New report on cycle of poverty in Hawaiʻi urges state lawmakers to find solutions

Solutions include substantially increasing public financing of affordable housing, as well as the creation of a state level child tax credit.

Study: Low wages a threat to ‘heart and soul’ of society in Hawaiʻi

The report concludes that chronically low wages have prevented Hawaiʻi’s working families from thriving, and that the effect of poverty on children has ramifications for future generations.

The long struggle over taxing the rich

States’ taxes lean most heavily on poorer residents. These states are trying to change that.

Hawaiʻi’s working moms deserve (child tax) credit

As we celebrate Women’s History Month, we must do more than simply celebrate the thousands of working moms out there—we need to deliver tax justice to them and their families.

Tax to fund affordable housing advances in state legislature

Senate Bill 362, Draft 2, which raises the conveyance tax on property sales over $2 million, has survived committee (a feat that only one in 10 bills achieve) and is set for a final floor vote in the Senate this week.

‘Audacious’ tax relief plan advances at Hawaiʻi Legislature

The biggest proposed savings are in a bill from Gov. Josh Green that would boost all Hawaiʻi income tax bracket thresholds and increase the standard deduction along with the personal exemption.

Move ahead with care on tax relief

Legislators must ensure that the relief package makes the most of state resources, finding the right balance of lower taxes and the services that Hawaiʻi’s people need most.

While a tax hike to fund homeless services may not pass, housing advocates have a plan

When it comes to Hawaiʻi's conveyance tax rates, advocates say the state is low compared to other high-cost areas in the U.S.

Proposed tax increase to fund homeless services not likely to advance in legislature

SB678 received nearly 100 pages of written testimony, with only two testifiers opposing it.

Property sale tax could create $2.1 million for Kauaʻi homeless

Based on 2018 data, Hawaiʻi Appleseed estimated the tax would generate $174 million for affordable housing and $34.8 million for homeless services statewide, including $2.1 million for Kauaʻi.

Rising prices, increasing poverty, slowing job growth: Hawaiʻi’s economy faces grim times

Among those facing higher costs are Oʻahu utility customers whose October bills could show more cost increases on top of a dramatic rise over the past year.

It’s gotten both worse and better for struggling working families

The good news is that 17 Hawaiʻi nonprofits are helping working families become more financially stable, find affordable housing, and get involved in policy.

As prices soar, top Democratic candidates for governor support relief from tax on groceries

Hawaiʻi Appleseed said a tax revenue boost must be paired with the tax cut to ensure key services aren’t cut. The organization suggested raising the capital gains tax or increasing tax on the wealthiest earners.

