Transformative change meets budget realities—a central lawmaking tension plays out in two new reports

Policy in Perspective 2025 and the Hawaiʻi Budget Primer FY2025–26 provide a compelling—and sometimes sobering—look at how Hawaiʻi invests, and often under-invests, in its communities.

Can Hawaiʻi afford to cut the grocery tax?

Any proposal to reduce or remove the GET on food must be paired with a credible plan for replacing the revenue. It’s a challenge, but also an opportunity to build a fairer and more sustainable system.

Proposed Trump tax cuts will overwhelmingly benefit the top 1 percent

As millions of Americans file their taxes this April, both the U.S. House and Senate have passed budget resolutions that open the pathway for a massive tax giveaway for the wealthiest people in the country.

How a second Trump presidency could impact the pocket books of Hawaiʻi’s working families

Outside of the top 5 percent richest households, families will likely see significant tax increases, while the cost of consumer items would spike under proposed tariffs.

Hawaiʻi’s elected leaders buy-in to costly “trickle-down” myth

Passing an “historic” tax cut that mostly benefits the wealthiest Hawaiʻi residents is not the path to a healthy economy that works for working people.

The big budget trouble with HB2404’s over-broad and sweeping tax cuts

Last minute changes to the bill, made without public scrutiny, will increase its cost by nearly eight-fold, while higher-income households will get a far bigger benefit than those struggling to make ends meet.

Leverage Hawaiʻi’s conveyance tax to equitably fund affordable housing, land conservation and infrastructure needs

The legislature has the opportunity this session to raise revenue to pay for much needed affordable housing—as well as land conservation and infrastructure—by increasing conveyance tax rates on investment properties.

Legislative agenda 2023: tax reforms to boost incomes and fund investments in our future

Top of the list of immediate challenges for Hawaiʻi is to find a way to prevent our people from being overwhelmed by the high and rising cost of living in the islands.

What made the 2022 Hawaiʻi legislative session a win for working families?

After multiple years with little progress on policy to help working families survive Hawaiʻi’s highest-in-the-nation cost of living, several factors came together to deliver a banner year in 2022.

Community-driven progress on Hawaiʻi’s affordable housing crisis

The only to address Hawai‘i’s long-standing housing crisis is through a comprehensive, community- and data-driven approach designed not to just build more housing, but to build the housing that Hawaiʻi residents need and can afford.

Hawaiʻi should eliminate its tipped sub-minimum wage

Research shows that employers frequently exploit tip credit provisions to pay their employees beneath the legal minimum wage. As a result, tipped workers tend to earn lower, less consistent wages than non-tipped workers, and they are more likely to experience poverty.

Put more money in working people’s pockets and reduce housing costs

This legislative session, Hawaiʻi Appleseed is pushing hard to implement a significant minimum wage increase, expand successful tax credits for low-income families, and lay the groundwork for housing policy that will mean no one in Hawaiʻi is left unsheltered because of poverty.

Federal spending reduced overall poverty last year despite the pandemic-recession

But in Hawaiʻi, tens of thousands of residents below the poverty line still struggled to make ends meet.

The cost of housing, Hawaiʻi’s top expense, has skyrocketed since 1980

Housing costs in Hawaiʻi have grown by far more than any other household cost—an extraordinary 79 percent increase between 1980 and 2018.

The Micronesian community is being disproportionately harmed by COVID-19

Given the precarious situation in which COVID-19 places the Micronesian community, the State of Hawaiʻi must take steps to help in both the short and long term.

Disaggregating data helps replace racist policies with anti-racist ones

One often overlooked way in which racism manifests itself in our policies is through our use of data. Disaggregating data can help end racist policies.

Protecting SNAP benefits for Hawaiʻi’s working families and seniors

The Trump Administration is floating a proposed rule change that would take away food assistance benefits from struggling families.

