Hawaiʻi ‘survival budget’ hits $104,052, report finds

The annual “household survival budget” for a Hawaiʻi family of four in 2021 at $104,052, up 15 percent from 2018. The figure drops to $85,812 when assorted earned income and child tax credits are factored in.

‘Audacious’ tax relief plan advances at Hawaiʻi Legislature

The biggest proposed savings are in a bill from Gov. Josh Green that would boost all Hawaiʻi income tax bracket thresholds and increase the standard deduction along with the personal exemption.

Move ahead with care on tax relief

Legislators must ensure that the relief package makes the most of state resources, finding the right balance of lower taxes and the services that Hawaiʻi’s people need most.

It’s gotten both worse and better for struggling working families

The good news is that 17 Hawaiʻi nonprofits are helping working families become more financially stable, find affordable housing, and get involved in policy.

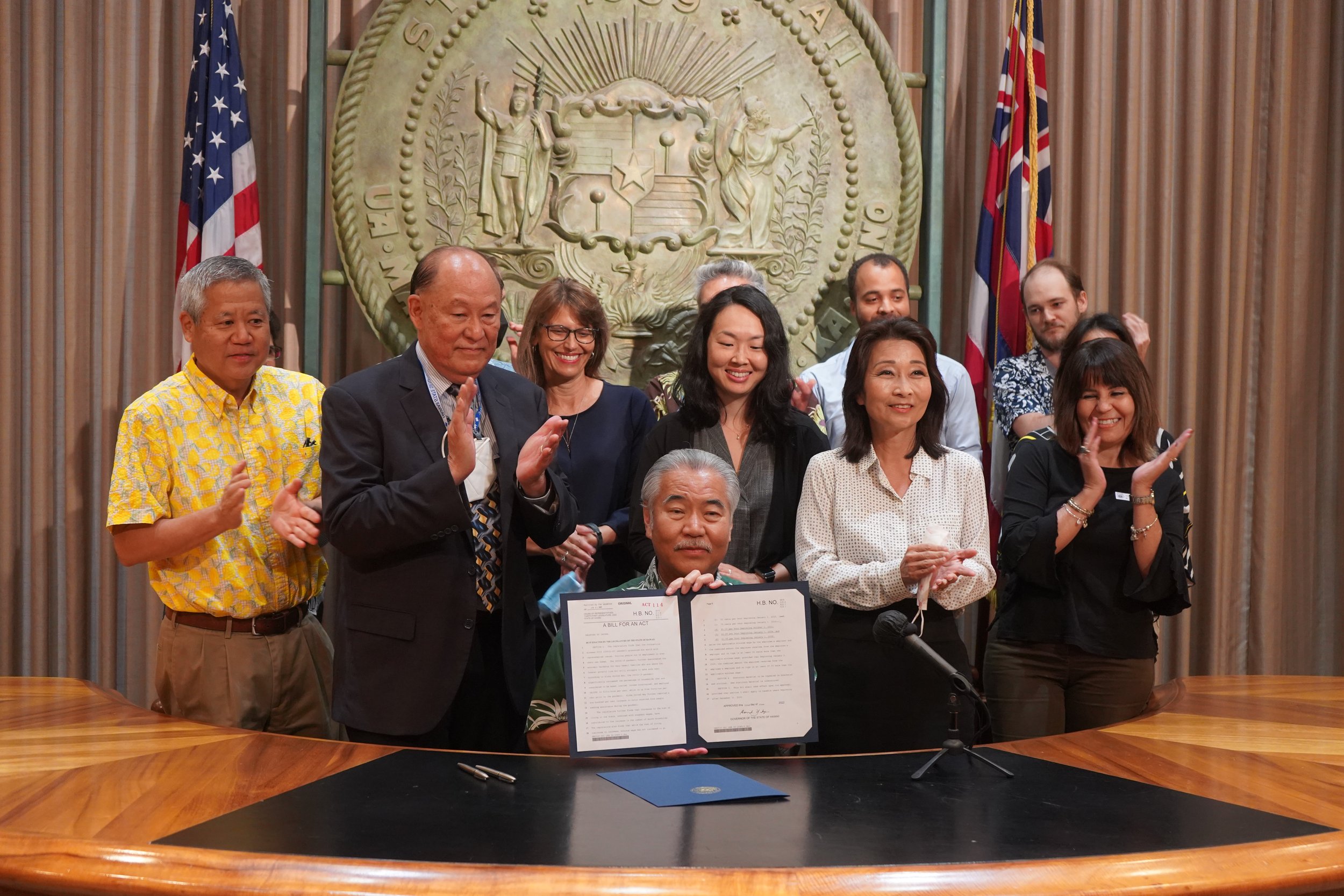

Ige signs $18 minimum wage increase, tax refund

“This historic legislation represents a significant and meaningful step toward transforming our economy so that it works for everyone,” said Hawai‘i Appleseed Executive Director Gavin Thornton. “But much more remains to be done.”

Ige signs minimum wage increase, tax rebate bills

Gov. David Ige, on Wednesday during a ceremony at the state Capitol in Honolulu, signed two bills that will help Hawaiʻi’s working individuals and families.

Bill to raise Hawaiʻi's minimum wage to $18 by 2028 passes out of conference committee

With last-minute amendments, a measure seeking to raise the state’s minimum wage passed out of conference committee on Friday.

Working class tax credit still alive

After taking a long, winding path through the Legislature, a bill making the Earned Income Tax Credit permanent and refundable has made it through both the House and the Senate, though disagreements over amendments mean that the bill will now go before a conference committee.

Inflation is forcing some Hawaiʻi families to change the way they shop for groceries

Economists agree this rising trend won’t go away anytime soon—that’s concerning for food banks and nonprofit organizations that help low-income and working class families.

State tax bill could have major impact on Kauaʻi

