Hawaiʻi budget challenges: tax revenues, fixed costs, state salaries

The Hawaiʻi legislature’s foremost task this session is approving a budget for the fiscal biennium: the two-year period that starts July 1, 2021 and ends June 30, 2023. The pandemic’s effects on the economy will make passing a balanced budget more challenging than ever. Here are some of the reasons why:

General Funds are Really Important

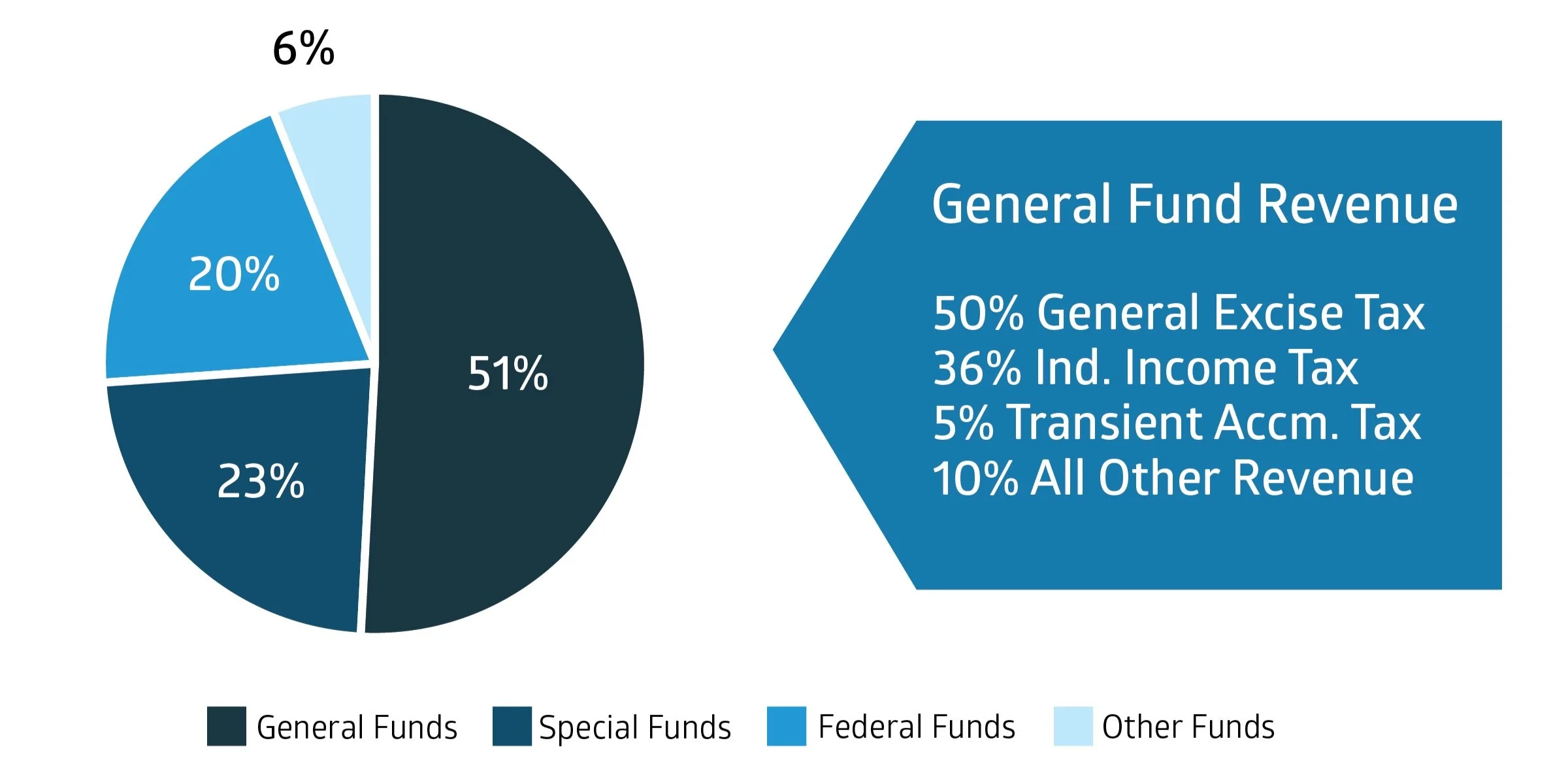

General fund revenues and spending are the main focus for budget makers every year, and they drive the budget process even more during an economic downturn.