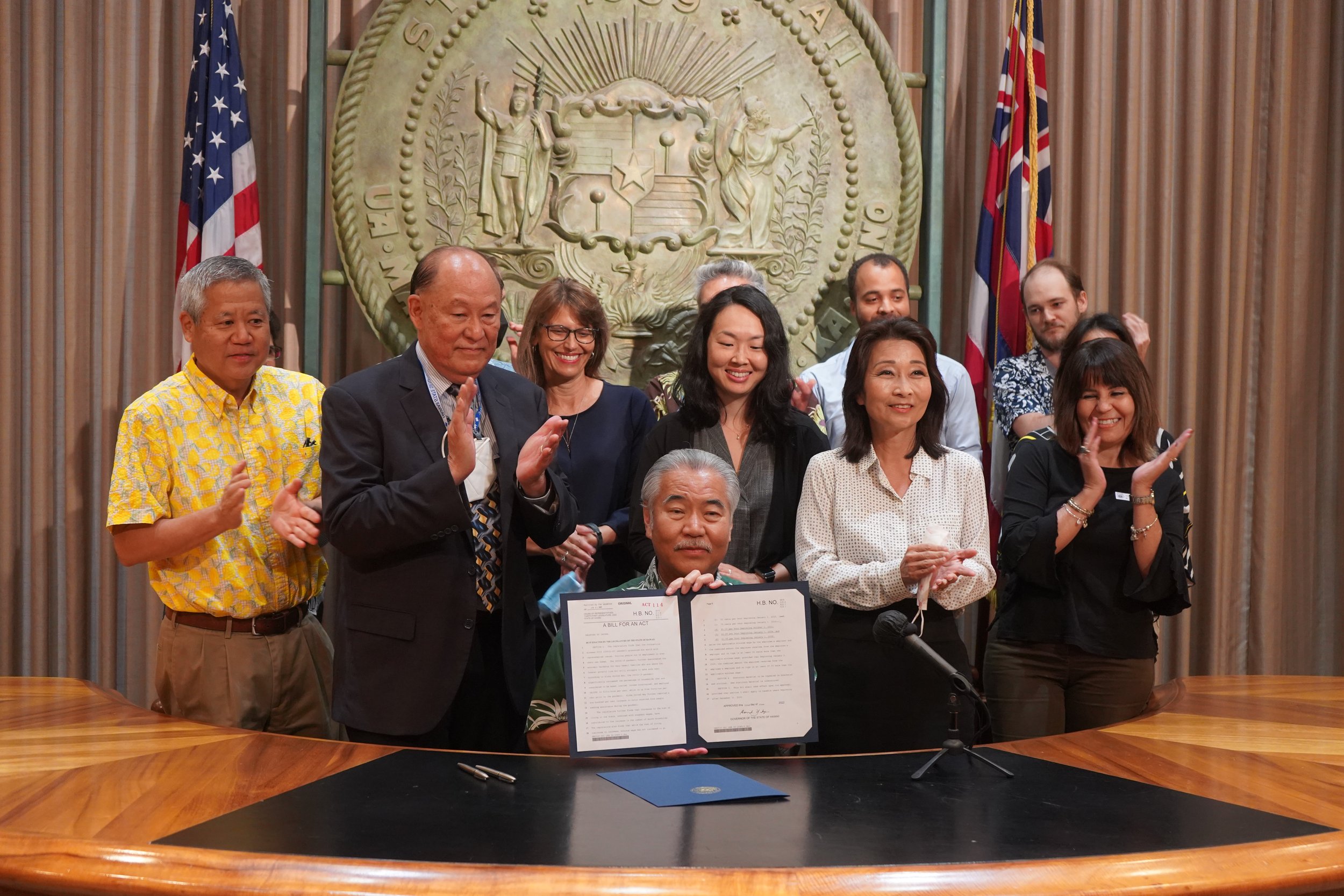

Ige signs $18 minimum wage increase, tax refund

“This historic legislation represents a significant and meaningful step toward transforming our economy so that it works for everyone,” said Hawai‘i Appleseed Executive Director Gavin Thornton. “But much more remains to be done.”

Ige signs minimum wage increase, tax rebate bills

Gov. David Ige, on Wednesday during a ceremony at the state Capitol in Honolulu, signed two bills that will help Hawaiʻi’s working individuals and families.

Bill to raise Hawaiʻi's minimum wage to $18 by 2028 passes out of conference committee

With last-minute amendments, a measure seeking to raise the state’s minimum wage passed out of conference committee on Friday.

