructure through district plan (not paid for by the project)

Streamlined environmental assessment (building only in places which have existing assessments on the books)

The savings do not come from the cost of construction. Rather, the savings come from all other costs which are not directly for materials and labor. The resulting cost of publicly-supported construction is compared to market rate housing in Figure 2.

Table 1. Hawaiʻi Building Costs

Figure 2. Public vs Private Development

Significant Challenges Remain

Once housing is constructed, it must be kept affordable for qualified buyers. Best practices include:

Equity Share/Restrict Resale Price. A property is kept affordable for all future owners by restricting the resale price to the original price of the home plus inflation. The current owner will earn less profit than if it were a fee simple home, but the gains can still be significant. For a two-bedroom home purchased for $400,000, an owner would earn $50,000 to $60,000 after five years based on recent inflation trends of 1.7 percent per year.

Focus group insight: Local buyers support equity sharing. We conducted four focus groups and participants were supportive once the concept was explained. When a buyer who was able to purchase a home at a below-market price later sells it, they should sell it at a price that ensures that the next owner gets the same opportunity. This is fair, even though there will be limited profit upon sale.

Buyer Restrictions: No more than 140 percent of the area median income (AMI) and own no other property. The original ALOHA Homes proposal does not include income restrictions. The intent was to allow anyone to participate in the program to facilitate the establishment of healthy, mixed-income communities.

However, we researched numerous jurisdictions across the United States and other countries and found that, generally, the less affordable housing there is available, the stricter the income requirements need to be. Accordingly, we recommend that ALOHA Homes strictly limit eligible buyers to the families the program is intended to help, those earning between 80 and 140 percent of AMI.

Other proposed ALOHA Homes restrictions to ensure that buyers are Hawaiʻi residents who are owner-occupants and own no other homes are all good practices.

Although there is potential for this model to provide affordable homes for local residents, there are some critical issues which still need to be addressed.

State land contribution. In testimony on the current 2021 ALOHA Homes bill (SB1, SD1), three state agencies—the Office of Hawaiian Affairs (OHA), the Department of Hawaiian Homelands (DHHL), and HHFDC—have raised concerns about how the program would address Native Hawaiian land claims.

Infrastructure funding. Significant public investment in infrastructure is needed to enable housing construction in transit-oriented development (TOD) areas at the prices proposed in this study. This funding could come from the federal, state or county level, but cannot be part of the project cost.

Stewardship. Successful below-market housing programs require management, generally from a nonprofit organization. The state would need to find a partner capable of serving in this capacity.

There is much more information within the interim report, including insights from focus groups and details on cost options. The interim report is available here.