Why? General funds typically pay for half of the state budget. Other funds, such as federal or special funds, may be unaffected by a recession but they can be spent only on the purpose for which they’re provided. They cannot be stretched to help cover general fund deficits.

Figure 1. How Hawaiʻi’s $16.2 Billion Operating Budget is Financed

Figure 1. A breakdown of how Hawaiʻi finances its state operating budget, with a further breakdown of the General Fund revenue.

The focus on general funds intensifies when the economy is bad since general funds are largely made up of tax revenue, which shrinks during recessions as incomes and spending decline. That’s true for the pandemic recession: Actual and projected tax collections are way down.

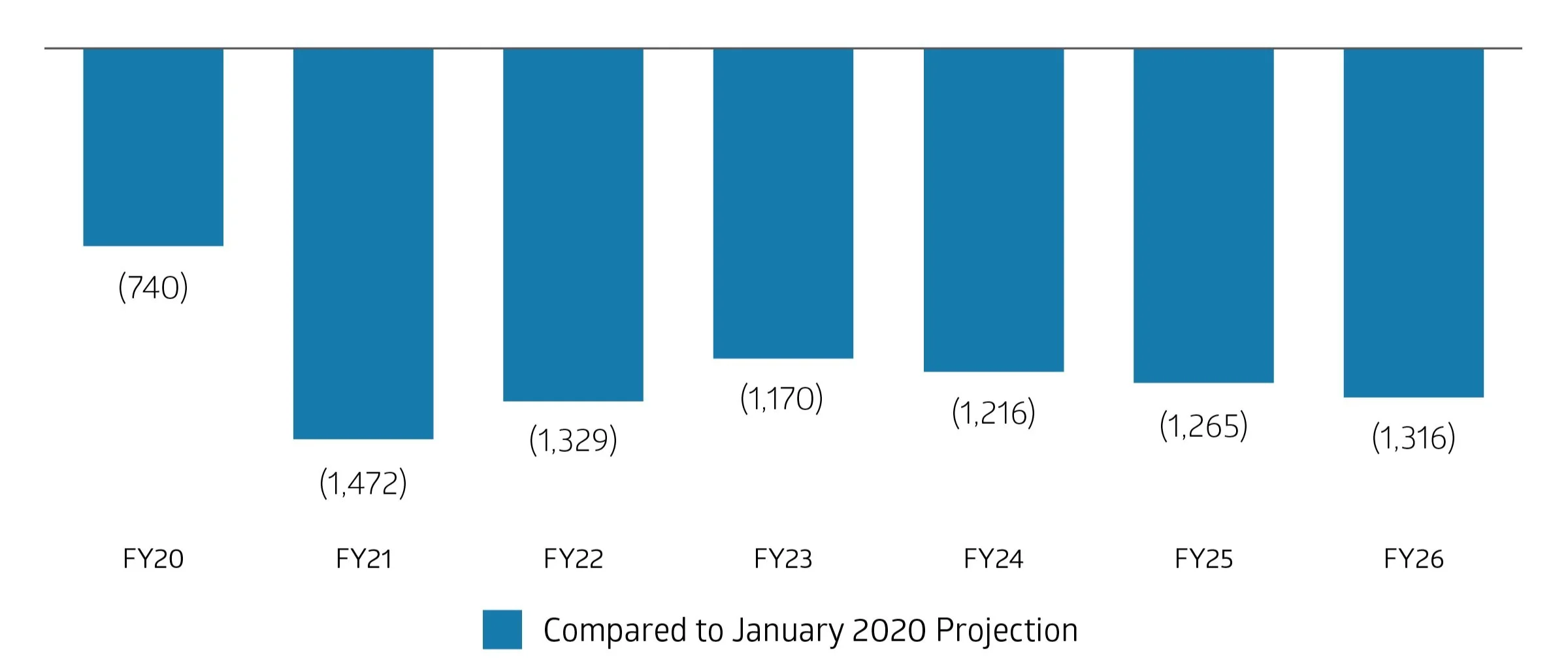

Lawmakers are looking at a budget forecast that compares the pre-COVID January 2020 forecast to the updated January 2021 projections and seeing a reduction in tax collections by $1.4 billion this year and $1.3 billion next year.

Figure 2. Revenue Projections in $ Millions

Figure 2. Hawaiʻi’s projected revenue over the next six fiscal years.

