How well do our elected legislative bodies reflect the general public?

Diversity in legislative bodies helps promote ideas that, by their nature, are more representative of the common good.

To empower indigenous peoples, decolonize data

Too often, indigenous populations have no control over the data that describes them, creating a disconnect between on-the-ground needs and top-down policy proposals.

The true cost of Trump’s tax cuts

The TCJA will enrich top earners without providing significant benefits for anyone else, widening the income and wealth gaps while dramatically increasing the federal deficit and endangering programs for people living in poverty.

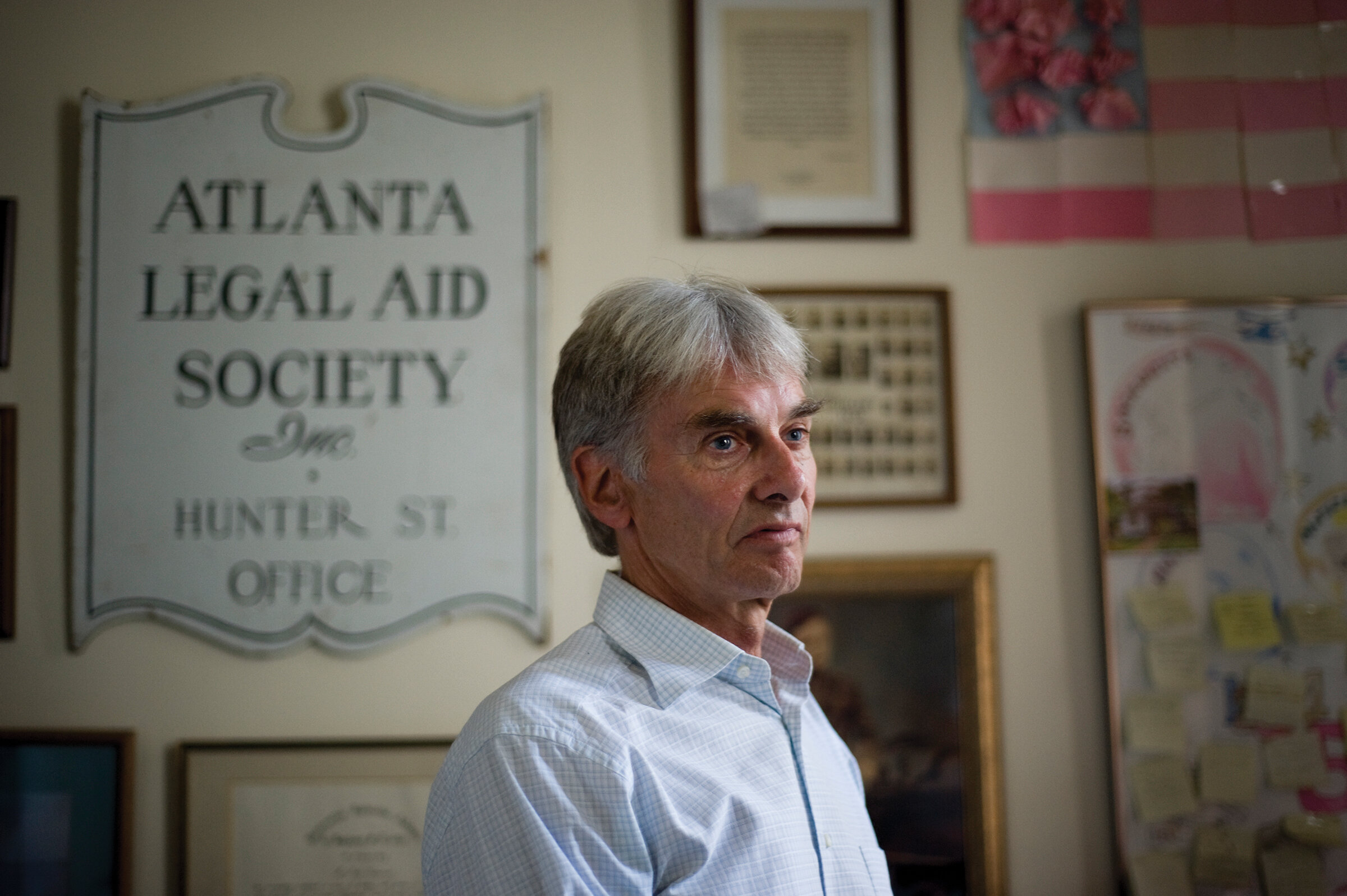

50 years in the fight for equal justice

Victor Geminiani, founding director of Hawaiʻi Appleseed and career advocate for low-income and underserved communities, will retire on August 31, 2019.

Lessons from the Great Recession: How Hawaiʻi can better protect its communities during economic crises

Managing state spending during economic downturns is hard, but the Great Recession has clear lessons about what services are just too critical to cut.

Make Hawaiʻi’s Earned Income Tax Credit refundable

Making the EITC refundable would make Hawaiʻi a more progressive tax state, and help working families make ends meet.

Redefining poverty would throw millions off critical social support programs

A Trump Administration rule change would force millions of Americans off critical programs that help women, children and families meet their basic needs.

Hawaiʻi plans to spend big on capital improvement projects and covering fixed costs

A brief analysis of the recently-adopted state spending plan for the next two fiscal years, starting July 1, 2019.

Hawaiʻi’s budget process became less transparent this year

Understanding the budget isn’t always easy. The legislature made this year’s budget process even murkier.

How high is too high? We actually know a lot about minimum wage increases

Raising the minimum wage would boost not just the pay of many struggling Hawaiʻi workers and their families; it would also boost the local economy.

Our taxes at work, and who pays them

Tax season is a good opportunity to reflect on our shared commitment to support the quality of life in our country and state.

Hawaiʻi’s Tax Commission recommends changes in tax code

The commission recommends revenue and tax policy changes needed to address the state’s budget needs, as well as create greater economic opportunity and social equity.

Hawaiʻi’s county budgets at a glance

During FY2018, the City and County of Honolulu, Kauaʻi County, Maui County, and Hawaiʻi County are expected to raise and spend more than $6 billion, the bulk of which is going to operations and the balance to capital improvements.

Hawaiʻi’s executive budget in action

The executive branch budget supports an array of essential health and social services, business development, environmental protection and education from kindergarten to university.

Will Hawaiʻi always be the “Health State?”

Research has shown that “health” is correlated with income and wealth equity, decent housing, and education, from preschool through college.

Appleseed announces 2019 policy agenda

After months of research spent examining these critical issues, this agenda prioritizes efforts for maximum benefit to the community at-large.

Highlights from Governor Ige’s proposed state budget, 2019-21

More than half of the proposed executive budget will need to go to covering fixed costs like Medicaid funding and public pension and other post-employment benefits—so called “unfunded liabilities.”

Identifying opportunity within Hawaiʻi’s tax system

There exists an opportunity to use taxes to encourage positive trends, while making adjustments to where the burden of these taxes fall to create new opportunity for Hawaiʻi residents to thrive.

Hawaiʻi’s largest revenue source also hits low-income households hardest

A good tax system is not just about revenue. It should also be simple to comply with, collect fees from non-residents who benefit from public services, and should be equitable in how it treats taxpayers at different income levels.

Where your taxes go: a breakdown of Hawaiʻi’s fund categories, part 2

Part 2 of our look at Hawaiʻi’s fund categories will cover special funds, reserve funds, bond funds and state debt, and other funding sources.