Hawaiʻi lawmakers finally agree on raising the minimum wage

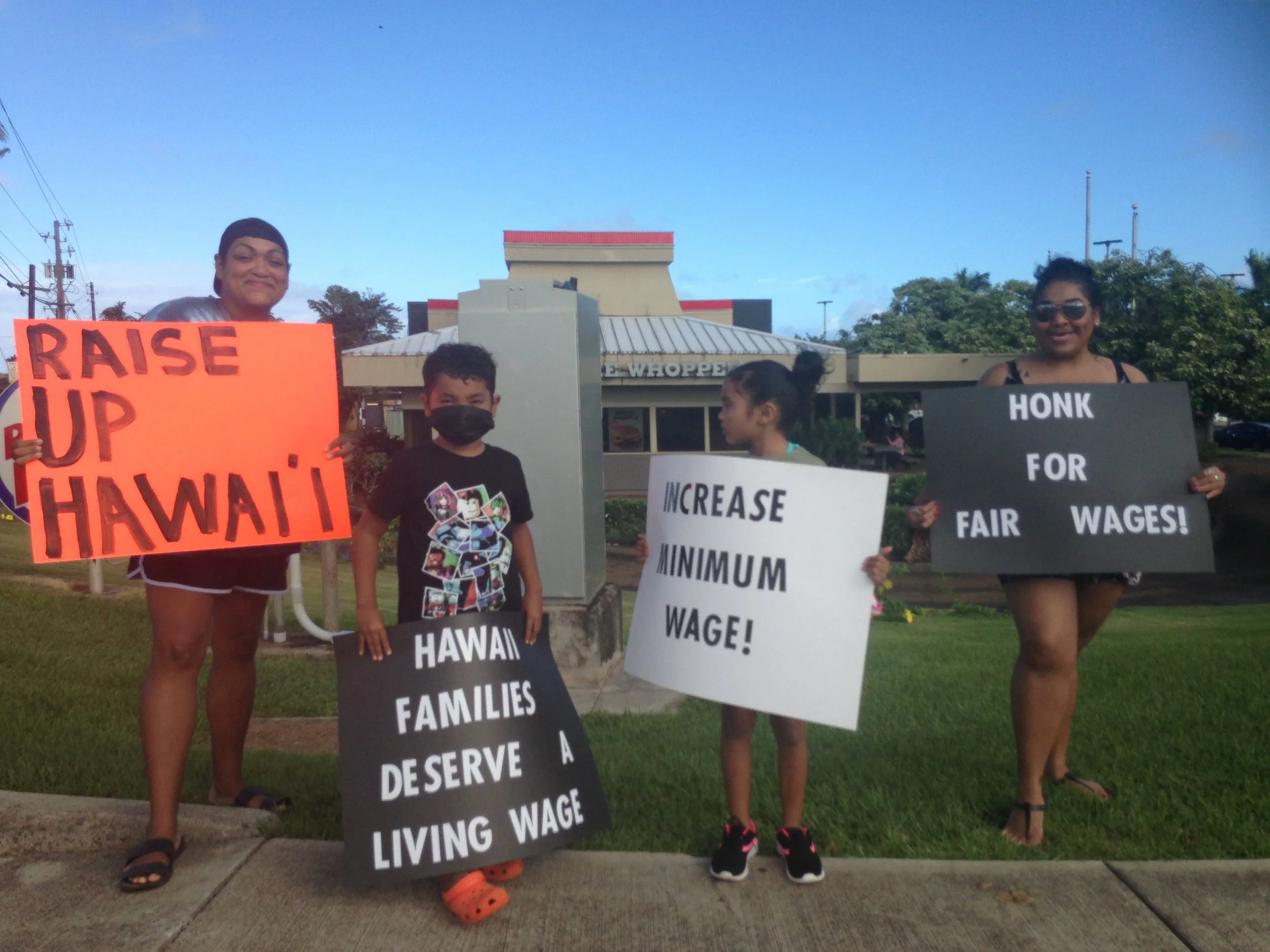

House Bill 2510 also makes a state earned income tax credit refundable. Meanwhile, many taxpayers could soon get a $300 tax rebate.

Friday deadline looms for Hawaiʻi lawmakers to raise minimum wage

Supporters rallied in events across the islands to urge lawmakers to agree on a final version by Friday. If they do not agree on terms, the measure will be killed. The sticking point has been how much the raises will be and how fast they will be implemented.

Thousands of houses are empty on Maui. Would higher taxes change that?

An estimated 15,000 housing units—about 1 in 5 throughout all of Maui County—are vacant, according to 2020 census estimates.

Working class tax credit still alive

After taking a long, winding path through the Legislature, a bill making the Earned Income Tax Credit permanent and refundable has made it through both the House and the Senate, though disagreements over amendments mean that the bill will now go before a conference committee.