Ige signs $18 minimum wage increase, tax refund

“This historic legislation represents a significant and meaningful step toward transforming our economy so that it works for everyone,” said Hawai‘i Appleseed Executive Director Gavin Thornton. “But much more remains to be done.”

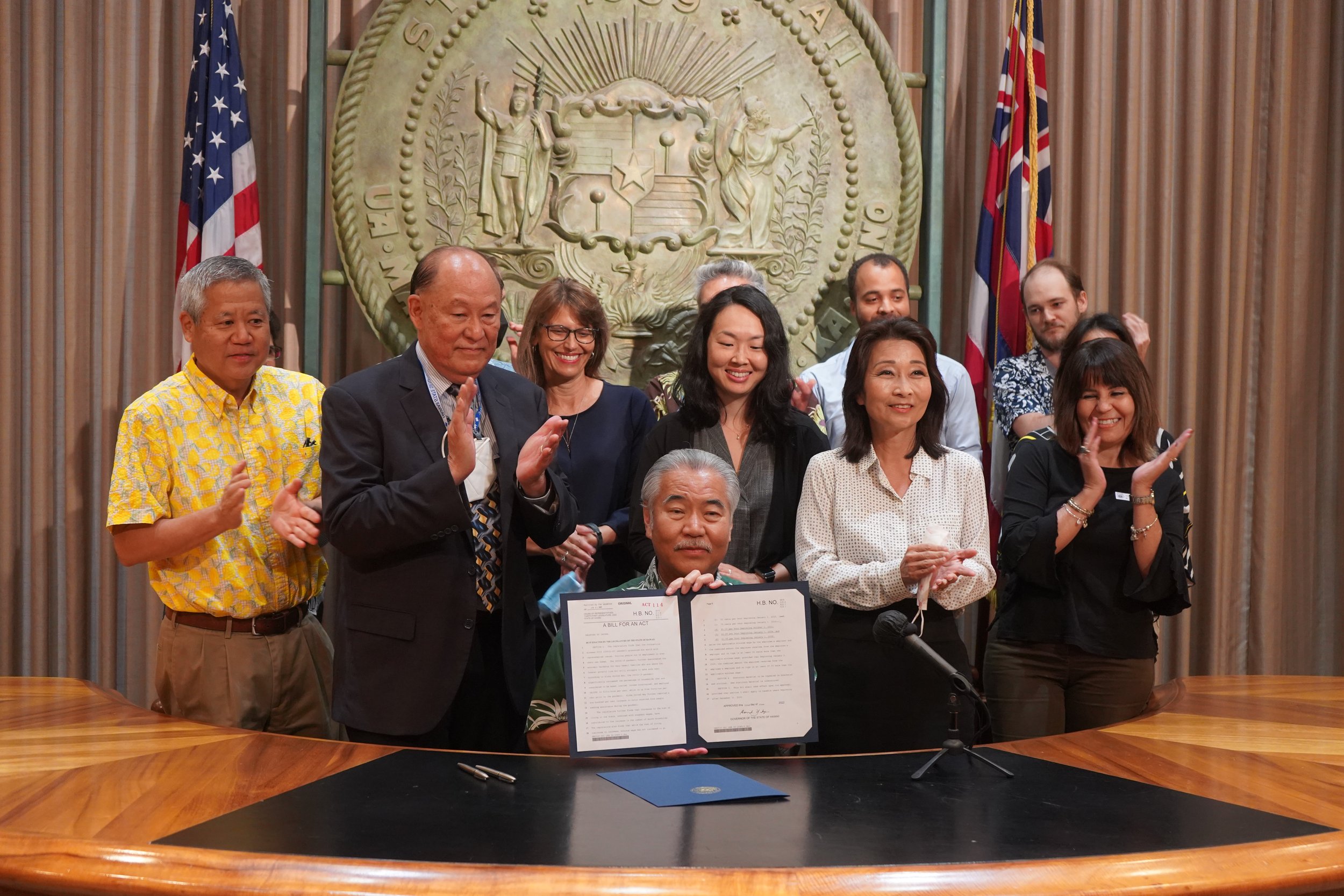

Ige signs minimum wage increase, tax rebate bills

Gov. David Ige, on Wednesday during a ceremony at the state Capitol in Honolulu, signed two bills that will help Hawaiʻi’s working individuals and families.

Bill to raise Hawaiʻi's minimum wage to $18 by 2028 passes out of conference committee

With last-minute amendments, a measure seeking to raise the state’s minimum wage passed out of conference committee on Friday.

Hawaiʻi lawmakers finally agree on raising the minimum wage

House Bill 2510 also makes a state earned income tax credit refundable. Meanwhile, many taxpayers could soon get a $300 tax rebate.

