Hawaiʻi Appleseed releases 2025–26 state budget primer and legislative recap

Together, these documents tell the story of how Hawaiʻi invests in its communities, analyzing the most recent legislative session and the budget that emerged from it.

Recent state tax cuts leave many struggling families behind, in need of more help

Tax credits can help round out relief efforts at low cost to the state by targeting assistance only to the families that need additional support.

Hawaiʻi Appleseed releases 2024 report exploring an Empty Homes Tax to address Honolulu’s housing crisis

Honolulu's severe housing crisis is being exacerbated by a growing trend of vacant homes purchased as investments by non-residents. To reverse this trend, Hawaiʻi Appleseed recommends a flat tax of 3–5 percent on empty homes.

Hawaiʻi Appleseed releases 2024 edition of its Budget Primer product

The biennial budget analysis product is a core service provided by Appleseed researchers.

Hawaiʻi’s conveyance tax can be an effective tool to address our housing crisis

Hawaiʻi lawmakers have an opportunity to tailor the sales tax on real property so that it reinvests nonresident wealth into our island communities through affordable housing development.

Hawaiʻi’s tax system makes inequality worse, national study finds

Hawaiʻi lawmakers can improve the economic health of our communities by re-balancing the state’s upside-down tax code.

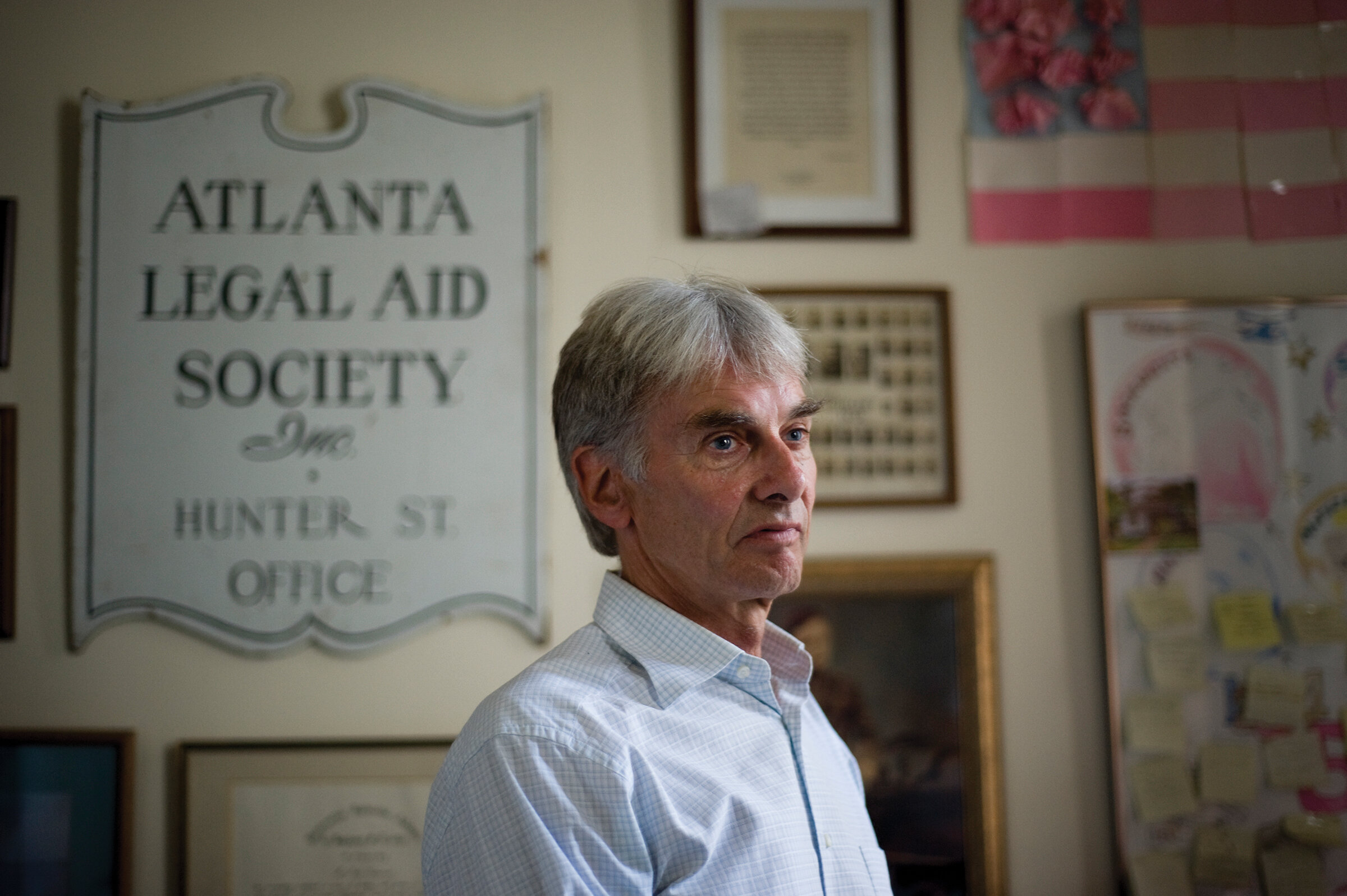

Hawaiʻi Appleseed announces Victor Geminiani’s retirement

The 50-year advocate for the low-income community and founder of Hawaiʻi Appleseed Center for Law & Economic Justice will retire on August 31, 2019.

Report examines the state of poverty in Hawaiʻi since the Great Recession

The state’s high cost of living and low wages has made recovery slow and painful for many families.

Half of Hawaiʻi’s residents are living paycheck-to-paycheck

An Appleseed-commissioned poll highlights the extent to which working families are now struggling to get by in Hawaiʻi.

Hawaiʻi families, businesses and economy would benefit greatly from state Earned Income Tax Credit

Now is the time for Hawaiʻi to invest in its residents and businesses by creating a state refundable EITC that puts dollars back into workers’ pockets and into the cash registers of local business.