Economic prosperity rises from the bottom up

The Hawaiʻi Appleseed Center for Law & Economic Justice looks at the recent legislative session's hits and misses in this Community Voice column for Aloha State Daily.

Lawmakers should leverage tax credits to preserve Hawaiʻi’s working class

Almost half of the population cannot pay their bills on time while also saving money for emergencies.

No income tax for working class? Unions float radical proposal

A better approach would be to expand an existing state tax credit that was created to offset some of the impact of the excise tax on food, or to create a new child tax credit to support working families.

Governor Green enacts historic tax relief for working class

Taxpayers could see higher paychecks starting next year. However, the tax cuts raise concerns about how the state will manage to balance the budget in the years ahead.

Hawaiʻi ‘survival budget’ hits $104,052, report finds

The annual “household survival budget” for a Hawaiʻi family of four in 2021 at $104,052, up 15 percent from 2018. The figure drops to $85,812 when assorted earned income and child tax credits are factored in.

‘Audacious’ tax relief plan advances at Hawaiʻi Legislature

The biggest proposed savings are in a bill from Gov. Josh Green that would boost all Hawaiʻi income tax bracket thresholds and increase the standard deduction along with the personal exemption.

Move ahead with care on tax relief

Legislators must ensure that the relief package makes the most of state resources, finding the right balance of lower taxes and the services that Hawaiʻi’s people need most.

Rising prices, increasing poverty, slowing job growth: Hawaiʻi’s economy faces grim times

Among those facing higher costs are Oʻahu utility customers whose October bills could show more cost increases on top of a dramatic rise over the past year.

It’s gotten both worse and better for struggling working families

The good news is that 17 Hawaiʻi nonprofits are helping working families become more financially stable, find affordable housing, and get involved in policy.

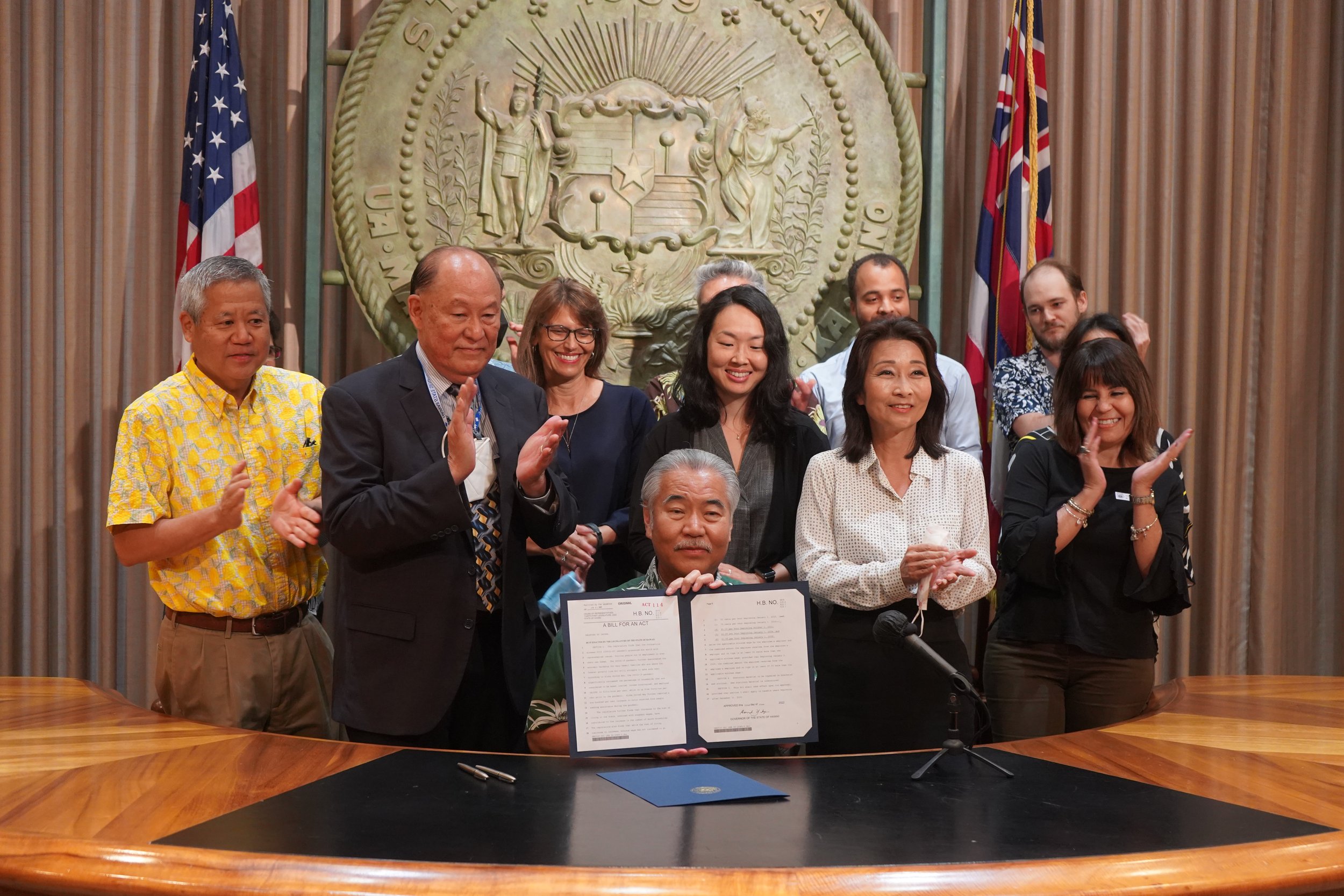

Ige signs $18 minimum wage increase, tax refund

“This historic legislation represents a significant and meaningful step toward transforming our economy so that it works for everyone,” said Hawai‘i Appleseed Executive Director Gavin Thornton. “But much more remains to be done.”

Ige signs minimum wage increase, tax rebate bills

Gov. David Ige, on Wednesday during a ceremony at the state Capitol in Honolulu, signed two bills that will help Hawaiʻi’s working individuals and families.

Bill to raise Hawaiʻi's minimum wage to $18 by 2028 passes out of conference committee

With last-minute amendments, a measure seeking to raise the state’s minimum wage passed out of conference committee on Friday.

Working class tax credit still alive

After taking a long, winding path through the Legislature, a bill making the Earned Income Tax Credit permanent and refundable has made it through both the House and the Senate, though disagreements over amendments mean that the bill will now go before a conference committee.

Inflation is forcing some Hawaiʻi families to change the way they shop for groceries

Economists agree this rising trend won’t go away anytime soon—that’s concerning for food banks and nonprofit organizations that help low-income and working class families.

State tax bill could have major impact on Kauaʻi

A bill in the state legislature could potentially mean more money in the pockets of working families on Kauaʻi.

Legislators consider extending income tax credit for struggling families

Every dollar a tax filer gets from the EITC generates another $1.24 in economic activity. This type of tax refund can act as an economic stimulus for the state.

Hawaiʻi legislature 2022: smart spending could help big problems

The legislature has money available for almost any policy initiative imaginable, and every member of the house and senate is up for reelection.

Aim higher for Hawaiʻi’s minimum wage

Job losses have not been linked to past raises. The EITC has not sufficiently offset poverty levels. Nearly half the population barely gets by.

Working families need more relief

The statistics about how many of Hawaiʻi’s people struggle look worse with each passing year, so plainly the safety net needs reinforcement.

Hawaiʻi’s child well-being 17th in latest national rankings

High housing costs remain a significant challenge in our state. When families spend so much of their income on housing, they have fewer resources to meet other basic needs.