Fixed Costs Put the Squeeze on Limited General Funds

Even as tax revenues are down, “fixed costs” remain high, totaling more than $4 billion. These are the obligations that the state must pay before considering any other expenses. They’re made up of the state’s share of Medicaid, interest on bonds and borrowing, health and social security payments for current employees, and payments to state pension and retiree health funds. (The governor proposes to reduce payments toward the retiree health trust fund for up to four years, paying only current costs.)

By FY2019, fixed costs had risen to consume more than half of all general fund tax revenue. Now, with reduced tax revenue and increased fixed costs, the percentage is budgeted to be more than 60 percent.

Figure 3. Growth Trends in Hawaiʻi Fixed Costs, in $ Millions

Figure 3. Over the past seven fiscal years, Hawaiʻi’s fixed costs have steadily increased, taking up a bigger and bigger portion of funds the state could otherwise use to improve the quality of life in the islands. The trend is expected to continue.

General Funds Pay for Most State Salaries

The state’s payroll amounts to nearly $3.7 billion, almost a fourth of the state budget (this is salaries only; fringe benefits are included in fixed costs). About 75 percent of state salary costs are financed by general funds.

Figure 4. Spending Tax Revenue, Fixed Costs vs Other Costs

Figure 4. The larger the share of our state budget that we must devote to fixed costs, the smaller the share that the state can use for other important functions.

Distribution of Budget Cuts

Cuts in state spending will be aimed at programs funded by general funds. Expenses covered by federal, special, or other funds should be affected much less if at all.

That means the competition for scarce general funds is great. Fixed costs are at the top of the priority list because they have to be paid, and state worker salaries are usually the second on the list. As a result, all other expenses supported by general funds, including nonprofit service contracts, are likely to face deep cuts.

Figure 5. Distribution of General Funds in Fiscal Year 2021

Figure 5. Fixed costs take up almost half of all general funds in the current fiscal year.

General funds supporting the current budget amount to $8.3 billion. That’s significantly more than $6.3 billion in projected tax revenues, but this year rainy day funds and borrowed money are bolstering general funds. Expenses budgeted for general fund support in FY2021 include $4.1 billion for fixed costs and $2.7 billion for salaries. That leaves just $1.5 billion for all other general fund operating expenses.

Actions Taken or Proposed to Support State Needs

The state budget is a big part of Hawaiʻi’s economy and maintaining state spending will support a faster recovery. The governor and legislature have identified—and in some cases taken action on—ways to keep government running and cover state general operating costs. However, most come at a cost.

Borrowing is essential to support general fund-supported operations and to keep special funds flowing for unemployment insurance, but both of these have short pay-back periods and will add to fixed costs for debt-service payments in years to come. The pause in full funding of required retiree health payments should be reversed as soon as possible to reduce future indebtedness.

Furloughs are damaging to the economy as well as to workers. Increases in certain taxes are on the table, but putting them in place and collecting the revenue will take some time.

The following actions have been taken or proposed to support state needs:

Use the Rainy Day Fund: $396 million

Issue bonds to borrow operating funds: $750 million

Borrow from the federal government to fund the Unemployment Insurance Trust: $700 million (this may increase)

Defer full retiree healthcare payments for 4 years: $1.85 billion (proposed)

Freeze position vacancies: $130 million (proposed)

Furlough state workers 2 days/month: $338 million (proposed)

Raid special fund balances: $400–600 million (proposed)

Restrict general fund expenses other than fixed costs and salaries: 10–20 percent or more

Raise certain taxes: To be determined

Understanding the Budget

The budget unveiled in December 2020 was created before an additional federal aid package was approved and new revenue projections were released by the Council on Revenues. The budget will be redrafted several more times in coming months.

Typically, the House revises the governor’s budget, then the Senate edits the House draft. The final conference draft reflects the most up-to-date revenue projections that the Council on Revenues will issue on March 8. This year, deliberations may be further affected by much hoped-for additional federal assistance.

We recommend the links below as resources to understand budget proposals and processes:

Budget in Brief (Governor’s Budget Proposal)

Budget Worksheets (Legislature’s Budgets)

Hawaiʻi Data Collaborative (Plans to Post Details for Each Version of the Budget)

Hawaiʻi Budget & Policy Center (State Budget Primer)

We’ll be back with updates as legislators grapple with our most important expression of policy—the state budget.