Where your taxes go: a breakdown of Hawaiʻi’s fund categories, part 1

This post will cover the general fund and federal funds.

What makes a good tax system?

The best tax systems give appropriate breaks to low-income households to generate economic activity and collect more from those who have the most to spare.

Hawaiʻi’s tax system exacerbates inequality

Hawaiʻi taxes—and those in the United States on average—increase inequality between rich and poor.

Public charge rule change would hurt Hawaiʻi’s economy

Not only would the proposed rule change adversely impact the standard of living of Hawaiʻi’s immigrant families, it would also harm Hawaiʻi’s overall economy.

Incomes in Hawaiʻi are not as high as you’ve heard: Here’s why

Over the years, the media has often reported that Hawaiʻi incomes are among the highest in the nation. If that doesn’t sound quite right to you, trust your gut.

The life cycle of the Hawaiʻi state budget

The governor, the state Legislature, the Council on Revenues, the Department of Budget and Finance, and all the executive departments and agencies contribute to the process.

How Hawaiʻi’s constitution impacts its spending plan

In order for the executive branch to spend any money on programs or projects, the legislative branch has to write and pass a bill authorizing that specific expense.

Official poverty data obscures the reality faced by many Hawaiʻi residents

If you hear Hawaiʻi has one of the lowest official poverty rates in the nation, remember that doesn’t take into account our highest-in-the-nation cost of living.

Budget basics: three common questions and their answers

The state budget is a spending plan for the state based on the amount of available money it has collected through taxes and other means.

Supreme Court opens door to e-commerce tax equity

States can now require on-line and mail-order sellers to collect and remit taxes on sales to their state residents.

Hawaiʻi state budget highlights, 2017–19

Hawaiʻi’s budget is a powerful foundation for daily life and an important demonstration of our state’s priorities.

Federal tax cuts will actually do very little for working families in Hawaiʻi

It is already clear that the Tax Cuts and Jobs Act significantly benefits the most affluent among us, while doing almost nothing to help the people who need relief the most.

Coming soon: The Hawaiʻi Budget and Policy Center

Hawaiʻi Appleseed is creating a new think tank focused on research and analysis of state budget and tax policy—the Hawaiʻi Budget & Policy Center (HBPC).

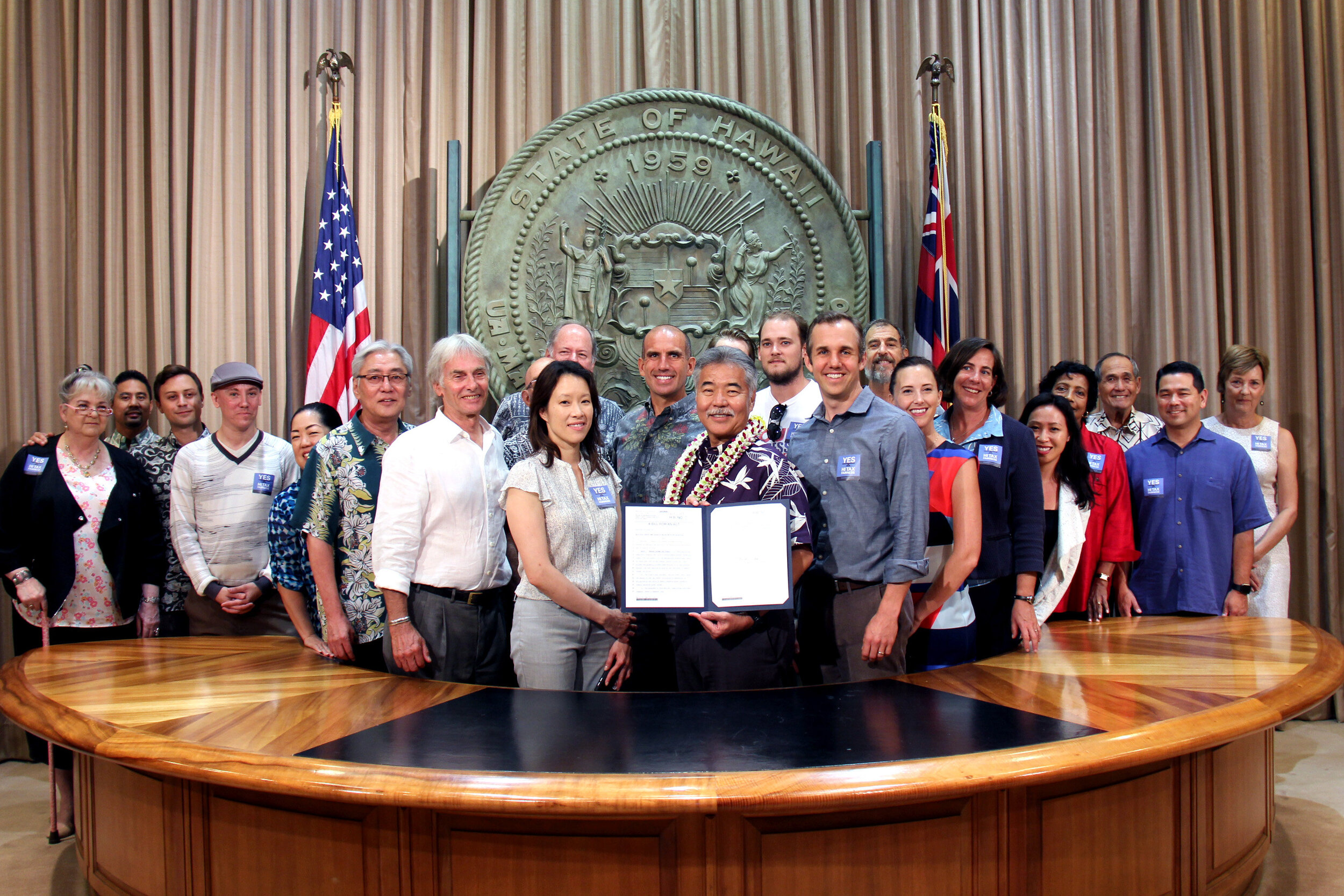

Governor Ige signs HB209, a win for working families and children

With this new law, Hawaiʻi joins 28 other states and Washington D.C. in offering a state-level EITC to help working families keep more of their earnings.

Hawaiʻi bill will create historic new working families tax credit

Rep. Scott Saiki called passage of the bill the “most consequential work in the last few years to reduce poverty and Hawaiʻi’s high cost of living.”

Report emphasizes need for Hawaiʻi working family tax credit

Report highlights the financial situation of Hawaiʻi residents and their opinion of tax credits that would let low-income workers keep more of what they earn.

A win for Hawaiʻi’s foster families

The state human services department has agreed to increase the amount that should be paid to cover the expense of caring for children in foster care.

Appleseed releases 2016 State of Poverty report

The report brings together the most recent available data to provide a snapshot of how low-income residents have fared after the economic recovery from the Great Recession.