Hawaiʻi coalition calls for tax fairness for local needs

As Hawaiʻi struggles to meet growing needs in housing, education, health care and climate resilience, a broad coalition of community groups, labor unions and nonprofit advocates is pushing lawmakers to confront a long-standing question: how to pay for it.

Hawaiʻi’s working moms deserve (child tax) credit

As we celebrate Women’s History Month, we must do more than simply celebrate the thousands of working moms out there—we need to deliver tax justice to them and their families.

Tax to fund affordable housing advances in state legislature

Senate Bill 362, Draft 2, which raises the conveyance tax on property sales over $2 million, has survived committee (a feat that only one in 10 bills achieve) and is set for a final floor vote in the Senate this week.

It’s gotten both worse and better for struggling working families

The good news is that 17 Hawaiʻi nonprofits are helping working families become more financially stable, find affordable housing, and get involved in policy.

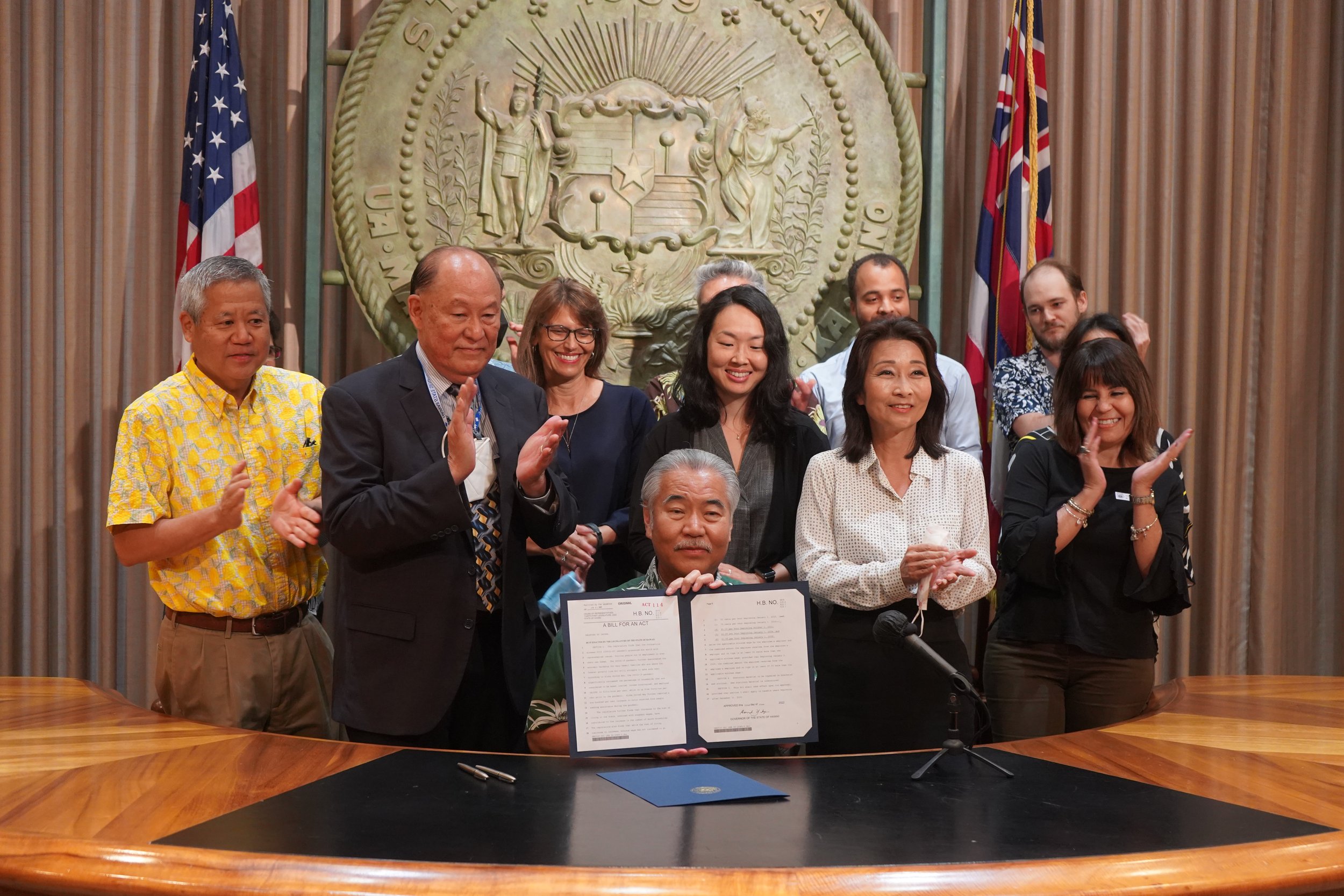

Ige signs $18 minimum wage increase, tax refund

“This historic legislation represents a significant and meaningful step toward transforming our economy so that it works for everyone,” said Hawai‘i Appleseed Executive Director Gavin Thornton. “But much more remains to be done.”

Ige signs minimum wage increase, tax rebate bills

Gov. David Ige, on Wednesday during a ceremony at the state Capitol in Honolulu, signed two bills that will help Hawaiʻi’s working individuals and families.

Will this be the year for tax breaks for the poor?

Bills that have sailed through the Legislature so far would boost taxes on the wealthy to pay for tax breaks for low-income families.

Bills to raise Hawaiʻi’s minimum wage are non-starters

A measure to establish a $15 per hour wage by 2021 did not get a hearing in the Senate Ways and Means Committee.

The Hawaiʻi Tax Fairness Initiative and SB648

Roger Epstein and Gavin Thornton visit Community Matters with Jay Fidell to talk about Tax Fairness and the work being done by the Hawaiʻi Appleseed Center for Law & Economic Justice on SB648 to help the working poor with working family, renters and food credits.