Move ahead with care on tax relief

Legislators must ensure that the relief package makes the most of state resources, finding the right balance of lower taxes and the services that Hawaiʻi’s people need most.

Proposed tax increase to fund homeless services not likely to advance in legislature

SB678 received nearly 100 pages of written testimony, with only two testifiers opposing it.

Rising prices, increasing poverty, slowing job growth: Hawaiʻi’s economy faces grim times

Among those facing higher costs are Oʻahu utility customers whose October bills could show more cost increases on top of a dramatic rise over the past year.

It’s gotten both worse and better for struggling working families

The good news is that 17 Hawaiʻi nonprofits are helping working families become more financially stable, find affordable housing, and get involved in policy.

As prices soar, top Democratic candidates for governor support relief from tax on groceries

Hawaiʻi Appleseed said a tax revenue boost must be paired with the tax cut to ensure key services aren’t cut. The organization suggested raising the capital gains tax or increasing tax on the wealthiest earners.

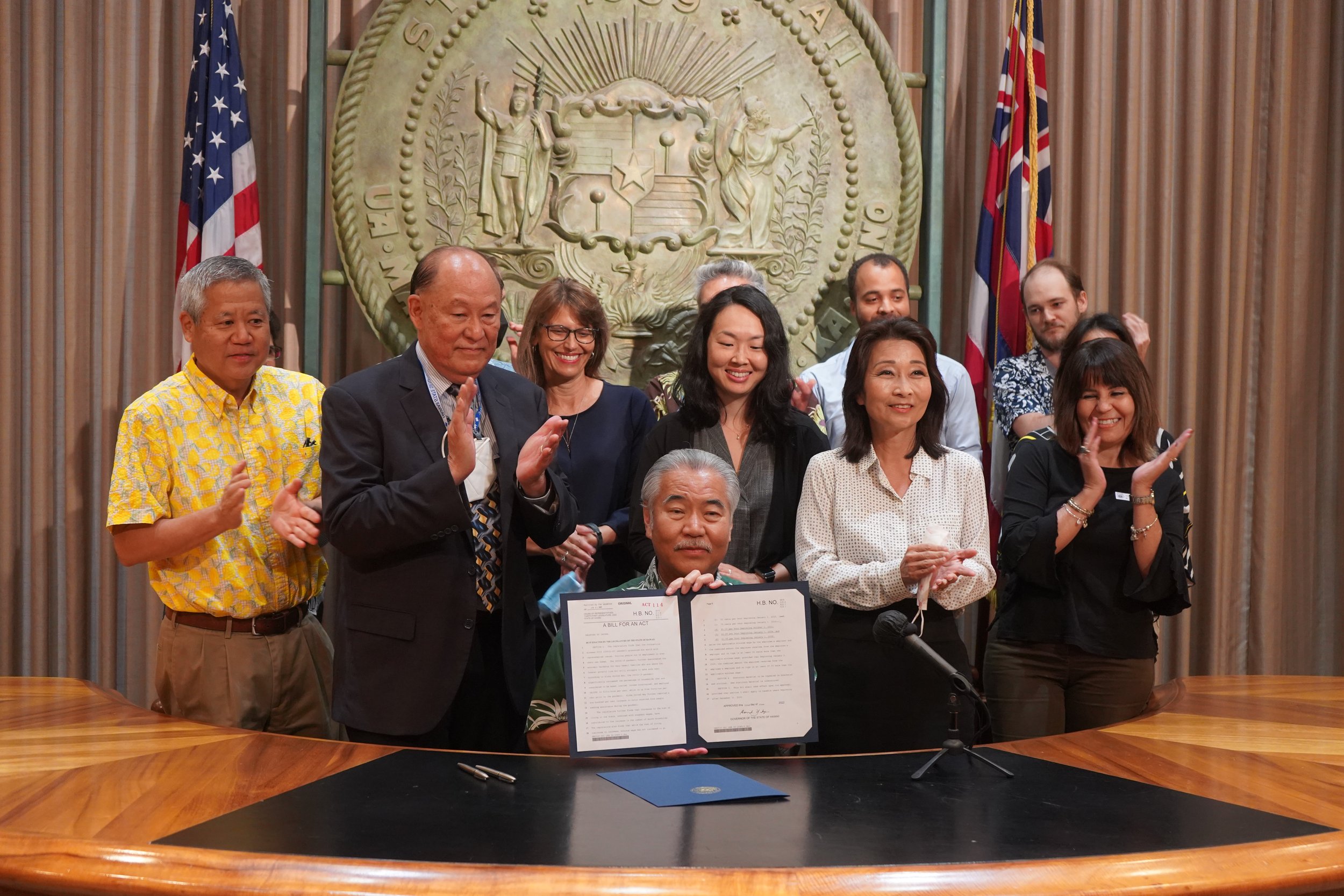

Ige signs $18 minimum wage increase, tax refund

“This historic legislation represents a significant and meaningful step toward transforming our economy so that it works for everyone,” said Hawai‘i Appleseed Executive Director Gavin Thornton. “But much more remains to be done.”

Ige signs minimum wage increase, tax rebate bills

Gov. David Ige, on Wednesday during a ceremony at the state Capitol in Honolulu, signed two bills that will help Hawaiʻi’s working individuals and families.

Thousands of houses are empty on Maui. Would higher taxes change that?

An estimated 15,000 housing units—about 1 in 5 throughout all of Maui County—are vacant, according to 2020 census estimates.

Working class tax credit still alive

After taking a long, winding path through the Legislature, a bill making the Earned Income Tax Credit permanent and refundable has made it through both the House and the Senate, though disagreements over amendments mean that the bill will now go before a conference committee.

State tax bill could have major impact on Kauaʻi

A bill in the state legislature could potentially mean more money in the pockets of working families on Kauaʻi.

Legislators consider extending income tax credit for struggling families

Every dollar a tax filer gets from the EITC generates another $1.24 in economic activity. This type of tax refund can act as an economic stimulus for the state.

How the ‘Build Back Better’ plan saves money and lives

The answer lies in an expansion of the strategy that held the line against poverty in 2020 and that helped America out of the Great Depression.

Hawaiʻi has the highest housing wage in the U.S.

Researchers analyzed rent prices in all 50 states to determine how much was needed to rent a two-bedroom apartment at fair market value without spending more than 30 percent of one’s income.

COVID-19 budget moves out for passage, but not without controversy

The allocations of the federal aid money drew criticism from social service agencies while the process of adopting the budget measure, using a method called gut-and-replace, riled others.

Social service workers rally at state Capitol

Lawmakers say they will use $635 million in CARES Act funds to assist the unemployed and local businesses, but advocates say it’s still not enough.

Extra help urged for Hawaiʻi renters who face eviction due to COVID-19 pandemic

The situation for renters is likely to get worse in the coming months, especially after the $600 boost to federal unemployment benefits expires July 31.

Nonprofits urge lawmakers to quickly commit federal funds to cope with social needs

The Working Families Coalition released a plan to distribute $362 million including CARES Act funds to help families with rent, food, healthcare and more.

Working families need more relief

The statistics about how many of Hawaiʻi’s people struggle look worse with each passing year, so plainly the safety net needs reinforcement.

Half of Hawaiʻi barely gets by

Two or three jobs are not enough to provide financial stability for many local families. How can we create CHANGE?

State’s poor face nation’s second-largest tax burden

The least wealthy income earners in Hawaiʻi pay the second most in taxes of any state in the union, according to an analysis of tax systems across the country.