Hawaiʻi’s two-tier tax system: How the rich use a glaring loophole to pay less

In Hawaiʻi, how you earn your money can determine how much tax you pay. This system is rigged in favor of the wealthiest among us.

While teachers, nurses and service workers pay income tax on every dollar they earn, the wealthy can shield a large portion of their profits thanks to a special tax break on capital gains.

Capital gains are the profits from the sale of assets like stocks, bonds, art, antiques and real estate. These profits are collected almost entirely by Hawaiʻi’s very wealthiest households—yet they are taxed at a significantly lower rate than income from work. This costly loophole not only reduces state revenue but fundamentally shifts the tax burden away from those most able to pay.

Currently, Hawaiʻi’s income tax rates follow a progressive structure, ranging from 1.4 percent to 11 percent for high earners. However, long-term capital gains are capped at a maximum rate of just 7.25 percent. This creates a substantial tax break for the wealthy. For example, an individual earning over $200,000 would pay the top 11 percent rate on their salary, while their investment profits are shielded at the lower 7.25 percent rate.

This disparity exacerbates economic inequality. Lower-income families, who rely almost exclusively on wages to make ends meet, rarely realize significant capital gains. The data is stark: over 70 percent of long-term capital gains in Hawaiʻi are accrued by taxpayers with incomes exceeding $400,000. Closing this loophole is a necessary step toward creating a tax system that treats all income equally, and one that is capable of funding solutions to Hawaiʻi’s greatest challenges.

Options for Closing the Loophole

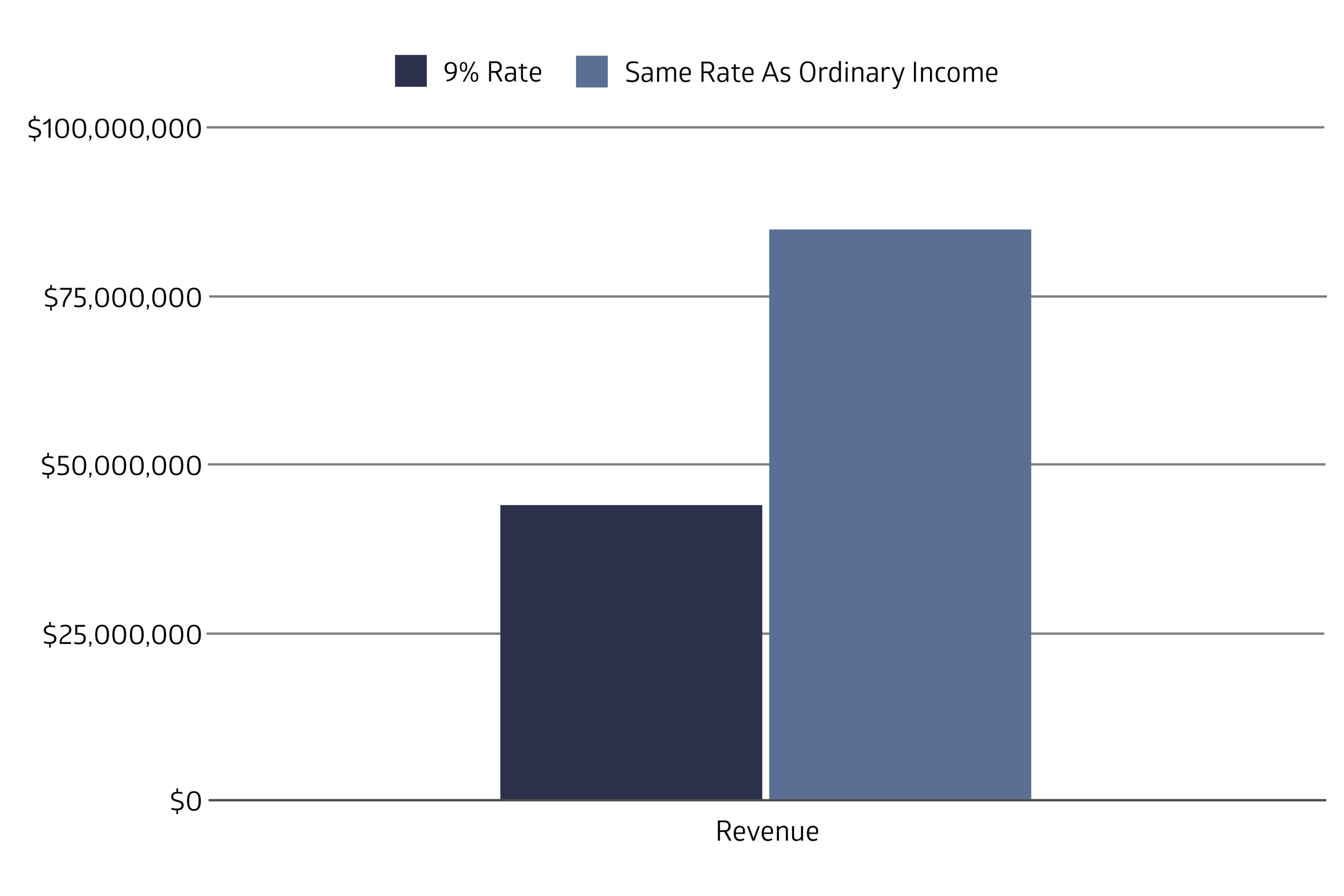

State legislators can close this loophole by either raising the maximum capital gains rate (past legislation in 2024 recommended a 9 percent cap), or by simply taxing capital gains at the same progressive rates as ordinary income from wages.

Taxing capital gains at the same rate as ordinary income could raise $85 million, while raising the top rate to 9 percent would generate $44 million in the first year (Figure 1). It is important to remember that these estimates are based on resident taxpayers only. The actual revenue increases would be significantly higher if non-resident taxpayers were included.

Figure 1: Projected Revenue Comparison from Two Different Ways to Raise Taxes on Capital Gains (Tax Year 2026)

Aligning the capital gains tax with the taxation of ordinary income is not a broad-based tax increase. Rather, it is a targeted correction of a flawed policy.

The data is unequivocal: this change would have a negligible impact on 99 percent of Hawaiʻi’s residents, with 88 percent of the new revenue coming solely from the top 1 percent of earners (Figure 2). This is the very definition of a progressive and equitable fiscal policy.

Figure 2. Average Projected Tax Increase From Taxing Capital Gains at the Same Rate as Ordinary Income, by Income Group

Taxing capital gains effectively is one of the most powerful tools we have available to check the dangers of vast, accumulated wealth. A fair capital gains tax policy ensures the state’s wealthiest residents contribute their fair share, correcting a system that has long favored unearned income over hard work.

The revenue generated is not an abstract figure—it is the essential funding needed to prepare for the serious fiscal harm that will be caused by federal legislation such as HR1, the “One Big Beautiful Bill.” By closing this loophole, we can build a more resilient, equitable and self-sufficient future for all of Hawaiʻi.

It is time to demand a tax code that works for everyone, not just the wealthy few.