Friday deadline looms for Hawaiʻi lawmakers to raise minimum wage

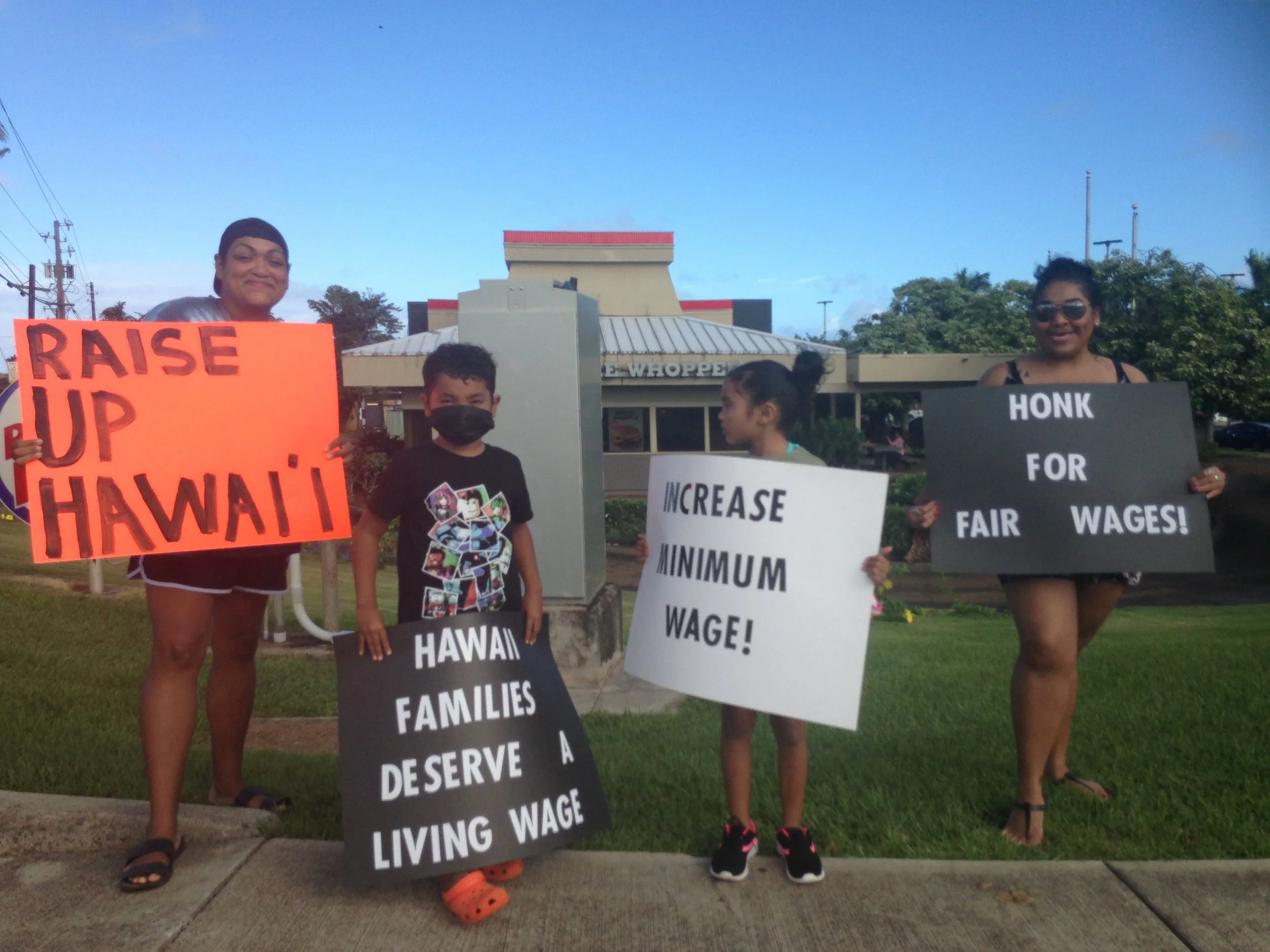

Supporters rallied in events across the islands to urge lawmakers to agree on a final version by Friday. If they do not agree on terms, the measure will be killed. The sticking point has been how much the raises will be and how fast they will be implemented.

Thousands of houses are empty on Maui. Would higher taxes change that?

An estimated 15,000 housing units—about 1 in 5 throughout all of Maui County—are vacant, according to 2020 census estimates.

EITC aid boosts isle families, economy

The EITC continues to serve as a vital tool for investing in Hawaiʻi’s working families and a link to strengthening our economy and communities.

Working class tax credit still alive

After taking a long, winding path through the Legislature, a bill making the Earned Income Tax Credit permanent and refundable has made it through both the House and the Senate, though disagreements over amendments mean that the bill will now go before a conference committee.

Lawmakers are expected to extend the earned income tax credit and make it refundable

House Bill 510 would not only extend the state’s earned income tax credit for another six years—but also make it refundable.

Hawaiʻi is spending $417 less on services per child compared to 2005, report says

The state is spending about $400 less per child than in 2005 according to a new report from the Hawaiʻi Budget & Policy Center and Hawaiʻi Children’s Action Network.

Legislature should prioritize children by investing in their future

Failure means relegating some kids to a future of poverty and poor mental and physical health.

Wage measures still alive

A bill in the state House of Representatives that would increase the minimum wage cleared a committee hurdle Tuesday.

New director Will White shares future advocacy plans for Hawaiʻi Budget & Policy Center

A discussion on the intersection of health and economic well-being, as well as short and long-term plans for HPBC.

State tax bill could have major impact on Kauaʻi

A bill in the state legislature could potentially mean more money in the pockets of working families on Kauaʻi.

Legislators consider extending income tax credit for struggling families

Every dollar a tax filer gets from the EITC generates another $1.24 in economic activity. This type of tax refund can act as an economic stimulus for the state.

Working families deserve permanent earned income tax refund

We can ensure that communities across Hawaiʻi are stronger and better prepared for the many challenges that lay ahead in the 21st century by strengthening our state EITC.

West Oʻahu reps plan to tackle traffic, tech and the cost of living

Lawmakers want the public to weigh in this session on the bills that matter most to their communities.

Hawaiʻi tax reform could increase healthcare affordability, experts say

The Hawaiʻi Budget & Policy Center is calling for lawmakers to pass tax reform that would address racial and socioeconomic disparities across the state.

Biden’s spending bill could be a ‘game changer’ for housing in Hawaiʻi

The Build Back Better bill that the U.S. Senate is debating has the potential to make a huge dent in Hawaiʻi’s affordable housing needs, according to advocates.

How the ‘Build Back Better’ plan saves money and lives

The answer lies in an expansion of the strategy that held the line against poverty in 2020 and that helped America out of the Great Depression.