Public charge rule change would hurt Hawaiʻi’s economy

Not only would the proposed rule change adversely impact the standard of living of Hawaiʻi’s immigrant families, it would also harm Hawaiʻi’s overall economy.

Hawaiʻi state budget highlights, 2017–19

Hawaiʻi’s budget is the blueprint for our current and future prosperity, and is an economic engine in itself, making up 20 percent of the state’s gross domestic product.

Coming soon: The Hawaiʻi Budget and Policy Center

Hawaiʻi Appleseed is creating a new think tank focused on research and analysis of state budget and tax policy—the Hawaiʻi Budget & Policy Center (HBPC).

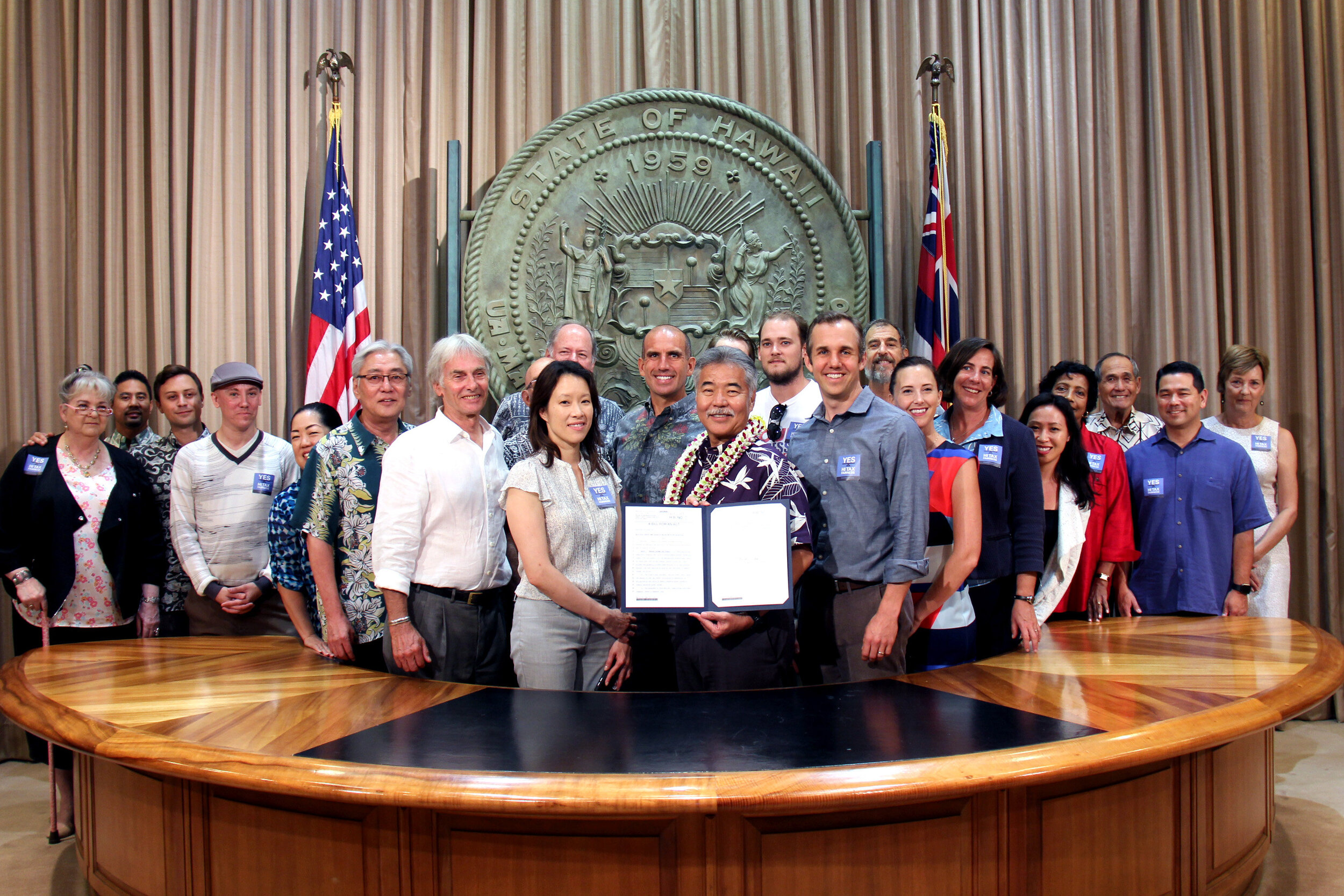

Governor Ige signs HB209, a win for working families and children

With this new law, Hawaiʻi joins 28 other states and Washington D.C. in offering a state-level EITC to help working families keep more of their earnings.

Hawaiʻi bill will create historic new working families tax credit

Rep. Scott Saiki called passage of the bill the “most consequential work in the last few years to reduce poverty and Hawaiʻi’s high cost of living.”

Report emphasizes need for Hawaiʻi working family tax credit

Report highlights the financial situation of Hawaiʻi residents and their opinion of tax credits that would let low-income workers keep more of what they earn.

Appleseed releases 2016 State of Poverty report

The report brings together the most recent available data to provide a snapshot of how low-income residents have fared after the economic recovery from the Great Recession.