A bill in the state legislature could potentially mean more money in the pockets of working families on Kauaʻi.

Aim higher for Hawaiʻi’s minimum wage

Job losses have not been linked to past raises. The EITC has not sufficiently offset poverty levels. Nearly half the population barely gets by.

Working families need more relief

The statistics about how many of Hawaiʻi’s people struggle look worse with each passing year, so plainly the safety net needs reinforcement.

Hawaiʻi’s child well-being 17th in latest national rankings

High housing costs remain a significant challenge in our state. When families spend so much of their income on housing, they have fewer resources to meet other basic needs.

Give low-income workers tax break

After years of putting it off, the legislature finally approved an important measure to help Hawaiʻi’s working poor—a state Earned Income Tax Credit (EITC), based on the federal credit.

Hawaiʻi debates progressive taxes, Oʻahu ferry, green fuel

A tax bill aimed at helping the islands' most economically vulnerable would raise taxes for wealthier families while giving tax credits to those with lower incomes.

Will this be the year for tax breaks for the poor?

Bills that have sailed through the Legislature so far would boost taxes on the wealthy to pay for tax breaks for low-income families.

Town Square: debt and taxes

With Hawaiʻi’s cost of living and many families and low-income individuals living paycheck to paycheck can policies be restructured to provide fairness to all?

Bills to raise Hawaiʻi’s minimum wage are non-starters

A measure to establish a $15 per hour wage by 2021 did not get a hearing in the Senate Ways and Means Committee.

The Hawaiʻi Tax Fairness Initiative and SB648

Roger Epstein and Gavin Thornton visit Community Matters with Jay Fidell to talk about Tax Fairness and the work being done by the Hawaiʻi Appleseed Center for Law & Economic Justice on SB648 to help the working poor with working family, renters and food credits.

Working Family Tax Credit rewards hard work for low pay

We all agree self-sufficiency is better than merely depending on handouts. We all agree that a willingness to work should be encouraged. Let’s further both by passing, this legislative session, the Working Family Tax Credit.