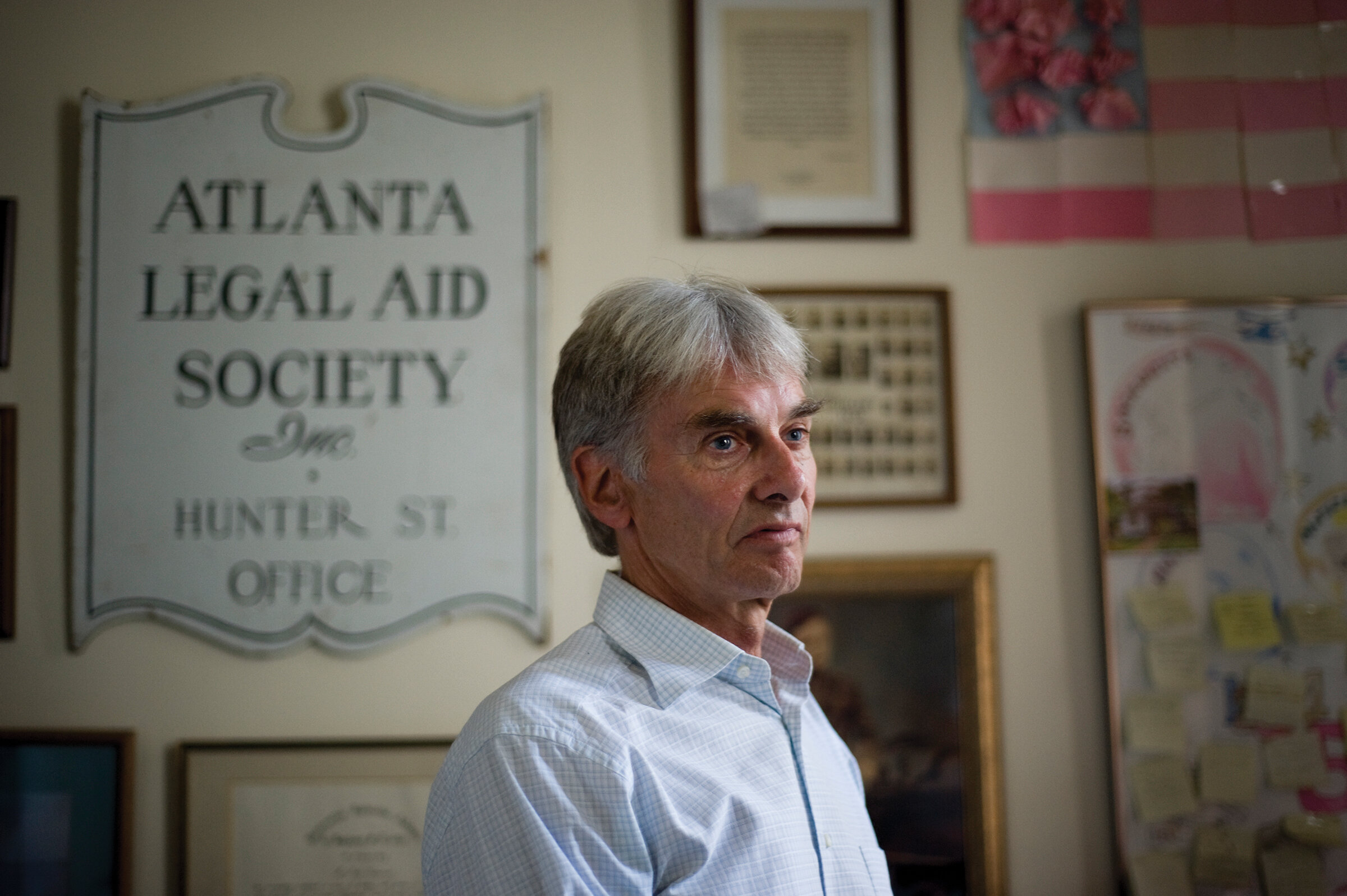

50 years in the fight for equal justice

Victor Geminiani, founding director of Hawaiʻi Appleseed and career advocate for low-income and underserved communities, will retire on August 31, 2019.

Redefining poverty would throw millions off critical social support programs

A Trump Administration rule change would force millions of Americans off critical programs that help women, children and families meet their basic needs.

How high is too high? We actually know a lot about minimum wage increases

Raising the minimum wage would boost not just the pay of many struggling Hawaiʻi workers and their families; it would also boost the local economy.